When you encounter the message "this account is restricted to certain account types," it means that you do not have the appropriate permissions to access the account or perform a specific action. This restriction is typically implemented to protect sensitive information or ensure compliance with regulations. For example, certain financial accounts may be restricted to account holders who have met specific eligibility criteria, such as a minimum balance or account type.

The importance of restricting access to certain account types lies in maintaining the security and integrity of sensitive data. By limiting access to authorized individuals, organizations can reduce the risk of unauthorized transactions, data breaches, and fraud. Additionally, these restrictions help organizations comply with industry regulations and legal requirements related to data protection and privacy.

In some cases, you may be able to request access to a restricted account by contacting the account provider and providing proof of your identity and eligibility. However, it's important to note that access will only be granted if you meet the necessary requirements and the account provider deems it appropriate.

- Planes Girl Exploring The World Of Aviation Enthusiasts And Their Impact

- Laios Feet Dungeon Meshi A Comprehensive Guide To Exploring The World Of Fantasy And Culinary Adventures

This Account is Restricted to Certain Account Types

When encountering the message "this account is restricted to certain account types," it is crucial to understand its implications and explore the key aspects associated with this restriction. Here are 9 essential aspects to consider:

- Security: Restricting access helps protect sensitive data and prevent unauthorized transactions.

- Compliance: Adherence to regulations and legal requirements related to data protection and privacy.

- Account Type: Eligibility criteria based on account type, such as premium or business accounts.

- Account Status: Restrictions may apply to accounts that are inactive, delinquent, or under review.

- User Verification: Additional verification steps may be required to confirm identity and eligibility.

- Fraud Prevention: Limiting access reduces the risk of fraudulent activities and identity theft.

- Data Sensitivity: Protection of confidential information, such as financial data or personal records.

- Account Hierarchy: Restrictions based on user roles and permissions within an organization.

- Customer Eligibility: Meeting specific criteria, such as age, residency, or creditworthiness.

These aspects highlight the importance of restricting access to certain account types. By implementing these measures, organizations can safeguard sensitive data, comply with regulations, and protect the interests of their customers. Understanding these key aspects provides insights into the rationale behind account restrictions and the benefits they offer in maintaining the integrity and security of financial and personal information.

Security

In the context of "this account is restricted to certain account types," restricting access plays a critical role in enhancing security measures and safeguarding sensitive data. By limiting access to authorized individuals, organizations can minimize the risk of unauthorized transactions and data breaches.

- Audrey Peters Tiktok Unveiling The Rising Stars Journey And Impact

- Father And Daughter Taboo Exploring The Sensitive Dynamics Of Familial Relationships

- Data Protection: Restricting access helps protect confidential information, such as financial data, personal records, and trade secrets, from falling into the wrong hands.

- Fraud Prevention: Limiting access reduces the likelihood of fraudulent activities, such as identity theft, unauthorized purchases, and account takeovers.

- Compliance: Adhering to industry regulations and legal requirements related to data protection and privacy, such as GDPR and HIPAA, necessitates the implementation of access restrictions.

- Account Security: Restricting access helps prevent unauthorized individuals from accessing and potentially compromising user accounts, ensuring the integrity of account information and transactions.

These facets underscore the strong connection between "Security: Restricting access helps protect sensitive data and prevent unauthorized transactions" and "this account is restricted to certain account types." By implementing robust access restrictions, organizations can safeguard sensitive information, comply with regulations, and uphold the trust of their customers.

Compliance

In the context of "this account is restricted to certain account types," compliance plays a fundamental role in ensuring adherence to regulations and legal requirements related to data protection and privacy.

- Data Protection Regulations: Organizations are legally obligated to comply with regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), which mandate the implementation of appropriate measures to protect sensitive personal data.

- Privacy Laws: Compliance with privacy laws, such as the California Consumer Privacy Act (CCPA), requires organizations to implement access restrictions to safeguard consumer data and provide individuals with control over their personal information.

- Industry Standards: Compliance with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS), necessitates the implementation of robust access controls to protect sensitive financial data.

By restricting access to certain account types, organizations demonstrate their commitment to compliance and their responsibility in handling sensitive data. Failure to comply can result in significant legal consequences, reputational damage, and loss of customer trust.

