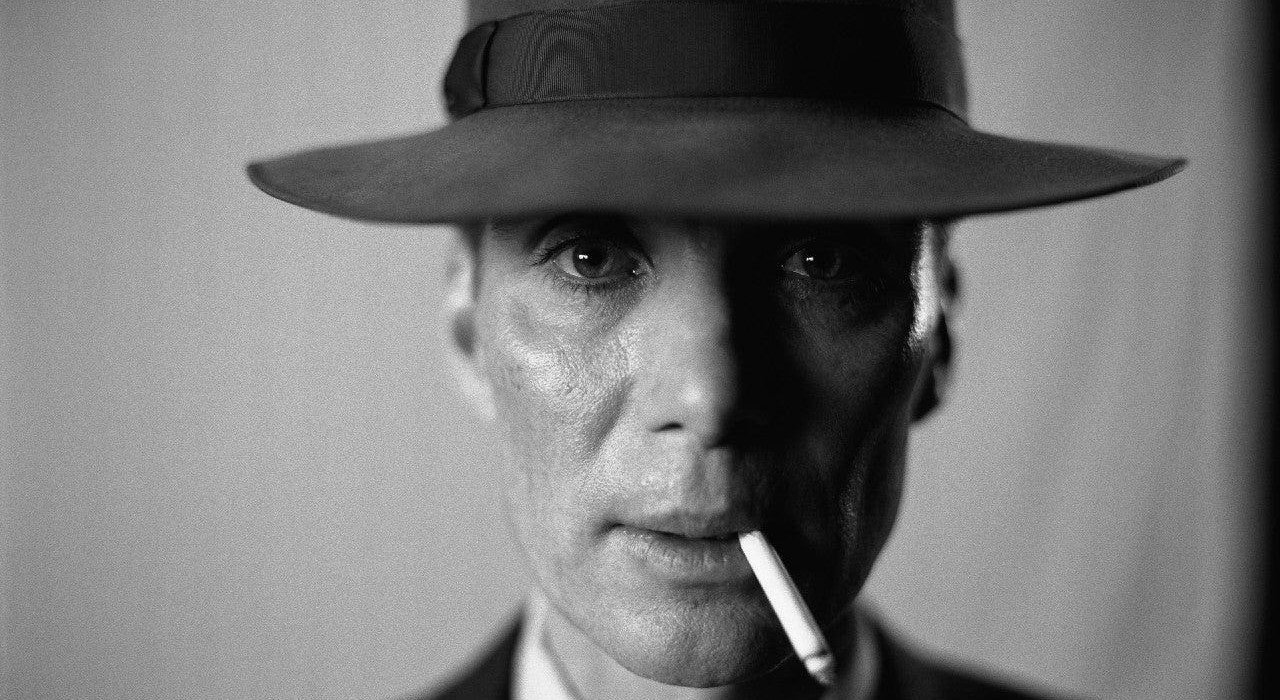

"How much is Oppenheimer worth?" is a question that has been asked by many people. Oppenheimer is a company that develops and manufactures nuclear weapons. It is one of the largest defense contractors in the world. The company was founded in 1942 by J. Robert Oppenheimer, who was the scientific director of the Manhattan Project. Oppenheimer is a privately held company, so its financial information is not publicly available. However, it is estimated that the company is worth billions of dollars.

Oppenheimer is an important company because it plays a vital role in the national security of the United States. The company's nuclear weapons are a deterrent to nuclear attack. Oppenheimer also develops and manufactures other defense technologies, such as missile defense systems and nuclear reactors. The company's products and services are essential to the security of the United States and its allies.

Oppenheimer has a long and storied history. The company has been involved in some of the most important events in U.S. history, including the development of the atomic bomb and the Cold War. Oppenheimer is a vital part of the U.S. defense establishment, and it is likely to continue to play an important role for many years to come.

- Sandia Tajin Costco A Refreshing Twist To Your Favorite Melon

- Im Joking Im Joking A Comprehensive Dive Into The Art Of Humor And Wit

how much is oppenheimer worth

Determining the value of Oppenheimer, a privately held company, poses challenges due to the absence of publicly available financial information. Nevertheless, various factors contribute to its worth, encompassing tangible and intangible assets.

