Caroline Ellison was the co-CEO of Alameda Research, a cryptocurrency hedge fund founded by Sam Bankman-Fried, the former CEO of FTX. She was responsible for managing the firm's trading operations and played a key role in the collapse of FTX. Ellison, along with Bankman-Fried and other executives from FTX and Alameda, has been charged with fraud and other financial crimes.

Ellison's actions as co-CEO of Alameda Research have had a significant impact on the cryptocurrency industry. The collapse of FTX, which was one of the largest cryptocurrency exchanges in the world, has led to a loss of trust in the industry and has caused the value of many cryptocurrencies to decline. Ellison's actions have also raised questions about the regulation of the cryptocurrency industry and the need for greater oversight.

The collapse of FTX and the subsequent charges against Ellison have sent shockwaves through the cryptocurrency industry. It is likely that the fallout from these events will continue to be felt for years to come.

- Audrey Peters Tiktok Unveiling The Rising Stars Journey And Impact

- How Long Does Royal Honey Take To Work Unveiling The Secrets Of Natures Gift

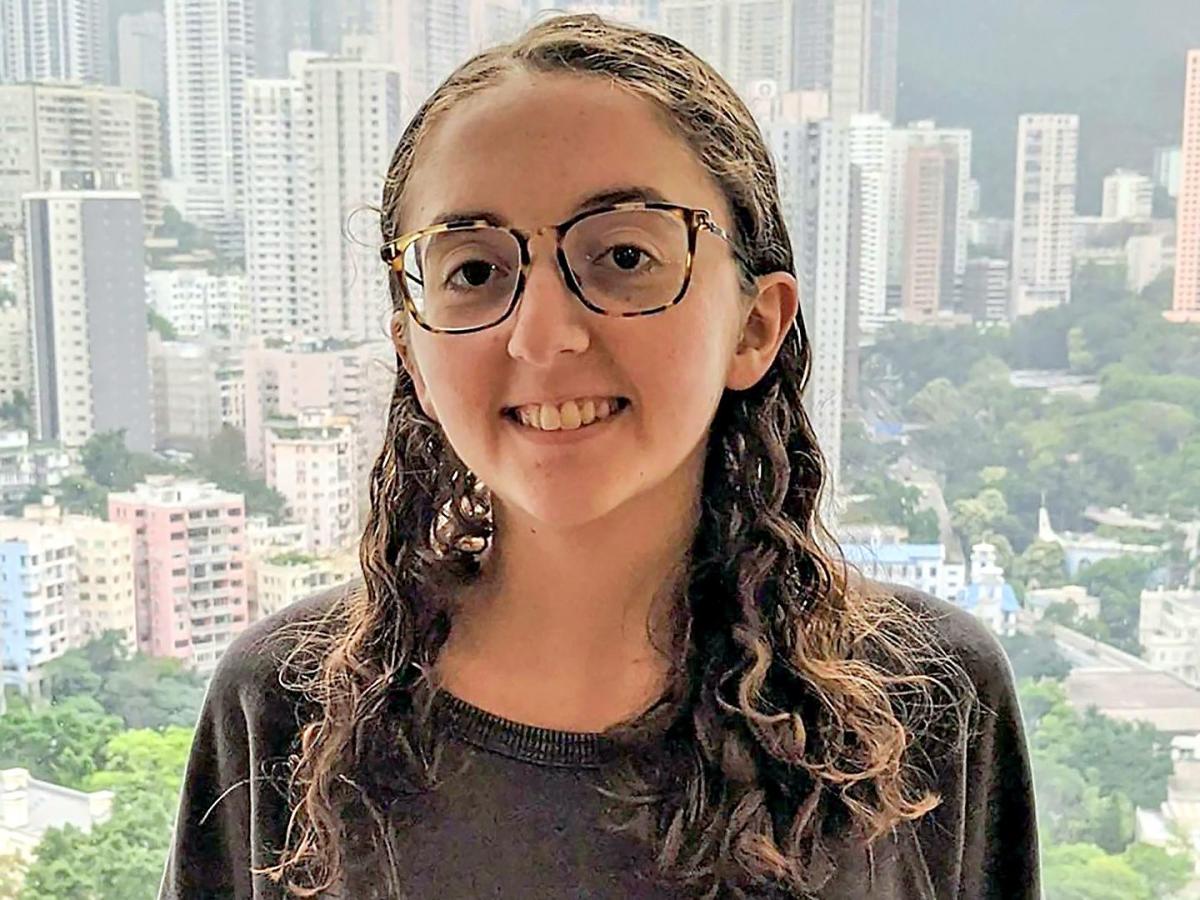

caroline ellison

Caroline Ellison, the former co-CEO of Alameda Research, played a key role in the collapse of FTX, one of the largest cryptocurrency exchanges in the world. Her actions have had a significant impact on the cryptocurrency industry and have raised questions about the regulation of the industry.

- Co-CEO of Alameda Research

- Role in FTX collapse

- Charged with fraud

- Impact on cryptocurrency industry

- Need for regulation

- Shockwaves through industry

- Fallout will continue

- Example of greed and recklessness

Ellison's actions are a reminder of the risks involved in investing in cryptocurrency. The industry is largely unregulated, and there is a lack of transparency and accountability. This can lead to fraud and other financial crimes. Ellison's case is an example of how greed and recklessness can lead to the collapse of even the largest companies.

Co-CEO of Alameda Research

Caroline Ellison was the co-CEO of Alameda Research, a cryptocurrency hedge fund founded by Sam Bankman-Fried, the former CEO of FTX. As co-CEO, Ellison was responsible for managing the firm's trading operations. Alameda Research was closely tied to FTX, and the two companies shared a number of executives. Ellison's role as co-CEO of Alameda Research gave her significant influence over the operations of FTX.

- Lexis Czumakabreu A Rising Star In The Spotlight

