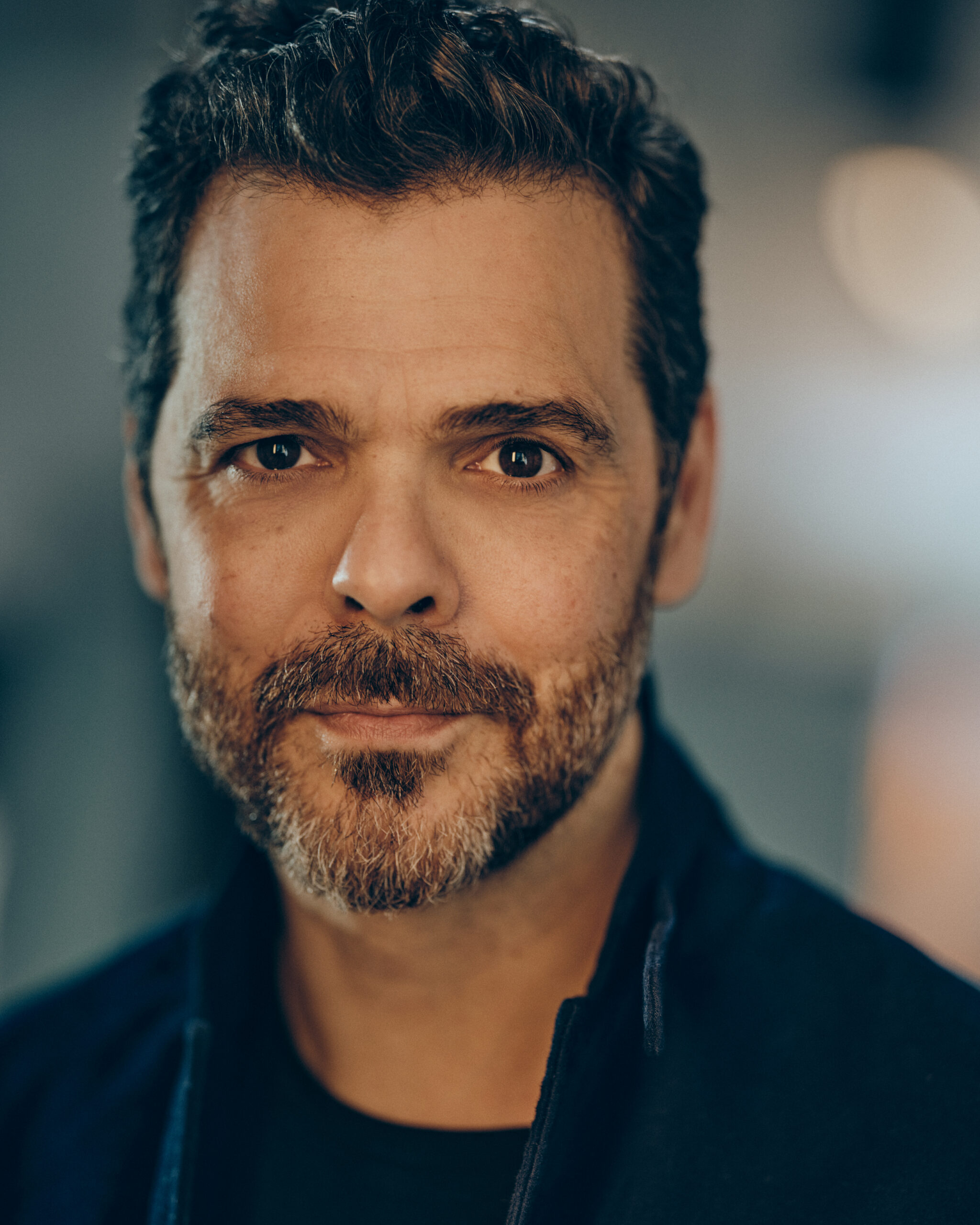

Justin Avoth's net worth and income refer to the financial assets and earnings of the renowned entrepreneur and investor. Avoth has amassed a substantial fortune through his successful ventures in various industries, including technology, real estate, and finance.

Avoth's business acumen and strategic investments have contributed to his impressive net worth. He has played a pivotal role in the growth and success of several companies, leading to significant financial gains. Additionally, his astute investments in real estate and other assets have further bolstered his wealth.