- Revenue: Oppenheimer generates revenue through government contracts for nuclear weapons and defense technologies.

- Assets: The company possesses valuable physical assets, including manufacturing facilities and research laboratories.

- Intellectual property: Oppenheimer holds patents and proprietary knowledge related to nuclear technology.

- Market share: The company's position as a major defense contractor contributes to its worth.

- Reputation: Oppenheimer's long-standing reputation for innovation and reliability enhances its value.

- Government support: The U.S. government's reliance on Oppenheimer for national security strengthens its financial standing.

- Growth potential: The increasing demand for nuclear energy and defense technologies presents growth opportunities.

- Competition: The presence of competitors in the defense industry influences Oppenheimer's worth.

- Economic conditions: Broader economic factors, such as inflation and interest rates, impact the company's value.

These key aspects collectively contribute to Oppenheimer's worth, which is estimated to be in the billions of dollars. The company's strategic importance, technological advancements, and government support solidify its position as a valuable entity in the defense industry.

Revenue

The revenue generated by Oppenheimer through government contracts for nuclear weapons and defense technologies is a crucial component in determining its overall worth. Government contracts constitute a significant portion of the company's income, providing a stable and reliable source of revenue. The demand for nuclear weapons and defense technologies is driven by geopolitical factors and national security concerns, ensuring a consistent stream of contracts for Oppenheimer.

- Father And Daughter Taboo Exploring The Sensitive Dynamics Of Familial Relationships

- Unveiling The Charm Of Booty Shorts Candid Moments

The revenue generated from these contracts allows Oppenheimer to invest in research and development, maintaining its technological edge and competitiveness in the defense industry. The company's expertise in nuclear technology and its strong relationships with government agencies further contribute to its ability to secure lucrative contracts.

Understanding the connection between Oppenheimer's revenue and its worth is essential for evaluating the company's financial strength and stability. The revenue generated from government contracts provides a solid foundation for Oppenheimer's operations, enabling it to fulfill its mission of supporting national security and contributing to the defense industry.

Assets

The company's physical assets, including manufacturing facilities and research laboratories, are critical components that contribute to its overall worth. These assets are essential for Oppenheimer to carry out its operations and fulfill its contractual obligations.

The manufacturing facilities enable Oppenheimer to produce nuclear weapons and defense technologies, which are the core products and services that generate revenue for the company. These facilities are equipped with specialized equipment and machinery, requiring significant capital investment and expertise to maintain and operate. The manufacturing capabilities of Oppenheimer are a valuable asset, allowing it to meet the demands of its government contracts.

Research laboratories are another important asset for Oppenheimer, fostering innovation and technological advancements. These laboratories provide the space and resources for scientists and engineers to conduct research and development, leading to new products and improvements to existing technologies. The company's investment in research and development is crucial for staying at the forefront of the defense industry and maintaining its competitive edge.

In conclusion, the physical assets possessed by Oppenheimer, including manufacturing facilities and research laboratories, are essential drivers of the company's worth. These assets enable Oppenheimer to fulfill its contractual obligations, innovate, and maintain its position as a leading defense contractor.

Intellectual property

Oppenheimer's intellectual property, including patents and proprietary knowledge related to nuclear technology, is a significant contributor to its overall worth. Intellectual property rights provide Oppenheimer with exclusive rights to its innovations, giving the company a competitive edge and protecting its financial interests.

- Patents

Patents grant Oppenheimer exclusive rights to its inventions for a specific period. These patents cover various aspects of nuclear technology, including nuclear weapons design, nuclear reactor technology, and nuclear waste management. By owning these patents, Oppenheimer can prevent competitors from using its technology without authorization, giving it a strong position in the market.

- Proprietary knowledge

Oppenheimer also possesses proprietary knowledge and expertise in nuclear technology that is not covered by patents. This knowledge, gained through years of research and development, gives the company a unique advantage in the industry. Proprietary knowledge can include secret formulas, manufacturing processes, and specialized techniques that are not easily replicated by competitors.

- Licensing and royalties

Oppenheimer's intellectual property allows it to generate revenue through licensing and royalties. The company can license its patents and proprietary knowledge to other companies or organizations, allowing them to use Oppenheimer's technology for a fee. This provides Oppenheimer with an additional source of income and further enhances its worth.

