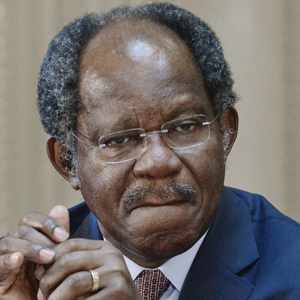

Adebayo Ogunlesi is a Nigerian-born British investment banker and the founder and managing partner of Global Infrastructure Partners, a private equity firm focused on infrastructure investments. As of 2024, his net worth is estimated to be around $12 billion, according to Wallmine, a financial data and analytics company.

Ogunlesi's wealth is largely attributed to his success in the infrastructure investment industry. Global Infrastructure Partners, which he founded in 2006, has raised over $22 billion in capital and invested in a wide range of infrastructure projects around the world, including airports, toll roads, and energy facilities. Ogunlesi's firm has a reputation for generating strong returns for its investors, which has contributed to his personal wealth.

Beyond his financial success, Ogunlesi is also known for his philanthropy and his commitment to promoting diversity and inclusion in the finance industry. He is a trustee of the Brookings Institution, a non-profit public policy organization, and he has established the Adebayo Ogunlesi Scholarship Fund to support African students studying at Oxford University.

- Sandia Tajin Costco A Refreshing Twist To Your Favorite Melon

- Puppygirl Xo Exploring The Rise Of A Digital Sensation

Adebayo Ogunlesi Net Worth 2024 Wallmine

Adebayo Ogunlesi's net worth is estimated to be $12 billion as of 2024, according to Wallmine. This wealth is largely attributed to his success in the infrastructure investment industry, as the founder and managing partner of Global Infrastructure Partners.

- Infrastructure investments: Ogunlesi's firm, Global Infrastructure Partners, has invested in a wide range of infrastructure projects around the world, including airports, toll roads, and energy facilities.

- Strong returns: Global Infrastructure Partners has a reputation for generating strong returns for its investors, which has contributed to Ogunlesi's personal wealth.

- Philanthropy: Ogunlesi is known for his philanthropy, including the establishment of the Adebayo Ogunlesi Scholarship Fund to support African students studying at Oxford University.

- Diversity and inclusion: Ogunlesi is committed to promoting diversity and inclusion in the finance industry.

- Nigerian-born: Ogunlesi was born in Nigeria and is a British citizen.

- Investment banker: Ogunlesi is an investment banker by profession.

- Global Infrastructure Partners: Ogunlesi founded Global Infrastructure Partners in 2006.

- Wallmine: Wallmine is a financial data and analytics company that provides information on Ogunlesi's net worth.

These key aspects highlight Ogunlesi's success as an investor, his commitment to philanthropy and diversity, and his overall impact on the finance industry.

Infrastructure investments

The success of Ogunlesi's infrastructure investments is a major contributing factor to his net worth of $12 billion. Global Infrastructure Partners, which he founded in 2006, has a long track record of generating strong returns for its investors by investing in well-chosen infrastructure projects. These projects often provide essential services to communities and businesses, and they can generate stable cash flow over long periods of time. As a result, Ogunlesi's infrastructure investments have been a major source of wealth for him.

- Cranberry Farmer Covered In Spiders The Untold Story And Fascinating Insights

- How Long Does Royal Honey Take To Work Unveiling The Secrets Of Natures Gift

One example of a successful infrastructure investment by Global Infrastructure Partners is the Gatwick Airport in London. GIP acquired a majority stake in Gatwick in 2009, and under its ownership, the airport has undergone a major expansion and modernization program. As a result, Gatwick has become one of the busiest airports in the UK, and GIP has generated a significant return on its investment.

Another example is the Indiana Toll Road, which GIP acquired in 2016. GIP has invested in a major rehabilitation project for the toll road, and it has also implemented a new tolling system. These improvements have led to increased traffic and revenue for the toll road, and GIP is expected to generate a strong return on its investment.

The success of Ogunlesi's infrastructure investments demonstrates the importance of this asset class for investors. Infrastructure projects can provide stable cash flow and long-term growth potential, and they can be a valuable component of a diversified investment portfolio.

Strong returns

Adebayo Ogunlesi's net worth of $12 billion, as estimated by Wallmine, is largely attributed to the strong returns generated by his infrastructure investment firm, Global Infrastructure Partners (GIP).