Understanding the connection between "Compliance: Adherence to regulations and legal requirements related to data protection and privacy" and "this account is restricted to certain account types" is crucial for organizations to navigate the complex regulatory landscape and maintain compliance. It enables them to implement effective access controls, safeguard sensitive data, and protect the privacy rights of their customers.

Account Type

In the context of "this account is restricted to certain account types," the account type plays a significant role in determining eligibility for access. Organizations often establish different types of accounts to cater to specific user needs and requirements. These account types may come with varying levels of access, features, and eligibility criteria.

- Premium Accounts:

Premium accounts typically offer exclusive features, benefits, and higher transaction limits. To access a premium account, users may need to meet specific eligibility criteria, such as maintaining a minimum balance or paying a subscription fee.

- Business Accounts:

Business accounts are designed for businesses and organizations. They may have specialized features tailored to business needs, such as multiple user access, invoicing tools, and higher transaction limits. Eligibility for business accounts often requires proof of business registration or tax identification.

- Tiered Accounts:

Some organizations implement tiered account structures, where users are assigned to different tiers based on factors such as account activity, loyalty, or account balance. Each tier may have its own set of eligibility criteria and access restrictions.

- Restricted Accounts:

Certain account types may be restricted to specific individuals or groups due to regulatory or security reasons. For example, accounts holding sensitive financial information or government data may require additional verification or authorization before granting access.

By restricting access based on account type, organizations can ensure that users have the appropriate level of access to sensitive data and functionality, mitigating risks and enhancing the overall security of their systems.

Account Status

The status of an account can significantly impact its accessibility. In the context of "this account is restricted to certain account types," account status plays a crucial role in determining whether access is granted or restricted.

Inactive accounts, which have not been used for a specified period, may be restricted to prevent unauthorized access and protect against fraud. Delinquent accounts, which have outstanding payments or overdue balances, may also be restricted until the account is brought up to date. Additionally, accounts that are under review, such as those flagged for suspicious activity or undergoing verification processes, may be restricted until the review is complete.

By restricting access to accounts based on their status, organizations can mitigate risks, enhance security, and ensure compliance with regulations. For example, restricting inactive accounts helps prevent dormant accounts from being compromised and used for malicious purposes. Restricting delinquent accounts encourages timely payments and reduces the risk of bad debt. Restricting accounts under review allows organizations to thoroughly investigate suspicious activities and prevent potential fraud or data breaches.

Understanding the connection between "Account Status: Restrictions may apply to accounts that are inactive, delinquent, or under review" and "this account is restricted to certain account types" is essential for organizations to effectively manage account access and maintain the integrity of their systems. By implementing appropriate restrictions based on account status, organizations can safeguard sensitive data, protect against fraud, and ensure the security and reliability of their accounts.