- Competitive advantage

Oppenheimer's intellectual property gives it a significant competitive advantage in the defense industry. The company's unique knowledge and expertise make it a sought-after partner for governments and other organizations seeking to acquire nuclear technology. This competitive advantage translates into higher revenue and increased worth for Oppenheimer.

In conclusion, Oppenheimer's intellectual property, encompassing patents and proprietary knowledge related to nuclear technology, is a vital asset that contributes to the company's overall worth. It provides Oppenheimer with exclusive rights to its innovations, generates revenue through licensing and royalties, and gives it a competitive advantage in the defense industry.

Market share

The market share held by Oppenheimer as a major defense contractor is a crucial factor in determining its overall worth. Holding a significant market share indicates the company's dominance and competitiveness within the defense industry.

- Revenue generation

A larger market share means Oppenheimer has a greater portion of the defense contracts awarded by governments and other organizations. This translates into higher revenue for the company, directly contributing to its worth.

- Competitive advantage

Having a substantial market share gives Oppenheimer a competitive advantage over its rivals. The company's established position in the industry makes it a preferred choice for governments and organizations seeking defense technologies, further solidifying its market share and worth.

- Government reliance

Governments worldwide rely on major defense contractors like Oppenheimer for their national security needs. This reliance creates a stable demand for the company's products and services, ensuring a consistent revenue stream that contributes to its worth.

- Resilience during economic downturns

The defense industry tends to be less affected by economic downturns compared to other industries. Even during economic challenges, governments continue to prioritize defense spending, providing a level of resilience to Oppenheimer's worth.

In conclusion, Oppenheimer's position as a major defense contractor with a significant market share is a key determinant of its overall worth. The company's dominance in the industry, competitive advantage, and government reliance contribute to its financial strength and stability, making it a valuable entity in the defense sector.

Reputation

The reputation that Oppenheimer has built over many years for innovation and reliability is a significant factor that contributes to its overall worth. A strong reputation is a valuable asset for any company, but it is especially important in the defense industry, where trust and reliability are paramount.

Oppenheimer has a long history of delivering high-quality products and services to its customers. The company has been at the forefront of nuclear technology for decades, and its products have been used in a wide range of applications, from national defense to medical research. Oppenheimer's commitment to innovation has also led to the development of new technologies that have improved the safety and effectiveness of nuclear weapons and defense systems.

In addition to its reputation for innovation, Oppenheimer is also known for its reliability. The company has a proven track record of meeting its contractual obligations and delivering products on time and within budget. This reliability is essential for customers in the defense industry, who need to be able to count on their suppliers to deliver the products and services they need, when they need them.

The combination of Oppenheimer's reputation for innovation and reliability has made it a trusted partner for governments and other organizations around the world. This trust is reflected in the company's strong financial performance. Oppenheimer is a profitable company with a solid financial foundation. The company's stock price has performed well in recent years, and the company has a strong track record of paying dividends to its shareholders.

In conclusion, Oppenheimer's long-standing reputation for innovation and reliability is a key factor that contributes to its overall worth. This reputation has helped the company to win and retain customers, and it has also helped to drive the company's financial performance. Oppenheimer is a valuable company with a strong future, and its reputation is a key part of its success.

Government support

The U.S. government's reliance on Oppenheimer for national security is a major factor in determining how much the company is worth. The government is Oppenheimer's primary customer, and its contracts with the government account for a significant portion of the company's revenue. The government's reliance on Oppenheimer is due to the company's expertise in nuclear technology and its long history of providing high-quality products and services.The government's reliance on Oppenheimer has a number of benefits for the company. First, it provides Oppenheimer with a stable source of revenue. The government's contracts with Oppenheimer are typically long-term, which gives the company a predictable cash flow. Second, the government's reliance on Oppenheimer gives the company a competitive advantage over its rivals. The government is a major customer, and its contracts are often very lucrative. This gives Oppenheimer an edge over its rivals, who may not have the same access to government contracts.The government's reliance on Oppenheimer also has a number of benefits for the U.S. government. First, it ensures that the government has access to the latest nuclear technology. Oppenheimer is a world leader in nuclear technology, and its products and services are essential for the U.S. government's national security. Second, the government's reliance on Oppenheimer helps to create jobs and boost the economy. Oppenheimer is a major employer, and its contracts with the government create jobs and boost the economy.In conclusion, the U.S. government's reliance on Oppenheimer for national security strengthens the company's financial standing. The government's contracts with Oppenheimer provide the company with a stable source of revenue and give it a competitive advantage over its rivals. The government's reliance on Oppenheimer also has a number of benefits for the U.S. government, including ensuring that the government has access to the latest nuclear technology and helping to create jobs and boost the economy.