- Laios Feet Dungeon Meshi A Comprehensive Guide To Exploring The World Of Fantasy And Culinary Adventures

The collapse of FTX has been attributed in part to the risky trading strategies employed by Alameda Research. Ellison has been accused of using FTX customer funds to prop up Alameda's trades. This led to a liquidity crisis at FTX when customers began to withdraw their funds. FTX was unable to meet these withdrawals and filed for bankruptcy in November 2022.

Ellison's actions as co-CEO of Alameda Research have had a significant impact on the cryptocurrency industry. The collapse of FTX has led to a loss of trust in the industry and has caused the value of many cryptocurrencies to decline. Ellison's actions have also raised questions about the regulation of the cryptocurrency industry and the need for greater oversight.

Role in FTX collapse

Caroline Ellison, the former co-CEO of Alameda Research, played a key role in the collapse of FTX, one of the largest cryptocurrency exchanges in the world. Alameda Research was closely tied to FTX, and the two companies shared a number of executives. Ellison's role as co-CEO of Alameda Research gave her significant influence over the operations of FTX.

- Risky trading strategies

Alameda Research employed risky trading strategies that contributed to the collapse of FTX. Ellison has been accused of using FTX customer funds to prop up Alameda's trades. This led to a liquidity crisis at FTX when customers began to withdraw their funds.

- Lack of oversight

There was a lack of oversight of Alameda Research's activities by FTX. This allowed Ellison to engage in risky trading practices without being held accountable. The lack of oversight also allowed Ellison to use FTX customer funds to prop up Alameda's trades.

- Conflicts of interest

There were a number of conflicts of interest between Alameda Research and FTX. For example, Ellison was dating Sam Bankman-Fried, the CEO of FTX. This created a situation where Ellison could not always act in the best interests of FTX customers.

- Lack of regulation

The cryptocurrency industry is largely unregulated. This allowed FTX and Alameda Research to operate with a lack of transparency and accountability. The lack of regulation also made it difficult for customers to understand the risks involved in investing in FTX.

Ellison's role in the collapse of FTX has had a significant impact on the cryptocurrency industry. The collapse of FTX has led to a loss of trust in the industry and has caused the value of many cryptocurrencies to decline. Ellison's actions have also raised questions about the regulation of the cryptocurrency industry and the need for greater oversight.

