A trust fund baby is a person who has inherited a large sum of money from a trust fund. These trusts are typically set up by wealthy parents or grandparents to provide for their children or grandchildren's financial future. The money in a trust fund can be used for various purposes, such as education, living expenses, or investments.

There are many benefits to being a trust fund baby. For one, it can provide financial security and peace of mind. Trust fund babies do not have to worry about paying for college or living expenses, and they can often afford to pursue their passions without worrying about money. Additionally, trust funds can provide tax benefits, as the income from a trust fund is often taxed at a lower rate than other forms of income.

However, there are also some potential drawbacks to being a trust fund baby. For example, trust fund babies may be more likely to develop a sense of entitlement and may not learn the value of money. Additionally, trust funds can sometimes lead to family conflict, as beneficiaries may disagree about how the money should be used.

- Tyler Funke The Rising Star In The Gaming Industry

- Discover The World Of Haide Unique A Comprehensive Guide

What is a Trust Fund Baby

A trust fund baby is a person who has inherited a large sum of money from a trust fund. These trusts are typically set up by wealthy parents or grandparents to provide for their children or grandchildren's financial future. The money in a trust fund can be used for various purposes, such as education, living expenses, or investments.

- Beneficiary: The person who receives the money from the trust fund.

- Grantor: The person who creates the trust fund.

- Trustee: The person who manages the trust fund.

- Inheritance: The money or property that is passed down from one person to another after they die.

- Wealth: A large amount of money or property.

- Financial security: The state of having enough money to meet your needs and live comfortably.

- Entitlement: The belief that you deserve something without having to earn it.

- Family conflict: Disagreements or disputes between family members.

- Tax benefits: Reductions in the amount of taxes that you have to pay.

- Investment: The act of putting money into something with the expectation of making a profit.

Trust funds can provide many benefits to beneficiaries, such as financial security and peace of mind. However, there are also some potential drawbacks, such as a sense of entitlement and family conflict. It is important for beneficiaries to understand the terms of their trust fund and to use the money wisely.

Beneficiary

The beneficiary is the most important person in a trust fund. Without a beneficiary, there would be no one to receive the money and the trust fund would not exist. Beneficiaries can be individuals, groups of people, or even organizations. In the case of a trust fund baby, the beneficiary is typically the child or grandchild of the person who created the trust fund.

- Im Joking Im Joking A Comprehensive Dive Into The Art Of Humor And Wit

- Lexis Czumakabreu A Rising Star In The Spotlight

Beneficiaries have a number of rights and responsibilities. They have the right to receive the money from the trust fund according to the terms of the trust. They also have the responsibility to use the money wisely and in accordance with the grantor's wishes. Beneficiaries may also have the right to make decisions about how the money is invested and managed.

The role of the beneficiary is essential to the success of a trust fund. Beneficiaries are the ones who benefit from the money in the trust fund and they have the responsibility to use it wisely.

Grantor

The grantor is the person who creates the trust fund. They are the ones who decide how much money to put in the trust fund, who the beneficiaries will be, and how the money will be used. The grantor's intentions are very important, as they will determine the terms of the trust fund and how it will be managed.

In the case of a trust fund baby, the grantor is typically the parent or grandparent of the beneficiary. The grantor may create the trust fund to provide for the beneficiary's education, living expenses, or other needs. The grantor may also specify how the money can be used, such as for specific investments or expenses.

The grantor's role is essential to the creation of a trust fund. The grantor's intentions will determine the purpose of the trust fund and how it will be used. It is important for the grantor to carefully consider their intentions and to create a trust fund that will meet the needs of the beneficiary.

Trustee

The trustee is the person who manages the trust fund. They are responsible for investing the money, paying taxes, and distributing the income to the beneficiaries. The trustee must act in the best interests of the beneficiaries and follow the terms of the trust.

- Role of the trustee

The trustee has a number of important roles and responsibilities. These include:- Investing the money in the trust fund

- Paying taxes on the income from the trust fund

- Distributing the income to the beneficiaries

- Managing the trust fund's assets

- Following the terms of the trust

- Qualifications of a trustee

Trustees must be qualified to manage a trust fund. They must have experience in investing and managing money. They must also be familiar with the tax laws that apply to trusts. - Compensation of a trustee

Trustees are typically compensated for their services. The compensation may be a percentage of the trust fund's assets or a flat fee. - Liability of a trustee

Trustees are liable for any losses that occur to the trust fund as a result of their negligence or misconduct.

The trustee plays a vital role in the management of a trust fund. They must be qualified and experienced in order to properly manage the fund and protect the interests of the beneficiaries.

Inheritance

Inheritance plays a significant role in the context of "what is a trust fund baby." A trust fund is a legal arrangement where an individual (the grantor) transfers assets to a trustee to hold and manage for the benefit of a beneficiary. Inheritance can be a source of funds for establishing a trust fund, providing financial security and stability for the beneficiary.