User Verification

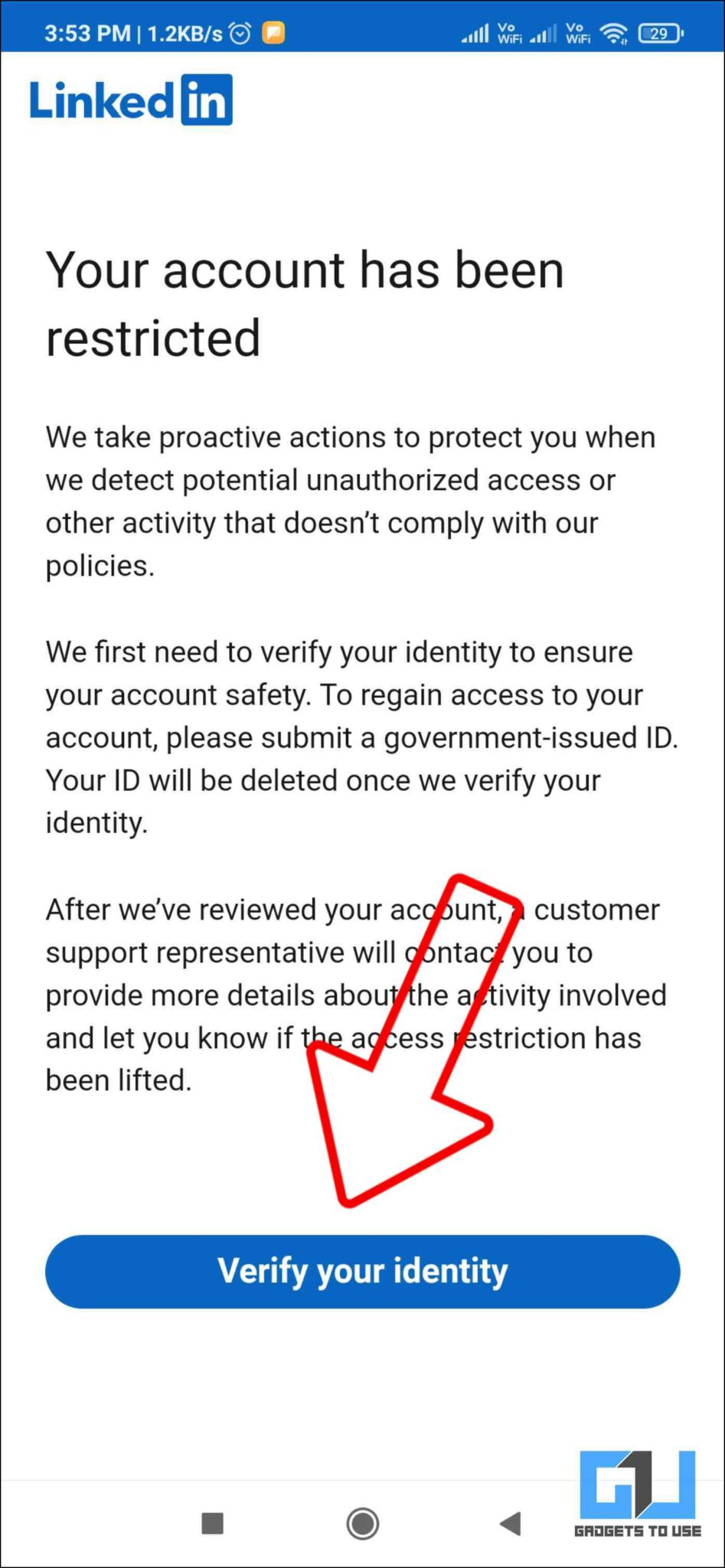

In the context of "this account is restricted to certain account types," user verification plays a pivotal role in enhancing the security and integrity of restricted accounts. By implementing additional verification steps, organizations can confirm the identity and eligibility of users attempting to access sensitive data or perform critical actions.

- Identity Verification:

To ensure that users are who they claim to be, organizations may employ identity verification measures such as multi-factor authentication, document verification, or biometric identification. This helps prevent unauthorized access to restricted accounts, reducing the risk of fraud and identity theft.

- Eligibility Confirmation:

In cases where access to certain account types is restricted based on specific criteria, organizations may implement eligibility confirmation processes. This involves verifying whether users meet the required criteria, such as age, residency, or professional. By confirming eligibility, organizations can ensure that restricted accounts are only accessible to authorized individuals.

- Account Recovery:

User verification is also essential in the context of account recovery. When users forget their passwords or experience account lockouts, they may need to undergo verification procedures to regain access to their accounts. This helps prevent unauthorized individuals from accessing restricted accounts, even if they have obtained the user's login credentials.

- Compliance and Regulation:

In certain industries, such as finance and healthcare, regulations require organizations to implement robust user verification mechanisms to protect sensitive data and comply with industry standards. By adhering to these regulations, organizations can demonstrate their commitment to data security and privacy.

These facets underscore the critical connection between "User Verification: Additional verification steps may be required to confirm identity and eligibility" and "this account is restricted to certain account types." By implementing robust user verification measures, organizations can safeguard sensitive data, prevent unauthorized access, and maintain the integrity of their systems. User verification is an essential component of a comprehensive security strategy aimed at protecting restricted accounts and ensuring the privacy and security ofsensitive information.

Fraud Prevention

In the context of "this account is restricted to certain account types," fraud prevention plays a central role in safeguarding sensitive data and protecting users from fraudulent activities. By limiting access to restricted accounts, organizations can significantly reduce the risk of fraud and identity theft, ensuring the integrity and security of their systems.