Charged with fraud

Caroline Ellison, the former co-CEO of Alameda Research, has been charged with fraud by the US Securities and Exchange Commission (SEC). The SEC alleges that Ellison and other FTX executives misled investors about the financial health of FTX and Alameda Research. The SEC also alleges that Ellison and other FTX executives used customer funds to prop up Alameda's trades.

The charges against Ellison are serious and could result in significant penalties. If convicted, Ellison could face jail time and fines. The charges against her are also a blow to the reputation of the cryptocurrency industry. FTX was one of the largest cryptocurrency exchanges in the world, and its collapse has shaken trust in the industry.

The charges against Ellison are a reminder of the importance of regulation in the cryptocurrency industry. The cryptocurrency industry is largely unregulated, and this has allowed fraud and other financial crimes to flourish. The SEC's charges against Ellison are a sign that regulators are taking a closer look at the cryptocurrency industry and are willing to take action against those who break the law.

Impact on cryptocurrency industry

Caroline Ellison, the former co-CEO of Alameda Research, played a key role in the collapse of FTX, one of the largest cryptocurrency exchanges in the world. Her actions have had a significant impact on the cryptocurrency industry, leading to a loss of trust and a decline in the value of many cryptocurrencies.

- Loss of trust

The collapse of FTX has shaken trust in the cryptocurrency industry. FTX was one of the most well-known and respected cryptocurrency exchanges in the world. Its collapse has led many investors to question the safety and security of their cryptocurrency investments.

- Decline in cryptocurrency prices

The collapse of FTX has led to a decline in the prices of many cryptocurrencies. This is because FTX was a major buyer of cryptocurrencies, and its collapse has reduced demand for these assets.

- Increased regulatory scrutiny

The collapse of FTX has led to increased regulatory scrutiny of the cryptocurrency industry. Regulators are now taking a closer look at the industry and are considering new regulations to protect investors.

- Need for greater transparency

The collapse of FTX has highlighted the need for greater transparency in the cryptocurrency industry. Investors need to be able to understand the risks involved in investing in cryptocurrencies and need to be able to trust that the companies they are investing in are operating in a responsible manner.

The impact of Caroline Ellison's actions on the cryptocurrency industry is still unfolding. However, it is clear that her actions have had a significant negative impact on the industry. The loss of trust, the decline in cryptocurrency prices, the increased regulatory scrutiny, and the need for greater transparency are all challenges that the industry will need to address in the years to come.

Need for regulation

The collapse of FTX, a major cryptocurrency exchange, has highlighted the need for greater regulation in the cryptocurrency industry. Caroline Ellison, the former co-CEO of Alameda Research, played a key role in the collapse of FTX. Her actions have raised questions about the adequacy of existing regulations and the need for new regulations to protect investors.

- Transparency and disclosure

One of the key issues that has been raised in the wake of the FTX collapse is the lack of transparency and disclosure in the cryptocurrency industry. Investors need to be able to understand the risks involved in investing in cryptocurrencies and need to be able to trust that the companies they are investing in are operating in a responsible manner. New regulations should require cryptocurrency exchanges to provide more transparency and disclosure about their operations.

- Conflicts of interest

Another issue that has been raised is the potential for conflicts of interest in the cryptocurrency industry. For example, Caroline Ellison was dating Sam Bankman-Fried, the CEO of FTX. This created a situation where Ellison could not always act in the best interests of FTX customers. New regulations should address the potential for conflicts of interest in the cryptocurrency industry.

- Risk management

The collapse of FTX has also raised questions about the risk management practices of cryptocurrency exchanges. New regulations should require cryptocurrency exchanges to have robust risk management practices in place.

- Enforcement

Finally, it is important to have strong enforcement of cryptocurrency regulations. This will help to ensure that companies comply with the regulations and that investors are protected.

The collapse of FTX has shown that the cryptocurrency industry is in need of greater regulation. New regulations should focus on transparency and disclosure, conflicts of interest, risk management, and enforcement. These regulations will help to protect investors and ensure that the cryptocurrency industry is able to grow in a sustainable way.

