The phrase "does state income tax come after federal" refers to the order in which individuals pay their income taxes. In the United States, federal income taxes are generally due on April 15th, while state income taxes are typically due on or around the same date. However, some states have different due dates for state income taxes. For example, California's state income tax is due on April 15th, while New York's state income tax is due on April 30th.

There are a number of reasons why state income taxes may be due after federal income taxes. One reason is that state income tax laws are typically more complex than federal income tax laws. This can make it difficult for individuals to calculate their state income tax liability, which can lead to delays in filing their state income tax return.

Another reason why state income taxes may be due after federal income taxes is that states often have different tax rates than the federal government. This can make it difficult for individuals to budget for their state income taxes, which can also lead to delays in filing.

- How Long Does Royal Honey Take To Work Unveiling The Secrets Of Natures Gift

- Unveiling Lawrence Sullivan A Comprehensive Guide To His Life Achievements And Legacy

Despite the potential for delays, it is important for individuals to file their state income tax return on time. Failure to file a state income tax return can result in penalties and interest charges. If you are unsure about how to file your state income tax return, you can contact your state's department of revenue for assistance.

Does State Income Tax Come After Federal?

Understanding the order in which you should pay your taxes is crucial to avoid penalties and interest charges. Here are 10 key aspects to consider when it comes to state income tax and federal income tax:

- Filing Deadline: Federal tax deadline is April 15th, while state deadlines vary.

- Tax Rates: State income tax rates differ from federal rates and can impact your overall tax liability.

- Deductions and Exemptions: State and federal deductions and exemptions may vary, affecting your taxable income.

- Tax Credits: Both federal and state governments offer tax credits that can reduce your tax bill.

- Tax Forms: You may need to file separate tax forms for state and federal taxes.

- Tax Payments: Estimated tax payments may be required for both state and federal taxes.

- Tax Refunds: If you overpaid your taxes, you may be eligible for a refund from both the state and federal government.

- Tax Audits: Both state and federal tax authorities can audit your tax returns.

- Tax Penalties: Failure to file or pay your taxes on time can result in penalties from both the state and federal government.

- Tax Professionals: Consider consulting with a tax professional for guidance on state and federal tax matters.

These key aspects highlight the importance of understanding the differences between state and federal income taxes. By considering these factors, you can ensure that you are meeting your tax obligations and minimizing your tax liability.

- Discover The World Of Haide Unique A Comprehensive Guide

- Puppygirl Xo Exploring The Rise Of A Digital Sensation

Filing Deadline

The connection between the filing deadline for federal and state income taxes and the question of "does state income tax come after federal" lies in the potential for different due dates. While the federal tax deadline is fixed on April 15th, state deadlines may vary, leading to a situation where state income tax payments may be due after federal taxes.

- Facet 1: Understanding State Deadlines

Individuals need to be aware of the specific filing deadline for their state of residence. Failure to meet the state deadline can result in penalties and interest charges, irrespective of whether federal taxes were filed on time.

- Facet 2: Impact on Tax Planning

The varying state deadlines can impact tax planning strategies. Taxpayers may need to adjust their withholding or estimated tax payments to ensure they have sufficient funds to cover both federal and state tax liabilities by their respective due dates.

- Facet 3: Implications for Tax Refunds

If a taxpayer overpays their state income taxes and is due a refund, the timing of the refund may vary depending on the state's processing schedule. This can affect cash flow and financial planning.

- Facet 4: Role of Tax Professionals

Tax professionals can provide guidance on state income tax deadlines and assist taxpayers in meeting their filing obligations. They can also advise on strategies to minimize tax liability and avoid penalties.

In conclusion, understanding the different filing deadlines for federal and state income taxes is crucial for taxpayers to avoid penalties and ensure timely payments. By considering the various facets discussed above, individuals can navigate the complexities of "does state income tax come after federal" and fulfill their tax obligations effectively.

