Greg Renker's net worth is the total value of his assets minus his liabilities. It is a measure of his financial worth. As of 2023, Greg Renker's net worth is estimated to be around $10 million.

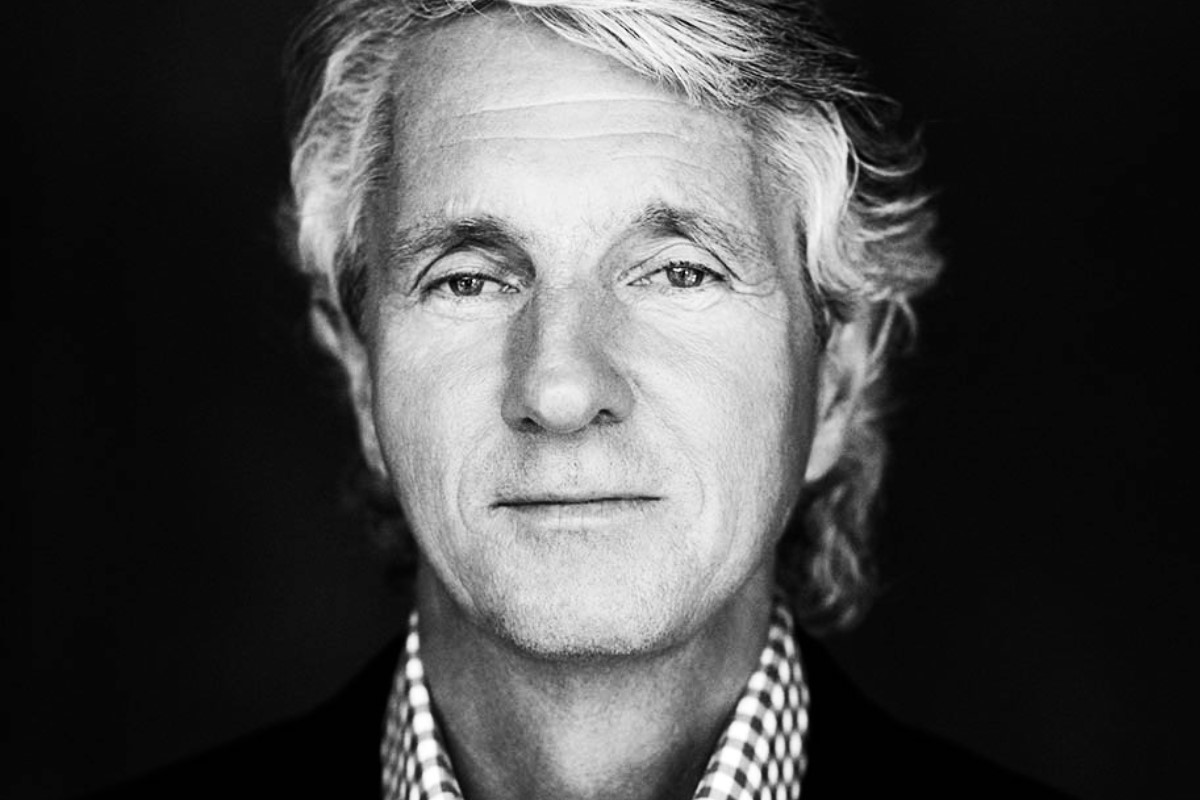

Greg Renker is a successful businessman and entrepreneur. He is the founder and CEO of several companies, including the Renker Group, a private investment firm. He has also made significant investments in real estate and other assets.

Greg Renker's net worth is a testament to his hard work and business acumen. He is a self-made millionaire who has achieved great success through his entrepreneurial endeavors.

- Unveiling Lawrence Sullivan A Comprehensive Guide To His Life Achievements And Legacy

- Maleficent Dti The Ultimate Guide To Understanding This Iconic Character

Greg Renker's Net Worth

Greg Renker's net worth is a measure of his financial worth. It is calculated by subtracting his liabilities from his assets. As of 2023, Greg Renker's net worth is estimated to be around $10 million.

- Assets: Greg Renker's assets include his cash, investments, and property.

- Investments: Greg Renker has made significant investments in real estate and other assets.

- Liabilities: Greg Renker's liabilities include his debts and other financial obligations.

- Income: Greg Renker's income comes from his various business ventures.

- Expenses: Greg Renker's expenses include his personal and business expenses.

- Net worth: Greg Renker's net worth is his assets minus his liabilities.

- Wealth: Greg Renker's wealth is his total assets, including his net worth and other non-financial assets.

- Financial planning: Greg Renker's financial planning involves managing his assets and liabilities to achieve his financial goals.

- Investing: Greg Renker's investing involves making strategic decisions about how to allocate his assets to grow his wealth.