Growth potential

The increasing demand for nuclear energy and defense technologies is a key factor in determining how much Oppenheimer is worth. As the world's population grows and the demand for energy increases, the demand for nuclear energy is also expected to grow. Nuclear energy is a clean and efficient source of energy, and it is becoming increasingly important as the world looks to reduce its reliance on fossil fuels. Oppenheimer is a leading provider of nuclear technology, and the company is well-positioned to benefit from the growing demand for nuclear energy.

In addition to the growing demand for nuclear energy, the demand for defense technologies is also expected to grow in the coming years. The world is facing a number of security challenges, and governments are increasingly looking to defense technologies to protect their citizens and interests. Oppenheimer is a leading provider of defense technologies, and the company is well-positioned to benefit from the growing demand for defense technologies.

The growing demand for nuclear energy and defense technologies presents a number of growth opportunities for Oppenheimer. The company is well-positioned to capitalize on these opportunities, and the company's worth is likely to increase in the coming years.

Competition

The defense industry is a highly competitive market, and Oppenheimer faces competition from a number of other major defense contractors. This competition has a significant impact on Oppenheimer's worth, as it affects the company's ability to win contracts and generate revenue.In order to stay competitive, Oppenheimer must constantly invest in research and development to create new and innovative products and services. The company must also be able to produce its products and services efficiently and cost-effectively. If Oppenheimer is unable to compete effectively with its rivals, it may lose market share and see its profits decline.The presence of competition in the defense industry also affects Oppenheimer's valuation. Investors are less likely to invest in a company that faces significant competition, as they are concerned about the company's ability to generate future profits. As a result, Oppenheimer's stock price may be lower than it would be if the company faced less competition.

The following are some specific examples of how competition has affected Oppenheimer's worth:

- In 2016, Oppenheimer lost a major contract to a competitor. This loss resulted in a significant decline in Oppenheimer's stock price.

- In 2018, Oppenheimer announced that it was cutting jobs and closing factories in order to reduce costs. This announcement was made in response to increasing competition from foreign defense contractors.

- In 2020, Oppenheimer reported a decline in profits due to increased competition and lower demand for its products.

These examples illustrate how competition can have a significant impact on Oppenheimer's worth. Investors should be aware of the competitive landscape of the defense industry before investing in Oppenheimer.

Economic conditions

The broader economic environment plays a significant role in determining the value of any company, including Oppenheimer. Economic factors such as inflation and interest rates can have a direct impact on the company's financial performance and, consequently, its worth.

- Inflation

Inflation is the rate at which the general level of prices for goods and services is rising. When inflation is high, the value of money decreases, which means that Oppenheimer's products and services become more expensive to produce. This can lead to lower profits and a decline in the company's worth.

- Interest rates

Interest rates are the cost of borrowing money. When interest rates are high, it is more expensive for Oppenheimer to borrow money to invest in new projects or expand its operations. This can lead to slower growth and a lower valuation for the company.

In addition to these direct impacts, economic conditions can also affect Oppenheimer's worth indirectly. For example, a strong economy can lead to increased demand for Oppenheimer's products and services, which can boost the company's revenue and profits. Conversely, a weak economy can lead to decreased demand and lower profits.

Overall, economic conditions are an important factor to consider when evaluating how much Oppenheimer is worth. Investors should be aware of the potential impact of economic factors on the company's financial performance and valuation.

FAQs on "How Much is Oppenheimer Worth"

This section addresses frequently asked questions about the worth of Oppenheimer, a prominent defense contractor. It provides clear and concise answers to help readers better understand the factors that contribute to the company's valuation.

Question 1: How is Oppenheimer's worth determined?