Tax Rates

The connection between state income tax rates and the question of "does state income tax come after federal" lies in the potential impact on an individual's overall tax liability. Here are four key facets to consider:

- Facet 1: Understanding Rate Disparities

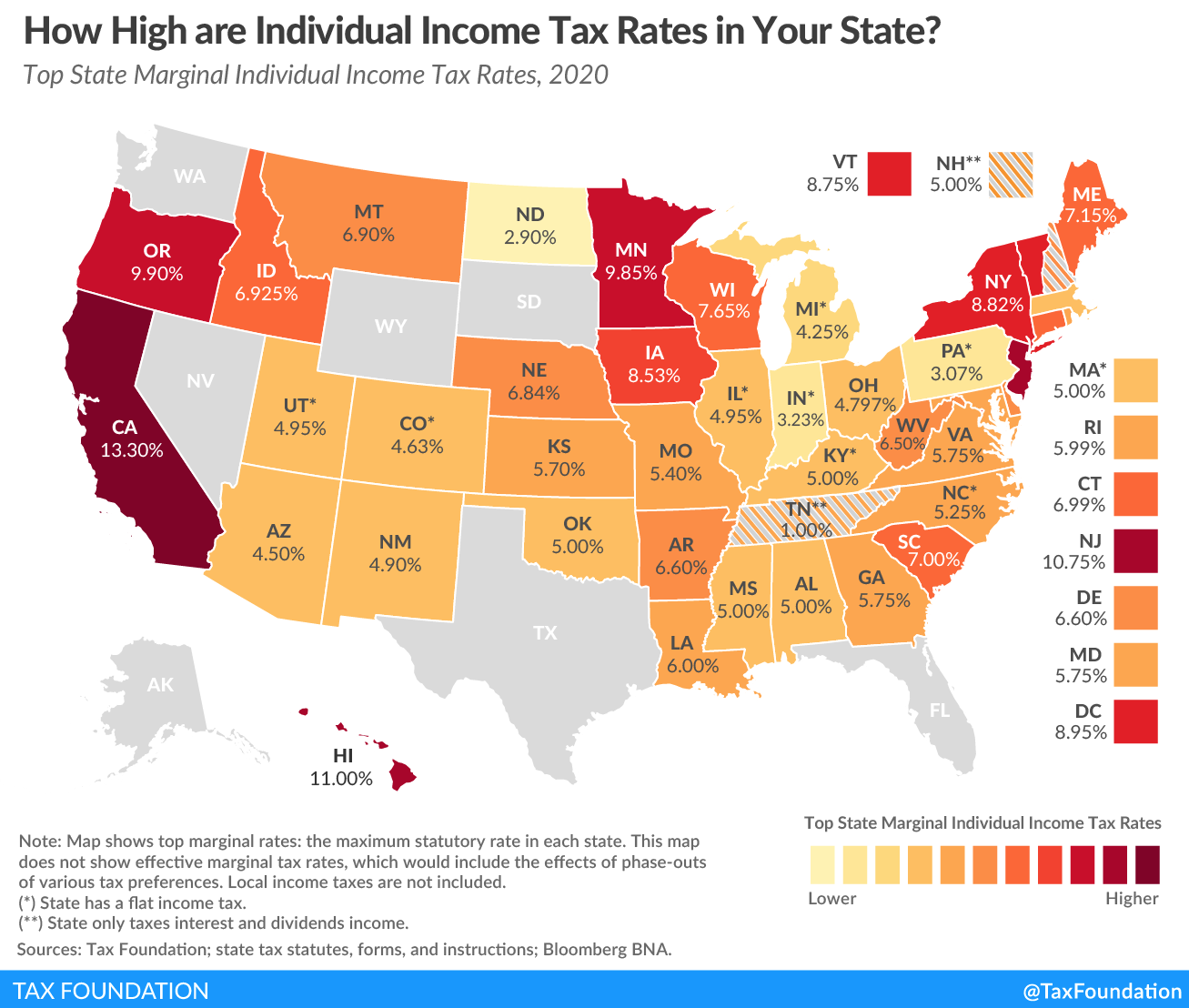

State income tax rates can vary significantly from the federal income tax rate. Some states have no income tax, while others have rates that range from 2% to over 10%. This disparity can have a substantial impact on a taxpayer's overall tax burden.

- Facet 2: Impact on Tax Planning

The difference in state income tax rates can influence tax planning strategies. Taxpayers may choose to reside or work in states with lower income tax rates to reduce their overall tax liability. This can also impact decisions related to investments and retirement planning.

- Facet 3: Implications for Tax Refunds

If a taxpayer overpays their state income taxes due to a higher state tax rate, they may receive a larger refund when they file their state tax return. Conversely, if they underpay due to a lower state tax rate, they may owe additional taxes.

