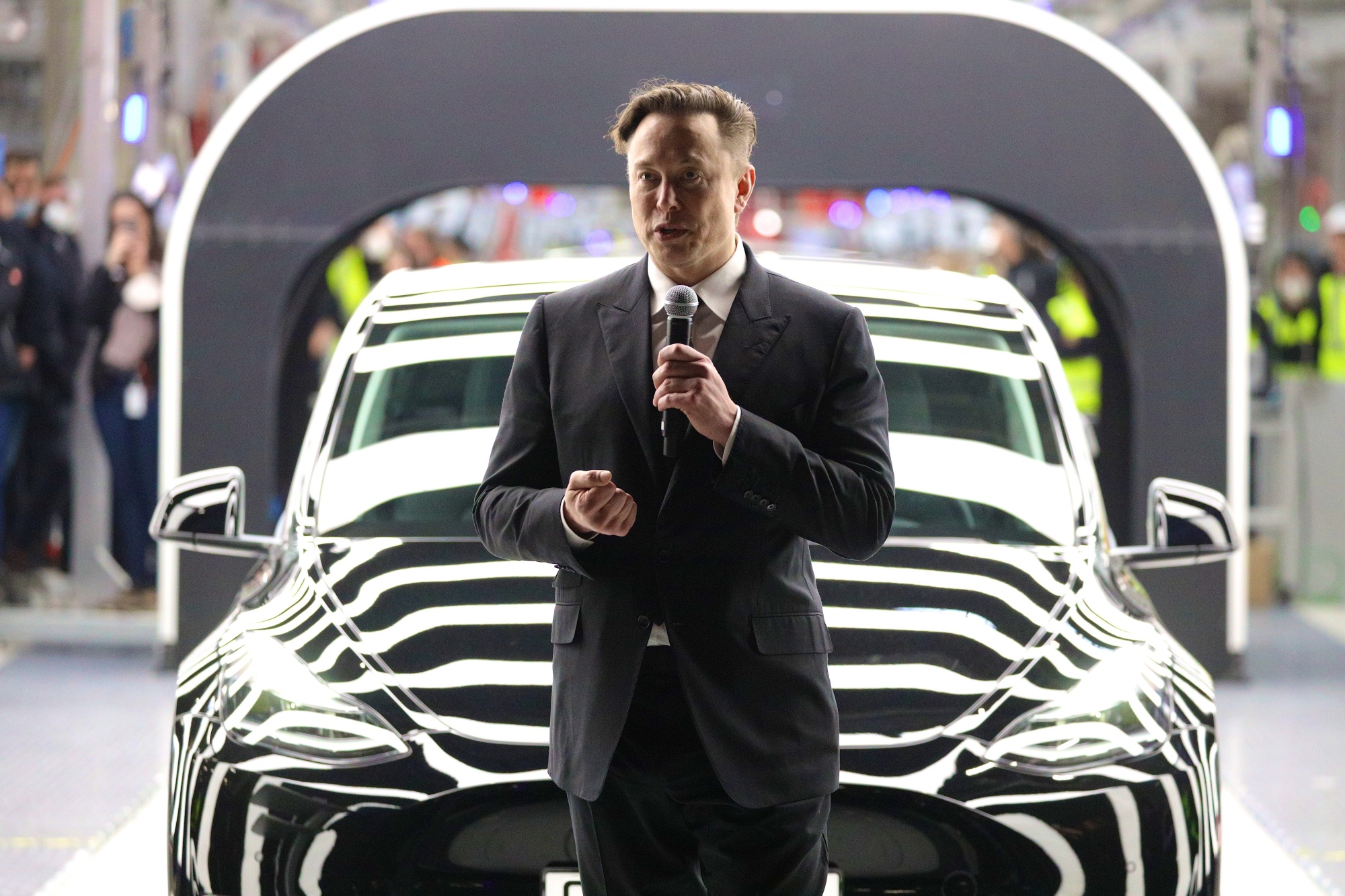

Elon Musk's potential acquisition of Mercedes-Benz refers to the ongoing speculation surrounding the possibility of Tesla CEO Elon Musk purchasing the German luxury automaker Mercedes-Benz. The rumor gained traction after Musk tweeted about his admiration for Mercedes-Benz and hinted at a potential collaboration. While there has been no official confirmation from either Musk or Mercedes-Benz, the prospect of such a deal has sparked significant interest and discussion within the automotive industry.