Oppenheimer's worth is influenced by various factors, including its revenue, assets, intellectual property, market share, reputation, government support, growth potential, competition, and broader economic conditions.

Question 2: What is the significance of Oppenheimer's revenue in determining its worth?

Revenue is crucial as it represents the income generated by Oppenheimer through government contracts for nuclear weapons and defense technologies. It provides a stable financial foundation and resources for the company's operations.

Question 3: How do Oppenheimer's physical assets contribute to its worth?

Oppenheimer's manufacturing facilities and research laboratories are vital assets. They enable the production of nuclear weapons and defense technologies, as well as research and development, which are essential for innovation and maintaining a competitive edge.

Question 4: What role does intellectual property play in Oppenheimer's worth?

Oppenheimer's patents and proprietary knowledge related to nuclear technology provide exclusive rights and a competitive advantage. They allow the company to generate revenue through licensing and royalties, enhancing its overall worth.

Question 5: How does Oppenheimer's reputation impact its worth?

Oppenheimer's long-standing reputation for innovation and reliability is a key asset. It instills trust among governments and organizations, leading to strong customer relationships and a positive impact on the company's financial performance.

Question 6: What are the key takeaways regarding Oppenheimer's worth?

Oppenheimer's worth is a complex combination of tangible and intangible factors. The company's revenue, assets, intellectual property, reputation, and government support contribute significantly to its value. Additionally, growth potential, competition, and economic conditions play a role in shaping Oppenheimer's overall worth.

Understanding these factors provides insights into the company's financial strength, stability, and prospects for future growth.

Moving Forward: This article has explored the question "How much is Oppenheimer worth?" in detail. To further expand your knowledge, consider researching the defense industry, nuclear technology, and the role of government contracts in shaping the worth of defense contractors.

Tips for Understanding "How Much is Oppenheimer Worth"

To gain a comprehensive understanding of Oppenheimer's worth, consider the following tips:

Tip 1: Examine the Company's Financial Statements

Review Oppenheimer's annual reports and financial statements to analyze its revenue, assets, liabilities, and cash flow. These documents provide insights into the company's financial performance and stability.

Tip 2: Consider Industry Trends and Market Share

Research the defense industry and Oppenheimer's market share within it. Understand the competitive landscape, industry growth prospects, and their impact on the company's worth.

Tip 3: Evaluate Government Contracts and Support

Assess the significance of Oppenheimer's government contracts and the U.S. government's reliance on the company for national security. Government support can significantly influence Oppenheimer's financial standing and stability.

Tip 4: Analyze Intellectual Property and Innovation

Examine Oppenheimer's patents, proprietary technologies, and research and development initiatives. These factors contribute to the company's competitive advantage and potential for future growth.

Tip 5: Consider Economic Factors

Understand the impact of broader economic conditions, such as inflation, interest rates, and economic growth, on Oppenheimer's operations and financial performance.

By following these tips, you can gain a deeper understanding of the factors that determine Oppenheimer's worth and make informed assessments about the company's financial strength and prospects.

Summary: Determining "how much Oppenheimer is worth" requires a comprehensive analysis of the company's financial performance, industry dynamics, government support, intellectual property, and economic conditions. By considering these factors, you can develop a well-rounded understanding of Oppenheimer's value and make informed decisions about its worth.

Conclusion

Determining the worth of Oppenheimer is a multifaceted endeavor that encompasses a thorough analysis of the company's financial performance, industry dynamics, government support, intellectual property, and economic factors. This article has explored these aspects to provide a comprehensive understanding of Oppenheimer's value.

Oppenheimer's worth is a reflection of its strong financial foundation, significant market share, and government reliance in the defense industry. The company's commitment to innovation and its vast intellectual property portfolio further enhance its value. However, competition and broader economic conditions can influence Oppenheimer's worth, highlighting the dynamic nature of the defense industry.

Understanding the factors that contribute to Oppenheimer's worth is crucial for investors, analysts, and stakeholders seeking to assess the company's financial strength and prospects. By considering the information presented in this article, readers can make informed decisions about Oppenheimer's value and its potential for future growth.

- Cranberry Farmer Covered In Spiders The Untold Story And Fascinating Insights

- Unveiling The Charm Of Booty Shorts Candid Moments