- Facet 4: Role of Tax Professionals

Tax professionals can provide guidance on state income tax rates and help taxpayers optimize their tax strategies. They can also assist with tax preparation and ensure that taxpayers are meeting their state and federal tax obligations.

In conclusion, understanding the differences in state income tax rates and their impact on overall tax liability is crucial for taxpayers. By considering these facets, individuals can make informed decisions, minimize their tax burden, and navigate the complexities of "does state income tax come after federal" effectively.

Deductions and Exemptions

The connection between deductions and exemptions, and the question of "does state income tax come after federal" lies in the impact these factors have on an individual's taxable income. Here are four key facets to consider:

- Facet 1: Understanding Disparities

State and federal income tax laws allow for different deductions and exemptions, which can lead to variations in taxable income. For example, some states offer deductions for state income taxes paid, while others do not. These differences can impact the amount of taxable income subject to state income tax.

- Facet 2: Impact on Tax Liability

The variation in deductions and exemptions can directly affect an individual's tax liability. A taxpayer with higher deductions and exemptions will have a lower taxable income, resulting in lower state income tax liability. This can impact the overall tax burden and financial planning.

- Facet 3: Implications for Tax Refunds

The interplay between state and federal deductions and exemptions can influence the amount of tax refund an individual receives. If a taxpayer claims more deductions and exemptions on their state tax return compared to their federal return, they may receive a larger state tax refund. Conversely, if they claim fewer deductions and exemptions, they may owe additional state taxes.

- Facet 4: Role of Tax Professionals

Tax professionals can provide guidance on state and federal deductions and exemptions, ensuring that taxpayers optimize their tax strategies. They can also assist with tax preparation and ensure that taxpayers are taking advantage of all allowable deductions and exemptions to minimize their tax liability.

In conclusion, understanding the differences in deductions and exemptions between state and federal income tax laws is crucial for taxpayers to minimize their tax liability and navigate the complexities of "does state income tax come after federal" effectively.

Tax Credits

The connection between tax credits and the question of "does state income tax come after federal" lies in the impact tax credits can have on an individual's overall tax liability. Tax credits are direct reductions in the amount of tax owed, as opposed to deductions, which reduce taxable income. Here are four key facets to consider:

- Understanding Tax Credits: Tax credits can vary between federal and state governments. Some tax credits are available at both the federal and state levels, while others are unique to each jurisdiction. Understanding the availability and eligibility criteria for both federal and state tax credits is crucial for maximizing tax savings.

- Impact on Tax Liability: Tax credits can significantly reduce tax liability by directly offsetting the amount of tax owed. This can be particularly beneficial for taxpayers with lower incomes or those facing financial hardship. Tax credits can also make a substantial difference for taxpayers who are close to a particular tax bracket threshold.

- Implications for Tax Refunds: Tax credits can impact the amount of tax refund an individual receives. If a taxpayer claims tax credits that exceed their tax liability, the excess amount will be refunded to them. Understanding the interplay between federal and state tax credits is essential for optimizing tax refunds.

- Role of Tax Professionals: Tax professionals can provide guidance on both federal and state tax credits, ensuring that taxpayers are claiming all available credits to minimize their tax liability. They can also assist with tax preparation and ensure that taxpayers are meeting their tax obligations.

In conclusion, understanding the availability and impact of tax credits at both the federal and state levels is crucial for taxpayers to minimize their tax liability and navigate the complexities of "does state income tax come after federal" effectively.

Tax Forms

The connection between the requirement to file separate tax forms for state and federal taxes and the question of "does state income tax come after federal" lies in the administrative processes and legal jurisdictions involved in tax collection. Here are three key facets to consider:

- Understanding Tax Jurisdictions: The United States has a federal system of government, which means that both the federal government and state governments have the authority to impose and collect taxes. As a result, taxpayers may need to file separate tax forms for each jurisdiction in which they have tax liability.

- Differences in Tax Laws: Federal and state tax laws are distinct, and they may have different requirements for filing tax returns. For example, some states have their own income tax forms that are different from the federal income tax form (Form 1040). Taxpayers need to be aware of the specific tax forms required by each jurisdiction to ensure they are meeting their tax obligations.

- Implications for Tax Deadlines: The filing deadlines for federal and state income taxes may not always be the same. While the federal income tax filing deadline is typically April 15th, state income tax filing deadlines can vary. Taxpayers need to be aware of the filing deadlines for both federal and state taxes to avoid penalties and interest charges.