Avoth's financial success serves as an inspiration to aspiring entrepreneurs and investors.

- How Tall Is Nle Choppa Exploring The Height And Legacy Of A Rising Music Icon

- Got It Wrong Outfits A Comprehensive Guide To Avoiding Fashion Mishaps

Justin Avoth's Net Worth and Income

Justin Avoth's net worth and income represent the financial success he has achieved through his entrepreneurial ventures and investments. Here are eight key aspects related to his financial standing:

- Venture Capital: Investments in early-stage technology companies

- Real Estate: Ownership of commercial and residential properties

- Private Equity: Investments in established businesses

- Investment Banking: Previous career in financial advisory

- Stock Market: Investments in publicly traded companies

- Cryptocurrency: Investments in digital assets

- Philanthropy: Donations to charitable causes

- Financial Planning: Strategic management of wealth

These aspects highlight the diverse sources of Avoth's wealth and his savvy financial management. His success serves as an example of the potential rewards of entrepreneurship, investment acumen, and prudent financial planning.

Venture Capital

Venture capital investments have played a significant role in Justin Avoth's net worth and income. By investing in early-stage technology companies with high growth potential, Avoth has gained substantial returns on his investments. These investments often involve providing funding to startups and emerging businesses in exchange for equity ownership.

- Medium Knotless Braids With Curls A Comprehensive Guide To Achieve Stunning Lowmaintenance Hairstyles

- Puppygirl Xo Exploring The Rise Of A Digital Sensation

One notable example of Avoth's successful venture capital investments is his early investment in the social media platform, Twitter. Avoth recognized the potential of Twitter and invested in the company during its early stages. As Twitter grew and gained popularity, Avoth's investment yielded significant financial rewards.

Venture capital investments require a high level of risk tolerance, as startups often face challenges and may not succeed. However, Avoth's track record in identifying and investing in promising technology companies has contributed to his overall net worth and income.

Real Estate

Real estate ownership, encompassing both commercial and residential properties, has been a significant contributor to Justin Avoth's net worth and income. Avoth has strategically invested in a diverse portfolio of real estate assets, generating substantial passive income and capital appreciation.

One key aspect of Avoth's real estate strategy is the acquisition of income-generating properties, such as apartment buildings and commercial complexes. These properties provide a steady stream of rental income, which contributes to his overall cash flow. Additionally, Avoth has invested in land development and residential properties, which have appreciated in value over time, further increasing his net worth.

Avoth's success in real estate can be attributed to his in-depth knowledge of the market, his ability to identify undervalued properties, and his long-term investment horizon. He carefully evaluates potential investments, considering factors such as location, property condition, and market trends, to make informed decisions.

Private Equity

Private equity investments have been a significant contributor to Justin Avoth's net worth and income. By investing in established businesses with strong growth potential, Avoth has gained substantial returns on his investments. These investments often involve acquiring a controlling or significant minority stake in a company.

- Leveraged Buyouts: Avoth has participated in leveraged buyouts, where a group of investors acquires a controlling stake in a company using a significant amount of debt financing. This strategy allows investors to gain control of a company without using their own capital, potentially generating high returns.

- Growth Equity: Avoth has invested in growth equity funds, which focus on investing in established businesses with strong growth potential. These investments provide capital to companies for expansion, acquisitions, or other strategic initiatives, aiming for significant capital appreciation.

- Venture Capital Crossover: Avoth has also invested in venture capital crossover funds, which invest in late-stage venture capital companies that are nearing an initial public offering (IPO). These investments offer the potential for high returns if the companies successfully go public.

- Distressed Debt: Avoth has invested in distressed debt, which involves purchasing the debt of companies that are experiencing financial difficulties. This strategy can generate high returns if the company successfully restructures and recovers.

Avoth's success in private equity can be attributed to his ability to identify undervalued businesses with strong growth potential, his expertise in structuring and negotiating deals, and his long-term investment horizon. He carefully evaluates potential investments, considering factors such as industry trends, competitive landscape, and management team, to make informed decisions.

Investment Banking

Justin Avoth's previous career in investment banking has significantly contributed to his net worth and income. Investment banking involves providing financial advisory services to corporations and governments, specializing in mergers and acquisitions, capital raising, and strategic planning.

During his time in investment banking, Avoth gained invaluable experience in financial analysis, deal structuring, and negotiation. He developed a deep understanding of financial markets, corporate finance, and investment strategies. This knowledge and expertise have been instrumental in his success as an entrepreneur and investor.