- Direct Inheritance: In some cases, a trust fund baby may inherit money or property directly from a deceased relative. This inheritance can be used to create a trust fund, ensuring that the funds are managed and used according to the grantor's wishes.

- Inheritance through a Will: Alternatively, a trust fund may be established through a will. In such cases, the deceased individual specifies in their will that a portion of their estate be placed in a trust fund for the benefit of a designated beneficiary.

- Inheritance Tax Implications: Inheritances may be subject to inheritance tax, which can impact the amount of money available to establish a trust fund. It is crucial to consider tax implications when planning and managing a trust fund.

- Estate Planning: Inheritance and trust fund planning often go hand-in-hand. Individuals who wish to establish a trust fund may use their estate plan to direct how their assets will be distributed after their death, including provisions for creating or funding a trust fund.

In summary, inheritance plays a crucial role in the context of "what is a trust fund baby." It can provide the financial foundation for establishing a trust fund, ensuring the long-term financial well-being of the beneficiary. Understanding the connection between inheritance and trust funds is essential for effective estate planning and ensuring that the grantor's wishes are fulfilled.

Wealth

In the context of "what is a trust fund baby," wealth plays a significant role. A trust fund is a legal arrangement where an individual (the grantor) transfers assets to a trustee to hold and manage for the benefit of a beneficiary. Wealth can be a source of funds for establishing a trust fund, providing financial security and stability for the beneficiary.

- Inheritance: Wealth can be inherited from family members or other individuals, and it can be used to create a trust fund. This inheritance can come in various forms, such as cash, stocks, real estate, or other valuable assets.

- Investments: Wealth can also be accumulated through investments. Individuals who have successfully invested their money may use a portion of their earnings to establish a trust fund, ensuring that the funds are managed and used for specific purposes, such as education, healthcare, or financial stability.

- Business and Entrepreneurship: Wealth can be generated through business ventures and entrepreneurial endeavors. Individuals who have built successful businesses or created valuable intellectual property may use their wealth to establish trust funds for themselves, their families, or charitable causes.

- Philanthropy and Giving: Some individuals with substantial wealth choose to use their resources to create trust funds for philanthropic purposes. These trust funds can support charitable organizations, educational institutions, or other causes that align with the grantor's values.

In summary, wealth is closely connected to the concept of "what is a trust fund baby." It provides the financial foundation for establishing trust funds, ensuring that the funds are managed and used according to the grantor's wishes. Understanding the connection between wealth and trust funds is essential for effective estate planning and ensuring that the grantor's intentions are fulfilled.

Financial security

Financial security is a crucial aspect of "what is a trust fund baby." A trust fund is a legal arrangement where an individual (the grantor) transfers assets to a trustee to hold and manage for the benefit of a beneficiary. Financial security is a primary reason for establishing trust funds, ensuring that the beneficiary has sufficient financial resources to meet their needs and live comfortably throughout their life.

Trust funds provide a stable financial foundation for beneficiaries, regardless of their circumstances or earning capacity. The funds can be used for various purposes, such as education, healthcare, living expenses, or investments, providing peace of mind and financial stability. In cases where the beneficiary faces unexpected events, such as job loss or medical emergencies, the trust fund serves as a safety net, ensuring their financial well-being.

Furthermore, trust funds can be structured to provide ongoing income to the beneficiary, allowing them to maintain a comfortable lifestyle without the pressure of managing their finances or relying solely on employment income. This financial security can have a profound impact on the beneficiary's quality of life, enabling them to pursue their goals, explore opportunities, and contribute to society without financial constraints.

In summary, the connection between financial security and "what is a trust fund baby" is undeniable. Trust funds are designed to provide beneficiaries with long-term financial stability, ensuring their well-being and empowering them to live comfortably and pursue their aspirations.

Entitlement

Entitlement is a complex psychological phenomenon that can have a significant impact on individuals and society as a whole. In the context of "what is a trust fund baby," entitlement plays a crucial role in shaping the beneficiary's perception of their wealth and its implications.