- Unauthorized Access Prevention:

Limiting access to certain account types helps prevent unauthorized individuals from gaining access to sensitive data or performing fraudulent transactions. By restricting access to authorized users only, organizations can minimize the risk of data breaches, unauthorized purchases, or account takeovers. - Identity Theft Mitigation:

Restricting access to certain account types helps mitigate the risk of identity theft, where fraudsters attempt to steal personal information to impersonate legitimate users. By limiting access to authorized individuals, organizations make it more difficult for fraudsters to obtain the necessary credentials to commit identity theft. - Fraudulent Transactions Reduction:

Limiting access to certain account types reduces the likelihood of fraudulent transactions, such as unauthorized purchases or money transfers. By restricting access to authorized users only, organizations can minimize the risk of financial losses and protect their customers from fraud. - Compliance and Regulatory Adherence:

In certain industries, such as finance and healthcare, regulations require organizations to implement robust fraud prevention measures to protect sensitive data and comply with industry standards. By limiting access to certain account types, organizations demonstrate their commitment to fraud prevention and regulatory compliance.

These facets highlight the critical connection between "Fraud Prevention: Limiting access reduces the risk of fraudulent activities and identity theft" and "this account is restricted to certain account types." By implementing stringent access restrictions, organizations can safeguard sensitive data, prevent fraud and identity theft, and maintain the integrity and security of their systems. Fraud prevention is an essential component of a comprehensive security strategy aimed at protecting restricted accounts and ensuring the privacy and security of sensitive information.

Data Sensitivity

The connection between "Data Sensitivity: Protection of confidential information, such as financial data or personal records." and "this account is restricted to certain account types" lies in the fundamental need to safeguard sensitive data from unauthorized access and potential misuse. By restricting access to certain account types, organizations can implement robust security measures to protect confidential information, ensuring the privacy and security of their customers and stakeholders.

Data sensitivity plays a crucial role in determining the level of access restrictions required for different account types. For instance, financial data, such as account balances, transaction history, and investment details, is highly sensitive and requires stringent access controls to prevent unauthorized access or fraudulent activities. Similarly, personal records, including addresses, phone numbers, and medical information, are considered sensitive and need to be protected from unauthorized disclosure to maintain privacy and prevent identity theft.

Organizations implement tiered access levels based on data sensitivity, ensuring that only authorized individuals with a legitimate need to know have access to specific types of data. This approach minimizes the risk of data breaches and misuse, as individuals without proper authorization are restricted from accessing sensitive information.

Understanding the connection between "Data Sensitivity: Protection of confidential information, such as financial data or personal records." and "this account is restricted to certain account types" is crucial for organizations to develop effective data protection strategies. By implementing appropriate access restrictions based on data sensitivity, organizations can safeguard sensitive information, comply with regulatory requirements, and maintain the trust and confidence of their customers.

Account Hierarchy

In the context of "this account is restricted to certain account types," account hierarchy plays a significant role in determining access privileges and permissions within an organization. By establishing a clear and structured account hierarchy, organizations can implement granular access controls, ensuring that users only have access to the data and functionality necessary for their roles and responsibilities.

- Role-Based Access Control (RBAC):

RBAC is a widely adopted approach to account hierarchy, where users are assigned specific roles based on their job functions and responsibilities. Each role is associated with a predefined set of permissions, determining the level of access that users have to different types of data and functionality. This approach allows organizations to easily manage and enforce access controls, ensuring that users only have the privileges they need to perform their jobs effectively.

By understanding the connection between "Account Hierarchy: Restrictions based on user roles and permissions within an organization." and "this account is restricted to certain account types," organizations can implement effective access control strategies. Account hierarchy allows organizations to define clear roles and responsibilities, assign appropriate permissions, and enforce granular access controls, ensuring the security and integrity of sensitive data and minimizing the risk of unauthorized access.

Customer Eligibility

The connection between "Customer Eligibility: Meeting specific criteria, such as age, residency, or creditworthiness." and "this account is restricted to certain account types" lies in the need for organizations to ensure that customers meet certain requirements before granting access to specific account types. By establishing eligibility criteria, organizations can mitigate risks, comply with regulations, and tailor their products and services to specific customer segments.

For instance, banks often restrict certain types of accounts, such as premium accounts or investment accounts, to customers who meet specific age and residency requirements. This helps ensure that customers have the legal capacity and financial stability to handle the responsibilities associated with these account types. Similarly, credit card companies may restrict access to certain credit cards based on creditworthiness, ensuring that customers are able to manage their debt and make timely payments.