Avoth's investment banking background has provided him with a strong foundation for making sound investment decisions. He can evaluate companies' financial performance, assess risks, and identify potential opportunities. This expertise has enabled him to make profitable investments in various asset classes, including venture capital, real estate, and private equity.

Stock Market

Justin Avoth's investments in publicly traded companies have been a substantial contributor to his net worth and income. The stock market provides a platform for investors to buy and sell shares of publicly listed companies. Avoth has a proven track record of identifying undervalued stocks with growth potential, leading to significant financial gains.

One notable example of Avoth's success in the stock market is his investment in Apple Inc. Avoth recognized the company's potential in the early 2000s and acquired a significant number of shares. As Apple's stock price soared over the following years, Avoth's investment generated substantial profits.

Avoth's approach to stock market investing involves in-depth research and analysis. He carefully evaluates companies' financial performance, industry trends, and competitive landscape before making investment decisions. This disciplined approach has enabled him to consistently generate positive returns on his stock market investments.

Cryptocurrency

Justin Avoth's investments in cryptocurrency, including Bitcoin, Ethereum, and others, have contributed to his overall net worth and income. Cryptocurrency investments have gained significant popularity in recent years, offering the potential for high returns but also involving a high level of risk.

Avoth has a deep understanding of the cryptocurrency market and has made strategic investments in digital assets. He recognizes the potential of blockchain technology and the increasing adoption of cryptocurrencies. Avoth's investments in cryptocurrency have generated substantial profits, further diversifying his investment portfolio.

The practical significance of Avoth's cryptocurrency investments lies in the potential for significant financial gains. Cryptocurrencies have exhibited high volatility, but over the long term, some digital assets have shown impressive growth. Avoth's ability to identify and invest in promising cryptocurrencies has contributed to his overall financial success.

Philanthropy

Justin Avoth's commitment to philanthropy, through donations to charitable causes, serves as a reflection of his values and dedication to giving back to the community. His charitable contributions have a meaningful impact on various organizations and initiatives, contributing to positive social change.

- Support for Education: Avoth recognizes the transformative power of education and has generously supported educational institutions and programs. His donations have enabled scholarships for underprivileged students, funded research initiatives, and contributed to the development of innovative educational programs.

- Healthcare Initiatives: Avoth's philanthropic efforts extend to supporting healthcare initiatives, improving access to essential medical care, and funding research for disease prevention and treatment. His donations have made a tangible difference in the lives of those facing health challenges.

- Community Development: Avoth is deeply involved in supporting community development initiatives, ranging from affordable housing projects to job training programs. His contributions empower local communities, fostering economic growth and improving the quality of life for residents.

- Disaster Relief: Avoth has promptly responded to natural disasters and humanitarian crises, providing financial assistance and resources to organizations involved in relief efforts. His timely donations have aided communities in rebuilding and recovering from devastating events.

Avoth's philanthropic endeavors demonstrate his belief in the importance of social responsibility and his commitment to making a positive impact on society. His generous donations have touched the lives of countless individuals and communities, leaving a lasting legacy of support and empowerment.

Financial Planning

Financial planning, a critical aspect of managing wealth, has played a significant role in Justin Avoth's net worth and income. Through strategic financial planning, Avoth has been able to optimize his financial resources, minimize risks, and achieve his financial goals.

- Asset Allocation: Avoth has implemented a well-diversified asset allocation strategy, balancing various asset classes such as stocks, bonds, real estate, and alternative investments. This diversification helps mitigate risk and enhance overall portfolio performance.

- Tax Optimization: Avoth utilizes various tax-advantaged investment vehicles and strategies to reduce his tax liability. Tax optimization enables him to maximize his after-tax income and preserve more of his wealth.

- Retirement Planning: Avoth has meticulously planned for his retirement, ensuring financial security during his post-work years. He has maximized contributions to retirement accounts and invested in assets that will provide a steady income stream in the future.

- Estate Planning: Avoth has established an estate plan that outlines the distribution of his assets after his passing. This plan includes trusts, wills, and other legal documents designed to minimize estate taxes and ensure his wealth is distributed according to his wishes.

Justin Avoth's success in financial planning demonstrates the importance of strategic wealth management. By implementing sound financial strategies, he has safeguarded and grown his wealth, providing financial stability and peace of mind.