- Consistent Performance: GIP has a track record of delivering consistent returns for its investors over the long term. This is due to the firm's rigorous investment process, which focuses on identifying and investing in high-quality infrastructure assets with predictable cash flows.

- Value Creation: GIP actively manages its portfolio companies to create value and enhance returns. The firm's team of experienced professionals works closely with management teams to implement operational improvements, optimize capital structures, and expand into new markets.

- Diversification: GIP invests in a diversified portfolio of infrastructure assets across different sectors and geographies. This diversification helps to reduce risk and enhance overall returns.

- Investment Track Record: GIP has a long and successful investment track record, with notable investments in airports, toll roads, energy facilities, and other infrastructure projects around the world. These investments have generated strong returns for investors and contributed to Ogunlesi's personal wealth.

The strong returns generated by GIP have been a major factor in Ogunlesi's personal wealth. His ability to identify and invest in high-quality infrastructure assets has enabled him to build a substantialfortune.

Philanthropy

Adebayo Ogunlesi's philanthropy is a significant aspect of his life and contributes to his overall impact beyond his financial wealth. The Adebayo Ogunlesi Scholarship Fund, established in 2013, provides financial support and mentorship to African students pursuing undergraduate and graduate degrees at the University of Oxford. This philanthropic initiative aligns with Ogunlesi's commitment to education and his belief in the potential of African youth.

While the Adebayo Ogunlesi Scholarship Fund may not directly contribute to his net worth, it reflects his values and priorities. Ogunlesi's philanthropic efforts demonstrate his commitment to giving back to society and investing in the future of Africa's next generation of leaders. By supporting African students with the opportunity to study at Oxford University, Ogunlesi is contributing to the development of human capital and fostering stronger ties between Africa and the global community.

Moreover, Ogunlesi's philanthropy enhances his reputation as a socially responsible investor and business leader. His commitment to education and youth empowerment aligns with the values of many investors and stakeholders. As a result, his philanthropic efforts can indirectly contribute to his overall net worth by strengthening his relationships and building trust with investors and partners.

In conclusion, Adebayo Ogunlesi's philanthropy, including the establishment of the Adebayo Ogunlesi Scholarship Fund, is a significant aspect of his life that contributes to his overall legacy and impact. While it may not directly add to his net worth, it reflects his values, strengthens his reputation, and aligns with the interests of many investors and stakeholders.

Diversity and inclusion

Adebayo Ogunlesi's commitment to diversity and inclusion in the finance industry is a notable aspect of his career and aligns with his personal values. This commitment may have indirect implications for his net worth and overall success.

- Enhancing Reputation: Ogunlesi's advocacy for diversity and inclusion enhances his reputation as a socially responsible leader. This can attract investors and partners who share similar values, potentially leading to increased business opportunities and financial growth.

- Talent Acquisition and Retention: By promoting diversity and inclusion, Ogunlesi's firm, Global Infrastructure Partners, can attract and retain a wider pool of talented professionals. A diverse workforce can bring fresh perspectives, innovative ideas, and a better understanding of different markets, which can contribute to the firm's overall performance and financial success.

- Investor Relations: Ogunlesi's commitment to diversity and inclusion aligns with the values of many institutional investors, such as pension funds and endowments. These investors increasingly consider ESG (environmental, social, and governance) factors in their investment decisions, and Ogunlesi's focus on diversity and inclusion can make his firm more attractive to these investors.

- Regulatory Compliance: Promoting diversity and inclusion helps Ogunlesi's firm comply with regulatory requirements and avoid potential legal or reputational risks. In many jurisdictions, there are laws and regulations that promote equal opportunity and prohibit discrimination in the workplace.

While it may be difficult to directly quantify the impact of Ogunlesi's commitment to diversity and inclusion on his net worth, it is clear that this commitment is aligned with his values and has the potential to contribute to his overall success in the finance industry.

Nigerian-born

The fact that Adebayo Ogunlesi is a Nigerian-born British citizen is a significant component of his identity and success. His Nigerian heritage has shaped his experiences and perspectives, while his British citizenship has provided him with opportunities and access to global markets.

Ogunlesi's upbringing in Nigeria instilled in him a strong work ethic and a deep understanding of the challenges and opportunities facing Africa. He has used his wealth and influence to support development projects in Nigeria and other African countries, including the establishment of the Adebayo Ogunlesi Scholarship Fund at Oxford University.