Shockwaves through industry

The collapse of FTX, a major cryptocurrency exchange, has sent shockwaves through the cryptocurrency industry. Caroline Ellison, the former co-CEO of Alameda Research, played a key role in the collapse of FTX. Her actions have raised questions about the adequacy of existing regulations and the need for new regulations to protect investors.

The collapse of FTX has had a ripple effect throughout the cryptocurrency industry. The value of many cryptocurrencies has declined, and trust in the industry has been shaken. Regulators are now taking a closer look at the industry and are considering new regulations to protect investors.

The collapse of FTX is a reminder of the risks involved in investing in cryptocurrency. The industry is still in its early stages of development, and there is a lack of regulation. This can lead to fraud and other financial crimes. Investors need to be aware of the risks involved and should only invest what they can afford to lose.

The collapse of FTX is a wake-up call for the cryptocurrency industry. The industry needs to take steps to improve transparency and accountability. Regulators also need to step up their oversight of the industry. Only then can the industry regain the trust of investors.

Fallout will continue

The collapse of FTX, a major cryptocurrency exchange, has sent shockwaves through the cryptocurrency industry. Caroline Ellison, the former co-CEO of Alameda Research, played a key role in the collapse of FTX. Her actions have raised questions about the adequacy of existing regulations and the need for new regulations to protect investors.

The fallout from the collapse of FTX is likely to continue for years to come. The value of many cryptocurrencies has declined, and trust in the industry has been shaken. Regulators are now taking a closer look at the industry and are considering new regulations to protect investors.

The collapse of FTX is a reminder of the risks involved in investing in cryptocurrency. The industry is still in its early stages of development, and there is a lack of regulation. This can lead to fraud and other financial crimes. Investors need to be aware of the risks involved and should only invest what they can afford to lose.

The collapse of FTX is also a reminder of the importance of regulation in the cryptocurrency industry. Regulators need to step up their oversight of the industry and ensure that companies are operating in a responsible manner. Only then can the industry regain the trust of investors.

Example of greed and recklessness

Caroline Ellison, the former co-CEO of Alameda Research, is an example of greed and recklessness in the cryptocurrency industry. Ellison played a key role in the collapse of FTX, one of the largest cryptocurrency exchanges in the world. Her actions led to the loss of billions of dollars in customer funds and shook trust in the cryptocurrency industry.

Ellison's greed and recklessness were evident in her trading strategies at Alameda Research. Alameda Research engaged in risky trading practices, including borrowing large sums of money to invest in cryptocurrency. Ellison also used FTX customer funds to prop up Alameda's trades. These risky practices eventually led to the collapse of both Alameda Research and FTX.

Ellison's actions have had a significant impact on the cryptocurrency industry. The collapse of FTX has led to a loss of trust in the industry and has caused the value of many cryptocurrencies to decline. Ellison's actions have also raised questions about the regulation of the cryptocurrency industry and the need for greater oversight.

The case of Caroline Ellison is a cautionary tale about the dangers of greed and recklessness in the cryptocurrency industry. Investors should be aware of the risks involved in investing in cryptocurrency and should only invest what they can afford to lose.

FAQs about Caroline Ellison

Caroline Ellison, the former co-CEO of Alameda Research, has been charged with fraud by the US Securities and Exchange Commission (SEC). Ellison played a key role in the collapse of FTX, one of the largest cryptocurrency exchanges in the world. The following are some frequently asked questions about Caroline Ellison and her involvement in the FTX collapse.

Question 1: Who is Caroline Ellison?Caroline Ellison is a former trader and executive at Alameda Research, a cryptocurrency hedge fund founded by Sam Bankman-Fried, the former CEO of FTX. Ellison was responsible for managing Alameda's trading operations.Question 2: What role did Caroline Ellison play in the collapse of FTX?

Ellison played a key role in the collapse of FTX by engaging in risky trading practices at Alameda Research. Alameda borrowed large sums of money to invest in cryptocurrency and used FTX customer funds to prop up its trades. These practices eventually led to the collapse of both Alameda and FTX.Question 3: What charges has Caroline Ellison been charged with?