In conclusion, understanding the need to file separate tax forms for state and federal taxes is crucial for taxpayers to meet their tax obligations and navigate the complexities of "does state income tax come after federal" effectively. By considering these facets, taxpayers can ensure they are filing the correct tax forms, meeting the appropriate filing deadlines, and fulfilling their tax responsibilities to both the federal and state governments.

Tax Payments

The connection between the requirement for estimated tax payments for both state and federal taxes and the question of "does state income tax come after federal" lies in the ongoing nature of tax obligations throughout the year.

- Facet 1: Understanding Estimated Tax Payments

Estimated tax payments are payments made during the year to cover current year tax liability, before the actual tax return is filed. These payments are typically made quarterly, and they are used to ensure that taxpayers are paying their taxes throughout the year, rather than in one lump sum when the tax return is due.

- Facet 2: State and Federal Estimated Tax Payments

Individuals who expect to owe more than a certain amount of tax may be required to make estimated tax payments to both the state and federal government. The rules for estimated tax payments vary depending on the jurisdiction, so it is important for taxpayers to understand the specific requirements for both the state and federal governments.

- Facet 3: Implications for Tax Liability

Making estimated tax payments can help taxpayers avoid penalties and interest charges. If a taxpayer underpays their estimated taxes, they may be subject to penalties when they file their tax return. Conversely, if they overpay their estimated taxes, they will receive a refund when they file their tax return.

- Facet 4: Role of Tax Professionals

Tax professionals can provide guidance on estimated tax payments and assist taxpayers in determining their estimated tax liability. They can also help taxpayers set up a payment schedule to ensure that they are meeting their tax obligations throughout the year.

In conclusion, understanding the requirement for estimated tax payments for both state and federal taxes is crucial for taxpayers to meet their tax obligations and navigate the complexities of "does state income tax come after federal" effectively. By considering these facets, taxpayers can ensure they are making timely estimated tax payments, avoiding penalties and interest charges, and fulfilling their tax responsibilities to both the federal and state governments.

Tax Refunds

In the context of "does state income tax come after federal," understanding the implications of tax refunds is crucial. Tax refunds arise when an individual or entity pays more taxes than they ultimately owe. These refunds can come from both the state and federal government, and the connection lies in the following facets:

- Facet 1: Overpayment of Taxes

If an individual or entity overpays their state or federal income taxes, they are entitled to a refund. This can occur due to various reasons, such as withholding more taxes than necessary from paychecks or overestimating income and claiming excessive deductions.

- Facet 2: Timing of Refunds

The timing of state and federal tax refunds can differ. Federal tax refunds are typically issued within a few weeks of filing a return, while state tax refunds may take longer to process. This difference can impact an individual's cash flow and financial planning.

- Facet 3: Impact on Tax Liability

Receiving a tax refund can reduce an individual's overall tax liability. The amount of the refund will depend on the amount of overpayment and the specific tax rates applicable to the individual's income.

- Facet 4: Role of Tax Professionals

Tax professionals can assist individuals in accurately calculating their tax liability and minimizing the chances of overpayment. They can also advise on strategies to optimize tax refunds and ensure that individuals are claiming all eligible deductions and credits.

In conclusion, understanding the connection between tax refunds and the question of "does state income tax come after federal" is crucial for individuals to maximize their tax savings and financial planning. By considering these facets, taxpayers can ensure they are receiving timely refunds and fulfilling their tax obligations efficiently.

Tax Audits

In the context of "does state income tax come after federal," understanding the implications of tax audits is crucial. Tax audits are examinations of an individual's or entity's tax return by a tax authority to ensure accuracy and compliance with tax laws. Both state and federal tax authorities have the authority to conduct audits, and the connection lies in the following facets:

- Facet 1: Scope and Purpose of Audits

Tax audits can be comprehensive or focused on specific aspects of a tax return. The purpose of an audit is to verify the accuracy of the information reported on the return, including income, deductions, credits, and other relevant data.

- Facet 2: Selection Process

Tax returns are selected for audit based on various criteria, such as random selection, specific triggers (e.g., high income, complex deductions), or discrepancies identified during data processing.

- Facet 3: Audit Procedures

During an audit, tax authorities may request additional documentation, ask questions, and examine financial records to verify the accuracy of the tax return. The procedures and documentation requirements may vary depending on the jurisdiction and the complexity of the audit.