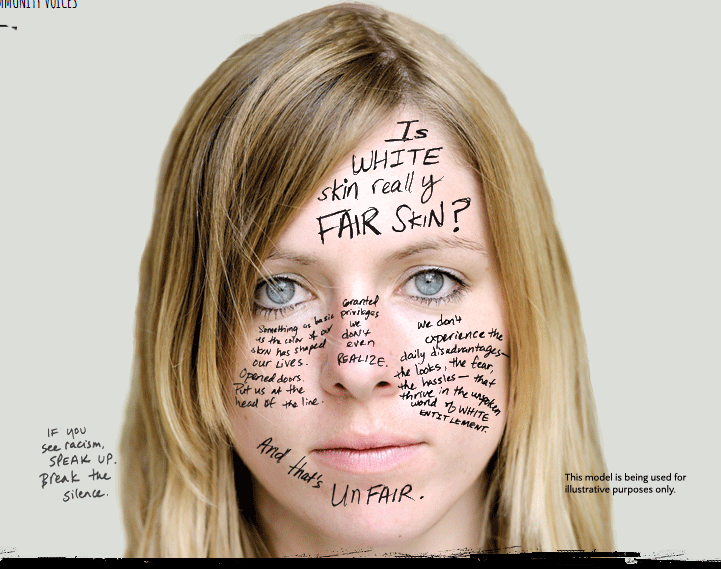

Trust fund babies are often perceived as having an inherent sense of entitlement due to their privileged upbringing and the unearned wealth they inherit. This entitlement can manifest in various ways, such as a belief that they are deserving of special treatment, a lack of appreciation for the value of money, and a sense of superiority over those who have not inherited wealth.

The connection between entitlement and "what is a trust fund baby" is evident in the way that trust funds can create an environment that fosters a sense of entitlement. When individuals receive substantial wealth without having to work for it, they may develop an inflated sense of self-importance and a belief that they are entitled to certain privileges and advantages.

This sense of entitlement can have negative consequences for trust fund babies and those around them. It can lead to unrealistic expectations, a lack of motivation to achieve personal goals, and difficulty forming meaningful relationships based on mutual respect.

It is important to note that not all trust fund babies develop a sense of entitlement. However, the potential for entitlement is inherent in the trust fund system, and it is essential to be aware of this potential and take steps to mitigate its negative effects.

One way to address the issue of entitlement among trust fund babies is to ensure that they are exposed to the realities of life outside their privileged bubble. This can involve encouraging them to work for their own money, volunteer their time to charitable causes, and interact with people from diverse backgrounds.

Ultimately, the goal is to help trust fund babies develop a healthy sense of self-worth and an understanding that their wealth does not make them inherently superior to others. By fostering a sense of gratitude and responsibility, we can help trust fund babies use their wealth to make a positive contribution to society.

Family conflict

Family conflict can be a significant factor in the lives of trust fund babies. When a large sum of money is involved, it can create tension and conflict among family members. This can be especially true if the trust fund was created by a wealthy relative who had complex or strained relationships with their family.

In some cases, family members may feel that they are entitled to a share of the trust fund, even if they were not specifically named as beneficiaries. This can lead to legal disputes and estrangement within the family.

Another potential source of conflict is the way that the trust fund is managed. If the trustee is not transparent about how the money is being invested and spent, it can create suspicion and distrust among family members.

Family conflict can have a negative impact on the well-being of trust fund babies. It can lead to feelings of guilt, shame, and isolation. It can also make it difficult for trust fund babies to develop healthy relationships with their family members.

It is important for trust fund babies to be aware of the potential for family conflict and to take steps to avoid it. This can include being transparent about the trust fund with family members, involving them in decisions about how the money is managed, and seeking professional help if necessary.

By understanding the connection between family conflict and "what is a trust fund baby," we can better support trust fund babies and help them to navigate the challenges that they may face.

Tax benefits

Trust funds can provide significant tax benefits to beneficiaries, which is an essential aspect of "what is a trust fund baby." When assets are placed in a trust, they are removed from the grantor's taxable estate, potentially reducing the amount of estate tax that is owed. Additionally, the income generated by a trust fund is often taxed at a lower rate than other forms of income, providing ongoing tax savings for the beneficiary.

One of the key tax benefits of a trust fund is the ability to defer capital gains taxes. When an asset is sold, the profit from the sale is typically subject to capital gains tax. However, if the asset is held in a trust, the capital gains tax can be deferred until the asset is distributed to the beneficiary. This can provide significant tax savings, especially for assets that are expected to appreciate in value.

Another important tax benefit of a trust fund is the ability to income splitting. This allows the income from the trust fund to be distributed among multiple beneficiaries, which can reduce the overall tax burden. Income splitting is particularly beneficial for families with high-income earners, as it can help to reduce their marginal tax rate.

Understanding the tax benefits of a trust fund is essential for "what is a trust fund baby." These tax benefits can provide significant financial savings for beneficiaries, allowing them to accumulate wealth more quickly and efficiently.

Investment

Investments play a crucial role in the context of "what is a trust fund baby." Trust funds are legal arrangements where an individual (the grantor) transfers assets to a trustee to hold and manage for the benefit of a beneficiary. A significant portion of trust fund assets is often invested to generate income and grow the fund over time, providing long-term financial security for the beneficiary.

- Diversification: Trust funds often invest in a diversified portfolio of assets, such as stocks, bonds, and real estate, to reduce risk and enhance returns. Diversification helps to ensure that the trust fund is not overly reliant on any single asset class or investment.