Justin Avoth Net Worth and Income

This section addresses common questions and misconceptions surrounding Justin Avoth's net worth and income, providing clear and informative answers.

Question 1: What are the primary sources of Justin Avoth's wealth?

Justin Avoth's wealth stems from a combination of successful business ventures, strategic investments, and his previous career in investment banking.

Question 2: How has Justin Avoth's investment strategy contributed to his net worth?

Avoth's investment strategy involves a diversified portfolio across various asset classes, including venture capital, real estate, private equity, and publicly traded companies. His ability to identify and invest in promising opportunities has significantly contributed to his wealth accumulation.

Question 3: What role has financial planning played in Justin Avoth's financial success?

Avoth's strategic financial planning has been instrumental in managing and preserving his wealth. He employs asset allocation, tax optimization, retirement planning, and estate planning to maximize his financial resources and achieve his long-term financial goals.

Question 4: How has Justin Avoth's background in investment banking influenced his investment decisions?

Avoth's investment banking experience has provided him with invaluable financial knowledge and expertise. He leverages this expertise to conduct in-depth research, analyze market trends, and make informed investment decisions.

Question 5: What is Justin Avoth's approach to philanthropy?

Justin Avoth is actively involved in philanthropy, focusing on supporting education, healthcare initiatives, community development, and disaster relief. His charitable contributions aim to create a positive social impact and empower communities.

Question 6: How does Justin Avoth ensure the long-term preservation of his wealth?

Avoth employs a comprehensive estate plan that outlines the distribution of his assets after his passing. This plan includes trusts, wills, and other legal documents designed to minimize estate taxes and ensure his wealth is distributed according to his wishes.

In summary, Justin Avoth's net worth and income are the result of a combination of successful business endeavors, strategic investments, financial planning, and a commitment to philanthropy.

Transition to the next article section:

For further insights into Justin Avoth's financial strategies and investment philosophy, please refer to the following sections of this article.

Tips Inspired by Justin Avoth's Net Worth and Income Journey

The financial success achieved by Justin Avoth offers valuable lessons and insights that can inform our own financial strategies. Here are some key tips to consider:

Tip 1: Embrace a Diversified Investment ApproachAvoth's wealth is attributed in part to his diversified investment portfolio, which spans venture capital, real estate, private equity, and public markets. Diversification helps mitigate risk and enhance overall portfolio performance by reducing exposure to any single asset class or market sector.Tip 2: Focus on Value InvestingAvoth seeks out undervalued assets with strong growth potential. By thoroughly researching and analyzing investment opportunities, you can identify companies or properties that are trading below their intrinsic value, offering the potential for significant returns.Tip 3: Leverage Financial PlanningEffective financial planning is crucial for managing and preserving wealth. Consider consulting with a financial advisor to develop a comprehensive plan that encompasses asset allocation, tax optimization, retirement planning, and estate planning.Tip 4: Embrace Continuous LearningAvoth continuously seeks knowledge and stays abreast of market trends. Dedicate time to educating yourself about financial markets, investment strategies, and tax laws to make informed decisions and adapt to changing circumstances.Tip 5: Exercise Patience and DisciplineBuilding wealth requires patience and discipline. Avoid making impulsive investment decisions or chasing short-term gains. Instead, focus on a long-term investment horizon and adhere to your financial plan, even during market fluctuations.SummaryBy incorporating these tips into your financial strategy, you can increase your chances of achieving long-term financial success. Remember that wealth accumulation is a journey that requires dedication, continuous learning, and a commitment to making sound financial decisions.Conclusion

Justin Avoth's journey to financial success serves as a testament to the power of strategic investing, calculated risk-taking, and long-term planning. His diversified portfolio, encompassing venture capital, real estate, private equity, and public markets, exemplifies the importance of asset allocation in mitigating risk and maximizing returns.

Avoth's success underscores the significance of thorough research, patience, and discipline in the pursuit of wealth accumulation. By embracing continuous learning and seeking undervalued assets with growth potential, investors can position themselves for long-term financial prosperity. Avoth's philanthropic endeavors further demonstrate the value of giving back to the community and making a positive impact on society.

- Whered You Get That Cheese Danny A Comprehensive Guide To The Cheesy Phenomenon

- Unveiling The Charm Of Booty Shorts Candid Moments