Should Musk acquire Mercedes-Benz, it would mark a major shakeup in the global automotive landscape. Mercedes-Benz is one of the world's most prestigious and well-established car manufacturers, with a rich history dating back to the late 19th century. The company is known for its high-quality vehicles, advanced technology, and luxurious interiors. Tesla, on the other hand, is a relative newcomer to the automotive industry, but it has quickly become a leader in the electric vehicle market. Tesla's vehicles are known for their sleek designs, impressive performance, and advanced self-driving features.

The combination of Mercedes-Benz's legacy and Tesla's innovation could create a formidable force in the automotive industry. Musk has been vocal about his plans to accelerate the transition to electric vehicles, and Mercedes-Benz has already made significant investments in electric vehicle development. Together, the two companies could potentially revolutionize the way we think about transportation.

Elon Musk's Potential Acquisition of Mercedes-Benz

Elon Musk's potential acquisition of Mercedes-Benz would be a major event in the automotive industry. Here are ten key aspects to consider:

- Legacy: Mercedes-Benz is one of the world's oldest and most prestigious automakers.

- Innovation: Tesla is a leader in electric vehicle technology.

- Luxury: Mercedes-Benz is known for its luxury vehicles.

- Performance: Tesla's vehicles are known for their performance.

- Technology: Both Mercedes-Benz and Tesla are investing heavily in technology.

- Market share: Mercedes-Benz and Tesla are two of the world's largest automakers.

- Brand value: Mercedes-Benz and Tesla are two of the world's most valuable brands.

- Competition: The acquisition would create a formidable competitor to other automakers.

- Consumers: The acquisition could benefit consumers by providing them with more choice and innovation.

- Employees: The acquisition could impact the employees of both companies.

These are just some of the key aspects to consider in relation to Elon Musk's potential acquisition of Mercedes-Benz. The ultimate impact of such a deal would depend on a number of factors, including the price, the terms of the deal, and the regulatory environment. However, it is clear that such a deal would have a major impact on the automotive industry and beyond.

Legacy

The legacy of Mercedes-Benz is a key factor in understanding the potential significance of Elon Musk's acquisition of the company. Mercedes-Benz has a long and storied history, dating back to the late 19th century. The company has a reputation for producing high-quality, luxury vehicles. This legacy would be a valuable asset to Tesla, which is a relative newcomer to the automotive industry.

- Vereena Motorcycle Accident A Comprehensive Analysis And Key Insights

- Unveiling The Mystery Japaneat Face Reveal And The Story Behind The Iconic Persona

- Brand recognition: Mercedes-Benz is one of the most recognizable brands in the world. This brand recognition would give Tesla access to a new market of potential customers.

- Engineering expertise: Mercedes-Benz has a long history of engineering excellence. This expertise would be beneficial to Tesla, which is investing heavily in the development of new technologies.

- Manufacturing capacity: Mercedes-Benz has a large manufacturing capacity. This would allow Tesla to increase its production output and meet the growing demand for its vehicles.

- Distribution network: Mercedes-Benz has a well-established distribution network. This would give Tesla access to new markets and sales channels.

Overall, the legacy of Mercedes-Benz would be a valuable asset to Tesla. This legacy would give Tesla access to a new market of potential customers, engineering expertise, manufacturing capacity, and a distribution network.

Innovation

Tesla's leadership in electric vehicle technology is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. Tesla has been at the forefront of the electric vehicle revolution, and its vehicles are known for their performance, range, and efficiency.

- Battery technology: Tesla has developed some of the most advanced battery technology in the world. This technology gives Tesla vehicles a longer range and faster charging times than other electric vehicles.

- Electric motors: Tesla's electric motors are also some of the most efficient in the world. This efficiency gives Tesla vehicles a better performance and range than other electric vehicles.

- Software: Tesla's software is also a key differentiator. Tesla's software is constantly updated with new features and improvements, and it gives Tesla vehicles a level of functionality and connectivity that is unmatched by other electric vehicles.

- Charging network: Tesla has also built a large network of charging stations around the world. This network makes it easy for Tesla owners to charge their vehicles, and it gives Tesla a major advantage over other electric vehicle manufacturers.

Tesla's leadership in electric vehicle technology would be a valuable asset to Mercedes-Benz. Mercedes-Benz is already investing heavily in electric vehicle development, but Tesla's technology would give Mercedes-Benz a significant advantage over its competitors.