- Growth Potential: Investments in growth-oriented assets, such as stocks and certain types of real estate, can help the trust fund to keep pace with inflation and potentially generate higher returns over the long term. This growth potential can be particularly valuable for trust funds that are intended to provide ongoing support for the beneficiary's future needs.

- Income Generation: Investments in income-generating assets, such as bonds and dividend-paying stocks, can provide a steady stream of income for the beneficiary. This income can be used to cover living expenses, education costs, or other financial obligations.

- Tax Advantages: Certain types of investments, such as municipal bonds, may offer tax advantages to the trust fund and the beneficiary. These tax advantages can further enhance the long-term growth and stability of the trust fund.

Understanding the connection between investments and "what is a trust fund baby" is essential for ensuring the long-term financial well-being of the beneficiary. By investing wisely, trust funds can provide a secure financial foundation and the potential for growth, empowering beneficiaries to pursue their goals and live comfortably throughout their lives.

FAQs on "What is a Trust Fund Baby?"

This section provides answers to some frequently asked questions about trust fund babies, offering a deeper understanding of the concept and its implications.

Question 1: How are trust funds created?

Trust funds are established when an individual (the grantor) transfers assets to a trustee, who is responsible for managing the assets and distributing them to the beneficiary according to the terms of the trust.

Question 2: What are the benefits of having a trust fund?

Trust funds provide several benefits, including financial security, tax advantages, investment opportunities, and the ability to manage assets for specific purposes or future generations.

Question 3: What are some potential drawbacks of being a trust fund baby?

Potential drawbacks include a sense of entitlement, lack of financial responsibility, and strained family relationships due to perceived unfairness in wealth distribution.

Question 4: How can trust funds be used responsibly?

Responsible use of trust funds involves understanding the terms of the trust, investing wisely, avoiding excessive spending, and using the funds to support education, personal growth, and charitable causes.

Question 5: How do trust funds impact estate planning?

Trust funds are commonly used in estate planning to reduce estate taxes, manage assets after death, and provide for the financial well-being of beneficiaries.

Question 6: Are there any legal or ethical concerns related to trust funds?

Trust funds are subject to various legal and ethical considerations, such as ensuring the trustee's fiduciary duty, avoiding conflicts of interest, and complying with tax regulations and anti-money laundering laws.

In summary, understanding the concept of "what is a trust fund baby" involves recognizing the legal, financial, and ethical aspects of trust funds. By addressing common questions and concerns, we can gain a comprehensive understanding of this topic and its implications.

Transition to the next article section:

The following section will explore the role of trust funds in wealth management and financial planning.

Tips on Understanding "What is a Trust Fund Baby"

To gain a comprehensive understanding of "what is a trust fund baby," consider the following tips:

Tip 1: Understand the Legal Structure of a Trust Fund

A trust fund is a legal arrangement where an individual (grantor) transfers assets to a trustee to manage for the benefit of a beneficiary. This structure provides financial protection and ensures that the grantor's wishes are followed.

Tip 2: Recognize the Financial Advantages of a Trust Fund

Trust funds offer financial security, tax benefits, and investment opportunities. They can supplement an individual's income, provide for education expenses, and serve as a safety net during financial emergencies.

Tip 3: Be Aware of Potential Drawbacks

While trust funds can be beneficial, it's important to be aware of potential drawbacks such as a sense of entitlement, strained family relationships, and the need for responsible management to avoid excessive spending.

Tip 4: Utilize Trust Funds Responsibly

Responsible use of trust funds involves understanding the terms of the trust, investing wisely, avoiding unnecessary expenses, and using the funds to support personal growth, education, and charitable causes.

Tip 5: Consider the Role in Estate Planning

Trust funds play a significant role in estate planning. They can reduce estate taxes, manage assets after death, and provide for the long-term financial well-being of beneficiaries.

Tip 6: Understand Legal and Ethical Considerations

Trust funds are subject to various legal and ethical considerations, including the trustee's fiduciary duty, conflict of interest avoidance, and compliance with tax regulations and anti-money laundering laws.

Summary:

By following these tips, you can develop a comprehensive understanding of "what is a trust fund baby," its legal, financial, and ethical implications, and how to responsibly utilize and manage trust funds.

Conclusion

In exploring "what is a trust fund baby," we have examined the legal, financial, and ethical dimensions of this concept. Trust funds provide financial security and advantages, but also come with potential drawbacks and responsibilities.

Understanding the complexities of trust funds is crucial for beneficiaries, grantors, trustees, and anyone interested in estate planning and wealth management. Responsible use of trust funds involves balancing financial benefits with personal growth and societal impact.

- Understanding Male Belly Expansion Causes Effects And Solutions

- Got It Wrong Outfits A Comprehensive Guide To Avoiding Fashion Mishaps