- Estate planning: Greg Renker's estate planning involves making arrangements for the distribution of his assets after his death.

These key aspects of Greg Renker's net worth provide a comprehensive understanding of his financial situation. By carefully managing his assets and liabilities, Greg Renker has been able to accumulate a significant net worth. His financial success is a testament to his hard work and business acumen.

Assets

Assets are an important part of Greg Renker's net worth. They are what give him financial security and allow him to live the lifestyle he wants. Greg Renker's assets include his cash, investments, and property.

- Debra Bollman Stenographer Expertise Success And Professional Insights

- What Is Grand Rising Unveiling The Phenomenon Thats Shaping The Future

Greg Renker's cash is the money he has in his bank accounts and on hand. He can use his cash to buy things he needs or wants, or he can invest it to grow his wealth.

Greg Renker's investments are the assets that he has purchased with the hope of making a profit. Greg Renker's investments include stocks, bonds, and real estate. He carefully researches his investments before he makes them, and he monitors them regularly to make sure they are performing well.

Greg Renker's property is the land and buildings that he owns. Greg Renker's property includes his home, his vacation home, and his investment properties. He uses his property to live in, to generate income, and to appreciate in value over time.

Greg Renker's assets are an important part of his net worth. They give him financial security and allow him to live the lifestyle he wants. Greg Renker carefully manages his assets to make sure they are growing in value and generating income.

Investments

Greg Renker's investments are an important part of his net worth. Investments can grow in value over time, generating income and increasing net worth. Greg Renker has made significant investments in real estate and other assets, which have contributed to his overall financial success.

Real estate is a particularly valuable asset class because it can provide both income and appreciation. Greg Renker owns a portfolio of rental properties that generate monthly income. He also owns several commercial properties, which he leases to businesses. These properties provide Greg Renker with a steady stream of income, which he can use to cover his expenses or reinvest in other assets.

In addition to real estate, Greg Renker has also invested in other assets, such as stocks and bonds. Stocks represent ownership in a company, and bonds represent a loan to a company or government. These investments can provide Greg Renker with income in the form of dividends or interest payments. They can also appreciate in value over time, increasing Greg Renker's net worth.

Greg Renker's investments are a key component of his net worth. By investing wisely, Greg Renker has been able to grow his wealth and achieve financial success.

Liabilities

Liabilities are the opposite of assets. They are debts or other financial obligations that Greg Renker owes to other people or organizations. Greg Renker's liabilities include his mortgage, his car loan, and his credit card debt. He also has other liabilities, such as taxes and legal fees. Greg Renker's liabilities are important because they reduce his net worth. The higher his liabilities, the lower his net worth. It is important for Greg Renker to manage his liabilities carefully to ensure that he does not get into financial trouble.

For example, if Greg Renker has $1 million in assets and $500,000 in liabilities, his net worth is $500,000. If Greg Renker's liabilities increase to $750,000, his net worth will decrease to $250,000. This shows how liabilities can have a negative impact on net worth.

Greg Renker can manage his liabilities by:

- Making sure he can afford to repay his debts before he takes them on.

- Making his debt payments on time and in full.

- Keeping his credit score high.

- Avoiding taking on too much debt.

By managing his liabilities carefully, Greg Renker can protect his net worth and financial well-being.

Income

Income is a key component of Greg Renker's net worth. It is what allows him to generate wealth and increase his net worth over time. Greg Renker's income comes from his various business ventures, which include:

- The Renker Group: The Renker Group is a private investment firm that Greg Renker founded in 2001. The firm invests in a variety of assets, including real estate, private equity, and venture capital.

- Real estate investments: Greg Renker owns a portfolio of rental properties and commercial properties. These properties generate income through rent payments and appreciation in value.

- Other investments: Greg Renker also has investments in stocks, bonds, and other financial assets. These investments generate income through dividends, interest payments, and capital gains.

Greg Renker's income from his various business ventures has allowed him to accumulate a significant net worth. He is a self-made millionaire who has achieved great success through his entrepreneurial endeavors.

Expenses

Greg Renker's expenses are an important part of his overall financial picture. Expenses reduce Greg Renker's net worth, so it is important for him to manage his expenses carefully.

- Personal expenses: Greg Renker's personal expenses include things like food, clothing, housing, and transportation. These expenses are necessary for Greg Renker to maintain his lifestyle.

- Business expenses: Greg Renker's business expenses include things like salaries, rent, and marketing. These expenses are necessary for Greg Renker to operate his businesses.

Greg Renker's expenses are an important consideration when it comes to his net worth. By carefully managing his expenses, Greg Renker can protect and grow his net worth over time.

Net worth

The concept of net worth plays a central role in understanding the overall financial health of an individual or organization, including Greg Renker. Greg Renker's net worth, which represents the difference between his assets and liabilities, provides valuable insights into his financial standing and wealth.