- Facet 4: Implications for Taxpayers

The outcome of an audit can range from no adjustments to significant changes in tax liability. If discrepancies or errors are found, the taxpayer may need to pay additional taxes, penalties, and interest. Conversely, if the audit finds that the taxpayer overpaid their taxes, they may be entitled to a refund.

In conclusion, understanding the connection between tax audits and the question of "does state income tax come after federal" is crucial for taxpayers to navigate the complexities of tax compliance. By considering these facets, taxpayers can be better prepared for the possibility of an audit and ensure that they are meeting their tax obligations accurately.

Tax Penalties

In the context of "does state income tax come after federal," understanding tax penalties holds significant importance. Failure to comply with tax filing and payment deadlines can lead to penalties imposed by both state and federal tax authorities, creating additional financial burdens for taxpayers. Here are key facets exploring this connection:

- Facet 1: Understanding Tax Penalties

Tax penalties are financial charges imposed by tax authorities for late filing or late payment of taxes. These penalties can vary in amount and severity depending on the jurisdiction and the extent of the delay. Penalties can range from fixed amounts to percentages of the unpaid tax liability.

- Facet 2: Implications for Taxpayers

Tax penalties can have significant financial consequences for taxpayers. Late filing penalties can accrue on a daily or monthly basis, resulting in substantial charges over time. Late payment penalties are typically a percentage of the unpaid tax amount and can add up quickly, increasing the overall tax liability.

- Facet 3: Similarities and Differences in State and Federal Tax Penalties

While both state and federal governments impose tax penalties for late filing and payment, the specific rules and penalties may differ. It is important for taxpayers to be aware of the specific penalties applicable in their state and at the federal level to avoid any surprises or additional charges.

- Facet 4: Professional Assistance and Compliance

Taxpayers who are unsure about their tax obligations or who have missed filing or payment deadlines are advised to seek professional assistance from tax preparers or accountants. Tax professionals can help taxpayers understand their responsibilities, calculate their tax liability accurately, and file their returns on time, minimizing the risk of penalties.

In conclusion, understanding the connection between tax penalties and the question of "does state income tax come after federal" is crucial for taxpayers to avoid costly penalties and maintain compliance with their tax obligations. By considering these facets, taxpayers can be proactive in meeting their filing and payment deadlines, ensuring timely fulfillment of their tax responsibilities to both state and federal authorities.

Tax Professionals

The connection between "Tax Professionals: Consider consulting with a tax professional for guidance on state and federal tax matters." and "does state income tax come after federal" lies in the complexity and nuances of tax laws and regulations. Understanding the order and implications of state and federal income tax payments can be challenging, and seeking professional guidance can help taxpayers navigate these complexities effectively.

Tax professionals, such as certified public accountants (CPAs) and enrolled agents (EAs), possess the knowledge and expertise to provide comprehensive advice on state and federal tax matters. They can assist taxpayers in understanding the different tax rates, deductions, credits, and exemptions applicable to their specific situations. By considering the interplay between state and federal tax laws, tax professionals can help taxpayers optimize their tax strategies, minimize their tax liability, and ensure compliance with all relevant regulations.

In the context of "does state income tax come after federal," tax professionals can provide valuable insights into the potential impact of state tax payments on federal tax liability. They can advise taxpayers on the timing of state tax payments to avoid penalties and interest charges, and help them understand the implications of any state tax refunds on their overall tax situation. Additionally, tax professionals can assist taxpayers in preparing and filing both state and federal tax returns accurately and efficiently, ensuring that all necessary forms and schedules are included.

Overall, the involvement of tax professionals is crucial for taxpayers seeking to navigate the complexities of state and federal tax matters, including the question of "does state income tax come after federal." Their expertise and guidance can help taxpayers make informed decisions, reduce their tax burden, and maintain compliance with all applicable tax laws.

FAQs on "Does State Income Tax Come After Federal?"

This section addresses frequently asked questions and misconceptions surrounding the topic of state income tax payments in relation to federal income tax obligations.

Question 1: Does state income tax always come after federal income tax?

No, the order of tax payments may vary depending on the specific state's tax laws and due dates. While some states require state income taxes to be paid after federal taxes, others may have different deadlines or allow for simultaneous payments.

Question 2: Can I deduct state income taxes from my federal taxable income?