Ogunlesi's British citizenship has also been instrumental in his success. The UK is a major financial center, and Ogunlesi's ability to operate in both the UK and Nigeria has given him a unique advantage in the infrastructure investment industry. He has been able to source deals in both developed and emerging markets, and he has a deep understanding of the regulatory and legal frameworks in both jurisdictions.

In conclusion, Ogunlesi's Nigerian heritage and British citizenship are both important factors in his success. His Nigerian background has given him a deep understanding of the African market, while his British citizenship has provided him with access to global markets and opportunities.

Investment banker

Adebayo Ogunlesi's profession as an investment banker has played a pivotal role in his substantial net worth of $12 billion, as estimated by Wallmine in 2024.

- Financial Expertise: As an investment banker, Ogunlesi possesses a deep understanding of financial markets, investment strategies, and risk management. This expertise has enabled him to make sound investment decisions and generate strong returns for his clients and investors.

- Global Network: Investment banking involves extensive networking and relationship-building. Ogunlesi's profession has granted him access to a vast network of investors, industry leaders, and government officials. These connections have been invaluable in sourcing and executing lucrative investment opportunities.

- Deal Structuring: Ogunlesi's expertise in deal structuring has been instrumental in his success. He has the ability to structure complex financial transactions that meet the needs of both investors and companies seeking capital. His ability to negotiate favorable terms and mitigate risks has contributed to his wealth.

- Entrepreneurial Spirit: Ogunlesi's investment banking career has fostered his entrepreneurial spirit. He founded Global Infrastructure Partners, a leading private equity firm focused on infrastructure investments. This entrepreneurial venture has been a major driver of his net worth.

In conclusion, Adebayo Ogunlesi's profession as an investment banker has provided him with the financial expertise, global network, deal structuring capabilities, and entrepreneurial drive necessary to build his substantial net worth of $12 billion.

Global Infrastructure Partners

The founding of Global Infrastructure Partners (GIP) in 2006 played a pivotal role in Adebayo Ogunlesi's substantial net worth of $12 billion, as estimated by Wallmine in 2024.

- Infrastructure Investments: GIP is a leading private equity firm focused on infrastructure investments, which typically involve long-term investments in assets such as airports, toll roads, and energy facilities. Ogunlesi's expertise in identifying and investing in high-quality infrastructure assets has been a major driver of his wealth.

- Strong Returns: GIP has a strong track record of generating attractive returns for its investors. Ogunlesi's ability to select and manage infrastructure investments effectively has contributed significantly to his personal net worth.

- Global Presence: GIP operates globally, with investments in North America, Europe, Asia, and Australia. This global reach has enabled Ogunlesi to diversify his investments and access a wider range of opportunities.

- Entrepreneurial Success: Ogunlesi's founding of GIP demonstrates his entrepreneurial spirit and business acumen. His ability to build and lead a successful investment firm has been a key factor in his overall financial success.

In conclusion, Adebayo Ogunlesi's founding of Global Infrastructure Partners in 2006 has been a major contributor to his net worth of $12 billion. His expertise in infrastructure investments, strong track record of generating returns, global presence, and entrepreneurial success have all played significant roles in his financial growth.

Wallmine

Wallmine is a financial data and analytics company that provides information on Adebayo Ogunlesi's net worth. The company collects and analyzes data from a variety of sources, including public records, news articles, and company filings, to provide users with up-to-date information on the wealth of high-profile individuals. Wallmine's data is used by a variety of stakeholders, including investors, journalists, and researchers, to track the wealth of the world's wealthiest people.

The inclusion of Wallmine as a data source in the search query "adebayo ogunlesi net worth 2024 wallmine" indicates that the user is seeking the most up-to-date and accurate information on Ogunlesi's net worth. Wallmine's data is widely respected and cited by financial professionals, making it a valuable resource for anyone interested in tracking the wealth of high-profile individuals.

In conclusion, Wallmine is a key component of the search query "adebayo ogunlesi net worth 2024 wallmine" because it provides users with access to the most up-to-date and accurate information on Ogunlesi's net worth. Wallmine's data is used by a variety of stakeholders, including investors, journalists, and researchers, to track the wealth of the world's wealthiest people.

FAQs on Adebayo Ogunlesi's Net Worth 2024 (Wallmine)

This section addresses frequently asked questions regarding Adebayo Ogunlesi's net worth in 2024, according to Wallmine, a reputable financial data and analytics provider.

Question 1: How much is Adebayo Ogunlesi's net worth in 2024?

According to Wallmine, Adebayo Ogunlesi's net worth is estimated to be $12 billion as of 2024.