Understanding the connection between "Customer Eligibility: Meeting specific criteria, such as age, residency, or creditworthiness." and "this account is restricted to certain account types" is crucial for organizations to effectively manage customer access and mitigate risks. By establishing clear eligibility criteria and implementing robust verification processes, organizations can ensure that customers meet the necessary requirements and are suitable for the specific account types they are applying for.

FAQs on "This Account is Restricted to Certain Account Types"

The following frequently asked questions (FAQs) provide insights into the reasons and implications of encountering the message "this account is restricted to certain account types":

Question 1: Why is my account restricted?

Answer: Your account may be restricted due to various reasons, including account type eligibility criteria, security measures, compliance with regulations, or account status (e.g., inactive, delinquent, or under review).

Question 2: How can I gain access to a restricted account?

Answer: The process for gaining access to a restricted account varies depending on the reason for the restriction. In some cases, you may be able to request access by contacting the account provider and providing proof of your identity and eligibility.

Question 3: What does it mean when an account is restricted due to security reasons?

Answer: Account restrictions for security reasons are implemented to protect sensitive data and prevent unauthorized access. It indicates that the account provider has detected suspicious activity or potential risks associated with the account.

Question 4: How can I prevent my account from being restricted?

Answer: To minimize the risk of account restrictions, it is recommended to use strong passwords, enable two-factor authentication, keep software and devices updated, and avoid clicking on suspicious links or downloading untrustworthy files.

Question 5: What should I do if I believe my account has been restricted in error?

Answer: If you believe your account has been restricted incorrectly, you should contact the account provider and provide evidence to support your claim. They will review your case and take appropriate action if necessary.

Question 6: Can I open an account with a different provider if my account is restricted?

Answer: Yes, you may be able to open an account with a different provider, subject to their eligibility criteria and account approval process. However, it is important to note that restrictions imposed by one provider may be shared with other providers through shared databases or industry practices.

Summary: Understanding the reasons behind account restrictions is crucial for taking appropriate actions. By adhering to security best practices, meeting eligibility criteria, and promptly addressing any account issues, individuals can minimize the likelihood of encountering account restrictions.

Transition to the next article section: For further information on account restrictions and related topics, please refer to the additional resources provided in the following section.

Tips Regarding "This Account is Restricted to Certain Account Types"

Encountering the message "this account is restricted to certain account types" can be frustrating. Understanding the reasons behind this restriction and taking appropriate actions can help resolve the issue swiftly and effectively.

Tip 1: Determine the Reason for Restriction:

Identifying the underlying cause for the restriction is crucial. Common reasons include ineligibility for the account type, security concerns, compliance with regulations, or account status issues (e.g., inactivity, delinquency, or review).

Tip 2: Contact the Account Provider:

If the reason for the restriction is unclear or you believe it is incorrect, promptly contact the account provider. Provide necessary documentation or information to support your claim and request a review of your account status.

Summary:

By following these tips, individuals can gain a clear understanding of account restrictions, take appropriate actions to resolve the issue, and minimize the likelihood of encountering such restrictions in the future.

Conclusion:

Understanding and addressing account restrictions is essential for maintaining access to essential financial services and online platforms. By adhering to security best practices, meeting eligibility criteria, and promptly resolving any account issues, individuals can ensure seamless and secure access to their accounts.

Conclusion

The exploration of "this account is restricted to certain account types" has brought to light the significance of account restrictions in safeguarding sensitive data, ensuring regulatory compliance, and maintaining the integrity of financial and online systems. Understanding the reasons behind account restrictions and taking appropriate actions to address them are crucial for individuals seeking access to essential services.

Account restrictions serve as a protective measure, highlighting the importance of adhering to security best practices, meeting eligibility criteria, and promptly resolving any account issues. By adopting a proactive approach, individuals can minimize the likelihood of encountering account restrictions and enjoy seamless access to their accounts.

- Whered You Get That Cheese Danny A Comprehensive Guide To The Cheesy Phenomenon

- Laios Feet Dungeon Meshi A Comprehensive Guide To Exploring The World Of Fantasy And Culinary Adventures