Yes, in most cases, state income taxes paid or accrued during the tax year can be deducted from federal taxable income, reducing your overall federal tax liability.

Question 3: What happens if I overpay state income taxes?

If you overpay your state income taxes, you will typically receive a refund from the state's taxing agency. The timing and process for receiving a refund may vary depending on the state's procedures.

Question 4: Can I get penalized for not paying state income taxes on time?

Yes, failure to file or pay state income taxes on time can result in penalties and interest charges imposed by the state's taxing agency. These penalties can vary in severity depending on the state's laws.

Question 5: Do all states have an income tax?

No, not all states impose an income tax. Currently, seven states do not have a personal income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

Question 6: How can I get help with state income tax matters?

If you have questions or need assistance with state income tax matters, you can contact the state's department of revenue or seek guidance from a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA).

Summary: Understanding the relationship between state and federal income tax payments is crucial for fulfilling your tax obligations and avoiding potential penalties. By being aware of the specific tax laws and deadlines applicable to your state, you can ensure timely and accurate tax payments, maximizing your tax savings and maintaining compliance.

Next Section: Exploring Tax Deductions and Exemptions

Tips on Navigating State and Federal Income Tax Obligations

Understanding the intricacies of state and federal income tax payments can help you optimize your tax strategy, minimize your tax liability, and avoid potential penalties. Here are a few tips to keep in mind:

Tip 1: Understand Your State's Tax Laws

Familiarize yourself with the specific tax laws and due dates applicable to your state of residence. Different states have varying tax rates, deductions, and exemptions that can impact your overall tax liability.

Tip 2: Plan for Estimated Tax Payments

If you expect to owe more than a certain amount of state or federal income tax, you may be required to make estimated tax payments throughout the year. This helps avoid penalties for underpayment when you file your tax return.

Tip 3: Utilize Deductions and Exemptions

Take advantage of available deductions and exemptions to reduce your taxable income. These can include deductions for state income taxes paid, mortgage interest, and charitable contributions, among others.

Tip 4: Seek Professional Guidance if Needed

If you have complex tax matters or need assistance with tax preparation, consider consulting with a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA).

Tip 5: File and Pay on Time

Meet all applicable filing and payment deadlines to avoid penalties and interest charges. Remember that state and federal tax deadlines may differ, so be mindful of both.

Tip 6: Understand the Impact of Overpayments

If you overpay your state or federal income taxes, you may be eligible for a refund. The timing and process for receiving a refund can vary depending on the jurisdiction.

Tip 7: Stay Informed of Tax Law Changes

Tax laws and regulations can change frequently. Stay informed about any updates or modifications to ensure you are compliant and taking advantage of the most current tax benefits.

Tip 8: Keep Accurate Records

Maintain organized records of your income, expenses, and tax-related documents. This will simplify the tax preparation process and provide necessary documentation if you are audited.

Summary: By following these tips, you can navigate the complexities of state and federal income tax obligations more effectively. Understanding your tax responsibilities, utilizing available deductions and exemptions, and seeking professional assistance when needed can help you minimize your tax burden and maintain compliance.

Conclusion: Fulfilling your tax obligations accurately and on time is crucial for responsible citizenship. By leveraging the information and tips provided here, you can confidently manage your state and federal income tax payments, ensuring a smooth and compliant tax season.

Conclusion

Understanding the intricacies of state and federal income tax payments is essential for responsible citizenship. The question of "does state income tax come after federal" highlights the importance of being aware of the distinct tax laws, deadlines, and implications applicable to each jurisdiction.

By delving into the various aspects of state and federal income tax obligations, taxpayers can gain a comprehensive understanding of their tax responsibilities. Utilizing available deductions and exemptions, planning for estimated tax payments, and seeking professional guidance when needed are key strategies for minimizing tax liability and maintaining compliance. Furthermore, staying informed about tax law changes and keeping accurate records ensures that taxpayers are always up-to-date with their tax obligations.

Fulfilling tax obligations accurately and on time not only avoids penalties and interest charges but also contributes to the overall functioning of public services and infrastructure. By actively engaging with their tax responsibilities, individuals play a vital role in supporting their communities and ensuring the smooth operation of society.

- Megamind Mewing The Ultimate Guide To Transforming Your Jawline And Facial Structure

- Mac And Cheese Costume The Ultimate Guide For Foodlovers