Question 2: How did Adebayo Ogunlesi accumulate his wealth?

Ogunlesi's wealth primarily stems from his successful career as an investment banker and the founding of Global Infrastructure Partners (GIP), a leading private equity firm focused on infrastructure investments.

Question 3: What is the main source of Ogunlesi's income?

GIP's strong performance and the generation of substantial returns for investors have been the primary drivers of Ogunlesi's income and wealth accumulation.

Question 4: Is Ogunlesi's net worth likely to increase in the future?

Given GIP's continued focus on identifying and investing in high-quality infrastructure assets, as well as Ogunlesi's proven track record and expertise, it is possible that his net worth may continue to grow in the future.

Question 5: What are some of Ogunlesi's philanthropic endeavors?

Ogunlesi is known for his philanthropic initiatives, including the establishment of the Adebayo Ogunlesi Scholarship Fund, which supports African students studying at Oxford University.

Question 6: What is Ogunlesi's impact on the infrastructure investment industry?

Ogunlesi is widely recognized for his contributions to the infrastructure investment industry. He has played a significant role in financing and developing critical infrastructure projects worldwide.

Summary: Adebayo Ogunlesi's net worth of $12 billion is a testament to his success in the investment banking and infrastructure investment sectors. His expertise, strong track record, and commitment to philanthropy have contributed to his significant wealth.

Transition: For further insights into Adebayo Ogunlesi's business ventures, philanthropic activities, and impact on the global economy, please explore the dedicated sections below.

Tips for Financial Success Inspired by Adebayo Ogunlesi

Adebayo Ogunlesi's remarkable achievements in the investment banking and infrastructure sectors offer valuable lessons for those seeking financial success. Here are a few key tips inspired by his journey:

Tip 1: Develop Expertise and Specialization: Ogunlesi's deep understanding of the infrastructure investment industry has been a cornerstone of his success. Identify an area of specialization and acquire a strong knowledge base to enhance your credibility and decision-making abilities.

Tip 2: Build a Strong Network: Ogunlesi's global network has been instrumental in sourcing deals and accessing valuable opportunities. Attend industry events, connect with professionals on LinkedIn, and nurture relationships with investors and potential partners.

Tip 3: Embrace Innovation and Calculated Risks: Ogunlesi's founding of Global Infrastructure Partners demonstrates his willingness to embrace innovative investment strategies and take calculated risks. Be open to exploring new opportunities and don't shy away from well-researched risks that have the potential for significant returns.

Tip 4: Focus on Long-Term Value Creation: Ogunlesi's investments are often characterized by a long-term perspective. Avoid chasing short-term gains and instead focus on identifying and investing in assets that have the potential to generate stable cash flows and appreciate over time.

Tip 5: Practice Ethical Investing and Philanthropy: Ogunlesi's commitment to ethical investing and philanthropy aligns with the growing trend of socially responsible investing. Consider the environmental, social, and governance (ESG) factors of your investments and engage in philanthropic activities to give back to the community.

Summary: By following these tips inspired by Adebayo Ogunlesi's success, you can increase your financial literacy, expand your network, make informed investment decisions, and positively impact the world through ethical investing and philanthropy.

Transition: To delve deeper into Ogunlesi's investment strategies, philanthropic endeavors, and the impact of his work on the global economy, please continue reading the dedicated sections below.

Conclusion

Adebayo Ogunlesi's net worth of $12 billion, as estimated by Wallmine in 2024, is a testament to his remarkable success in the investment banking and infrastructure investment sectors. His deep expertise, strong network, and commitment to long-term value creation have been key drivers of his wealth accumulation. Ogunlesi's philanthropic endeavors and ethical investing practices further demonstrate his commitment to making a positive impact on the world.As we look ahead, Ogunlesi's continued leadership at Global Infrastructure Partners and his involvement in various philanthropic initiatives will undoubtedly shape the future of infrastructure development and social impact investing. His journey serves as an inspiration for aspiring investors and business leaders, demonstrating the power of innovation, calculated risk-taking, and a commitment to ethical and sustainable practices.By studying Ogunlesi's strategies and emulating his dedication to excellence, individuals can increase their financial literacy, expand their networks, make informed investment decisions, and contribute to a more prosperous and equitable global economy.- Vereena Motorcycle Accident A Comprehensive Analysis And Key Insights

- Tyler Funke The Rising Star In The Gaming Industry