- Components of Net Worth

Net worth is calculated by subtracting liabilities from assets. In the context of Greg Renker's net worth, assets may include his cash, investments, and properties, while liabilities could include his debts, loans, and financial obligations.

- Importance of Net Worth

Net worth serves as a comprehensive measure of Greg Renker's financial well-being. It indicates his ability to meet financial obligations, make investments, and plan for the future.

- Applications of Net Worth

Greg Renker's net worth can be utilized for various purposes, such as securing loans, qualifying for financial assistance, and making informed financial decisions. It also provides a benchmark for tracking his financial progress over time.

In essence, understanding Greg Renker's net worth offers a holistic view of his financial position, allowing for informed assessments of his financial health and wealth.

Wealth

Greg Renker's wealth encompasses the entirety of his financial resources, extending beyond his net worth. While net worth captures the value of his assets minus his liabilities, wealth includes both financial and non-financial assets. These non-financial assets, such as personal property, collections, and intellectual property, contribute to his overall financial well-being.

The connection between wealth and net worth is crucial because it provides a more comprehensive view of an individual's financial standing. Net worth alone may not fully represent the value of all assets, particularly those that are not easily quantifiable. By considering wealth, we gain a better understanding of Greg Renker's financial strength and resilience.

For instance, Greg Renker's art collection, while not directly contributing to his net worth, still holds significant value and contributes to his overall wealth. Similarly, his intellectual property, such as patents or trademarks, represents a valuable asset that may not be fully captured in his net worth calculation.

Comprehending the relationship between wealth and net worth is essential for accurate financial planning and decision-making. It allows individuals like Greg Renker to assess their financial situation more holistically, make informed investments, and plan for the future.

Financial planning

Financial planning is an essential aspect of Greg Renker's overall financial well-being. It involves the careful management of his assets and liabilities to achieve his financial goals. Financial planning is closely connected to Greg Renker's net worth, as it directly influences the growth and preservation of his wealth.

Effective financial planning allows Greg Renker to make informed decisions about his investments, savings, and spending. By aligning his financial strategy with his long-term goals, he can maximize his net worth and secure his financial future. For instance, Greg Renker's financial plan may include strategies for increasing his income, reducing his expenses, and managing his debt effectively. These strategies contribute to his overall financial health and help him build a strong foundation for his wealth.

Understanding the connection between financial planning and net worth is crucial for individuals seeking to achieve financial success. It emphasizes the importance of proactive financial management and highlights the role of financial planning in building and preserving wealth over time.

Investing

Investing is a crucial component of Greg Renker's overall financial strategy and directly contributes to his net worth. By making strategic investment decisions, Greg Renker aims to increase the value of his assets and generate income over time. His investment portfolio may include a mix of stocks, bonds, real estate, and other financial instruments, each with varying levels of risk and return.

The connection between investing and net worth is evident in the potential for investments to appreciate in value and generate passive income. When Greg Renker's investments perform well, his net worth increases. Conversely, if his investments decline in value, his net worth may decrease. Therefore, making sound investment decisions is essential for Greg Renker to grow and preserve his wealth.

For example, if Greg Renker invests in a stock that increases in value by 10%, the value of his investment increases accordingly, positively impacting his net worth. Similarly, if he invests in a rental property that generates rental income, this income contributes to his overall net worth.

Understanding the close relationship between investing and net worth is crucial for individuals seeking to build and manage their wealth effectively. Strategic investing allows individuals to potentially grow their assets, generate passive income, and secure their financial future.

Estate planning

Greg Renker's net worth is an indication of his financial well-being and wealth. Estate planning is an essential aspect of managing and preserving wealth, as it ensures the orderly distribution of assets after an individual's passing. Estate planning and net worth are closely intertwined, as effective estate planning can protect and even enhance an individual's net worth.

- Protecting Assets: Estate planning safeguards assets from potential legal challenges, such as will contests or creditor claims. By clearly outlining the distribution of assets, Greg Renker can minimize the risk of disputes and ensure that his wishes are respected.

- Minimizing Taxes: Estate planning strategies can be employed to reduce or eliminate estate taxes, which can significantly impact the value of assets passed on to heirs. Greg Renker can utilize trusts, gifting, and other techniques to optimize tax efficiency.

- Preserving Wealth: Estate planning allows Greg Renker to control the distribution of his assets and ensure that they are managed according to his wishes. By appointing executors and establishing trusts, he can preserve the value of his wealth for future generations.

- Philanthropic Goals: Estate planning provides a platform for Greg Renker to fulfill his philanthropic goals. He can designate specific assets or percentages to charitable organizations, ensuring that his wealth supports causes he cares about.