Ellison has been charged with fraud by the SEC. The SEC alleges that Ellison and other FTX executives misled investors about the financial health of FTX and Alameda Research.Question 4: What are the potential consequences for Caroline Ellison?

If convicted, Ellison could face jail time and fines. The charges against her are serious and could result in significant penalties.Question 5: What impact did Caroline Ellison's actions have on the cryptocurrency industry?

Ellison's actions have had a significant impact on the cryptocurrency industry. The collapse of FTX has led to a loss of trust in the industry and has caused the value of many cryptocurrencies to decline.Question 6: What are the lessons that can be learned from the Caroline Ellison case?

The Caroline Ellison case is a cautionary tale about the dangers of greed and recklessness in the cryptocurrency industry. Investors should be aware of the risks involved in investing in cryptocurrency and should only invest what they can afford to lose.

The collapse of FTX and the charges against Caroline Ellison are a reminder of the importance of regulation in the cryptocurrency industry. Regulators need to step up their oversight of the industry and ensure that companies are operating in a responsible manner.

Transition to the next article section

Tips from Caroline Ellison's Case

Following the FTX collapse and Caroline Ellison's subsequent fraud charges, several crucial lessons can be learned regarding risk management and ethical conduct within the cryptocurrency industry. Here are some practical tips inspired by the case.

Tip 1: Exercise Prudence in Trading Strategies

Avoid excessive leverage and thoroughly research investments before committing funds. Remember that high-risk strategies can lead to substantial losses, as exemplified by Alameda Research's downfall.

Tip 2: Maintain Transparency and Accountability

Ensure accurate and transparent financial reporting. Regularly audit your operations and disclose any conflicts of interest to maintain investor trust and avoid the pitfalls that contributed to FTX's demise.

Tip 3: Segregate Customer Funds

Keep customer funds separate from company assets to prevent unauthorized usage or risky investments. This segregation protects users' assets and instills confidence in the platform's integrity.

Tip 4: Implement Robust Risk Management

Establish clear risk management policies and procedures. Regularly assess potential risks and implement measures to mitigate them. This proactive approach can help prevent catastrophic losses.

Tip 5: Foster a Culture of Compliance

Prioritize compliance with all applicable laws and regulations. Train employees on ethical conduct and establish a culture that values integrity and transparency. This helps avoid legal repercussions and maintains stakeholder trust.

Tip 6: Encourage Independent Oversight

Consider engaging external auditors or independent directors to provide objective assessments of your operations. Their insights can enhance transparency and help identify areas for improvement.

Tip 7: Prioritize Customer Protection

Always act in the best interests of customers. Provide clear and accessible information about products and services, and handle disputes fairly. Building trust through customer-centricity can help avoid the reputational damage experienced by FTX.

Summary

Caroline Ellison's case serves as a cautionary tale about the consequences of recklessness and misconduct in the cryptocurrency industry. By adhering to these tips, companies and individuals can enhance their risk management practices, safeguard customer interests, and foster a more ethical and sustainable ecosystem for digital assets.

Conclusion

Caroline Ellison's actions as co-CEO of Alameda Research played a key role in the collapse of FTX, one of the largest cryptocurrency exchanges in the world. Her involvement in risky trading practices and alleged misuse of customer funds have raised important questions about the regulation of the cryptocurrency industry. The fallout from the FTX collapse continues to impact the industry, highlighting the need for greater transparency, accountability, and investor protection.

The case of Caroline Ellison serves as a cautionary tale for all participants in the cryptocurrency industry. It is crucial for companies to prioritize ethical conduct, implement robust risk management practices, and operate in compliance with all applicable laws and regulations. Only through a commitment to transparency, accountability, and customer protection can the cryptocurrency industry regain trust and achieve long-term sustainability.

- Jynxzi R6 Skin A Comprehensive Guide To The Hottest Rainbow Six Siege Customization

- Jiren Boost Pill The Ultimate Guide To Enhancing Your Health Naturally