In summary, estate planning plays a crucial role in safeguarding and managing Greg Renker's net worth. By making informed decisions and utilizing effective estate planning strategies, he can protect his assets, minimize taxes, preserve wealth, and achieve his philanthropic goals, ensuring the legacy of his wealth.

FAQs on Greg Renker's Net Worth

Greg Renker's net worth, a measure of his financial standing, has garnered significant interest. This section addresses some frequently asked questions to provide a comprehensive understanding of his wealth and its implications.

Question 1: How much is Greg Renker's net worth?

Greg Renker's net worth is estimated to be around $10 million as of 2023. This figure represents the total value of his assets, including investments, property, and cash, minus any outstanding liabilities or debts.Question 2: How did Greg Renker accumulate his wealth?

Greg Renker's wealth primarily stems from his entrepreneurial endeavors. He is the founder and CEO of several companies, including The Renker Group, a private investment firm. Additionally, his investments in real estate and other assets have contributed to his financial success.Question 3: What is the significance of Greg Renker's net worth?

Greg Renker's net worth serves as an indicator of his financial well-being and overall financial health. It reflects his ability to generate income, manage expenses, and accumulate assets over time.Question 4: Is Greg Renker's net worth likely to increase in the future?

The trajectory of Greg Renker's net worth depends on various factors, including the performance of his businesses, investment decisions, and overall economic conditions. However, his history of entrepreneurial success and prudent financial management suggests that his net worth has the potential to continue growing.Question 5: How does Greg Renker manage his wealth?

Greg Renker utilizes a combination of strategies to manage his wealth, including investing in a diversified portfolio of assets, seeking professional financial advice, and implementing estate planning measures to preserve and distribute his wealth effectively.Question 6: What lessons can be learned from Greg Renker's financial journey?

Greg Renker's financial success highlights the importance of hard work, financial literacy, and strategic investing. His journey serves as an inspiration for individuals seeking to build and manage their own wealth.In summary, Greg Renker's net worth is a testament to his entrepreneurial acumen and prudent financial management. Understanding the various aspects and implications of his wealth provides valuable insights into the intricacies of wealth accumulation and management.

Transition to the next article section: Greg Renker's Investment Philosophy

Tips Related to "Greg Renker's Net Worth"

Understanding the concept of net worth and its components is essential for effective financial management. Here are some valuable tips to consider:

Tip 1: Track Assets and Liabilities Accurately

Maintaining an accurate record of your assets and liabilities is crucial. This includes quantifying all financial resources, such as cash, investments, and property, as well as any outstanding debts or obligations.

Tip 2: Understand the Impact of Investments

Strategic investments can significantly impact net worth over time. Diversify your portfolio and consider a mix of asset classes to manage risk and potentially enhance returns.

Tip 3: Manage Debt Effectively

Excessive debt can hinder net worth growth. Prioritize debt repayment and explore strategies to reduce interest expenses or consolidate debts.

Tip 4: Plan for the Future

Estate planning ensures the orderly distribution of your assets after your passing. Consider establishing a will or trust to protect your wealth and minimize estate taxes.

Tip 5: Seek Professional Advice

Consulting with a financial advisor can provide valuable insights and guidance. They can assist with investment planning, tax optimization, and overall financial strategy.

Tip 6: Monitor and Rebalance Regularly

Net worth is dynamic and can fluctuate over time. Regularly review your financial situation, rebalance your portfolio, and make adjustments as needed to align with your financial goals.

Tip 7: Stay Informed and Educate Yourself

Staying up-to-date with financial news and trends is essential. Engage in continuous learning and seek opportunities to enhance your financial literacy.

Tip 8: Remember the Importance of Risk Management

While pursuing wealth accumulation, it's crucial to manage risk prudently. Diversify your investments, assess your risk tolerance, and consider appropriate insurance coverage.

In conclusion, effectively managing your net worth requires a combination of financial literacy, strategic planning, and ongoing monitoring. By implementing these tips, you can gain a clearer understanding of your financial standing and make informed decisions to grow and preserve your wealth.

Conclusion on Greg Renker's Net Worth

Greg Renker's net worth, estimated at $10 million, is a testament to his entrepreneurial success and prudent financial management. His wealth encompasses assets such as investments, property, and cash, minus any outstanding liabilities. Renker's ability to generate income, manage expenses, and make strategic investment decisions has contributed to his financial well-being.

Understanding the components and implications of Greg Renker's net worth provides valuable insights into wealth accumulation and management. The concept of net worth is applicable to individuals and organizations alike, emphasizing the importance of tracking assets and liabilities, planning for the future, and seeking professional guidance when necessary. By adopting sound financial principles, individuals can work towards building and preserving their own wealth.

- Kodiak Bluegill A Comprehensive Guide To The Majestic Fish Species

- Audrey Peters Tiktok Unveiling The Rising Stars Journey And Impact