Luxury

The luxury of Mercedes-Benz vehicles is a key factor in understanding the potential significance of Elon Musk's acquisition of the company. Mercedes-Benz has a long history of producing high-quality, luxury vehicles. This reputation would be a valuable asset to Tesla, which is a relative newcomer to the automotive industry.

- Brand image: Mercedes-Benz is a luxury brand. This brand image would give Tesla access to a new market of potential customers who are looking for high-quality, luxury vehicles.

- Profit margins: Luxury vehicles typically have higher profit margins than non-luxury vehicles. This would give Tesla a boost in profitability.

- Competition: Mercedes-Benz competes with other luxury automakers, such as BMW and Audi. Tesla would face competition from these automakers, but it would also have the opportunity to differentiate itself by offering electric vehicles.

- Customer experience: Mercedes-Benz is known for providing a high-quality customer experience. This customer experience would be a valuable asset to Tesla, which is still developing its customer service operations.

Overall, the luxury of Mercedes-Benz vehicles would be a valuable asset to Tesla. This luxury would give Tesla access to a new market of potential customers, higher profit margins, and a competitive advantage over other automakers.

Performance

The performance of Tesla's vehicles is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. Tesla's vehicles are known for their acceleration, handling, and top speed. This performance is due to a number of factors, including Tesla's electric motors, lightweight chassis, and advanced software.

The performance of Tesla's vehicles would be a valuable asset to Mercedes-Benz. Mercedes-Benz is known for producing high-quality, luxury vehicles. However, Mercedes-Benz's vehicles are not known for their performance. Tesla's technology could help Mercedes-Benz to produce vehicles that are both luxurious and high-performing.

For example, Tesla's electric motors could be used to power Mercedes-Benz's vehicles. This would give Mercedes-Benz's vehicles the same acceleration and handling as Tesla's vehicles. Tesla's lightweight chassis could also be used to reduce the weight of Mercedes-Benz's vehicles. This would improve the vehicles' performance and efficiency.

Overall, the performance of Tesla's vehicles would be a valuable asset to Mercedes-Benz. This performance would give Mercedes-Benz's vehicles a competitive advantage over other luxury vehicles.

Technology

The investment in technology by both Mercedes-Benz and Tesla is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. Both companies are investing heavily in a range of technologies, including electric vehicles, autonomous driving, and artificial intelligence. This investment is driven by the belief that these technologies will be essential to the future of the automotive industry.

- Electric vehicles: Both Mercedes-Benz and Tesla are investing heavily in the development of electric vehicles. This investment is driven by the belief that electric vehicles will eventually replace gasoline-powered vehicles. Electric vehicles have a number of advantages over gasoline-powered vehicles, including lower operating costs, reduced emissions, and improved performance.

- Autonomous driving: Both Mercedes-Benz and Tesla are also investing heavily in the development of autonomous driving technology. This technology has the potential to revolutionize the way we travel. Autonomous vehicles will be able to drive themselves, freeing up drivers to do other things. This technology could also make our roads safer and more efficient.

- Artificial intelligence: Both Mercedes-Benz and Tesla are investing heavily in the development of artificial intelligence (AI). AI is a branch of computer science that deals with the creation of intelligent agents. AI has the potential to be used in a wide range of applications, including autonomous driving, vehicle diagnostics, and customer service.

The investment in technology by both Mercedes-Benz and Tesla is a clear indication that these companies are preparing for the future of the automotive industry. Elon Musk's acquisition of Mercedes-Benz could accelerate this investment and lead to the development of new and innovative technologies. This could have a major impact on the automotive industry and beyond.

Market share

The market share of Mercedes-Benz and Tesla is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. Mercedes-Benz is one of the world's largest luxury automakers, with a market share of approximately 2%. Tesla is the world's leading electric vehicle manufacturer, with a market share of approximately 1%. Combined, Mercedes-Benz and Tesla would have a market share of approximately 3%, making them one of the largest automakers in the world.

- Increased market share: The acquisition of Mercedes-Benz would give Tesla a significant increase in market share. This would give Tesla more leverage with suppliers and dealers, and it would allow Tesla to better compete with other automakers.

- Access to new markets: Mercedes-Benz has a strong presence in Europe and Asia. The acquisition of Mercedes-Benz would give Tesla access to these new markets and help Tesla to grow its global sales.

- Economies of scale: The acquisition of Mercedes-Benz would give Tesla access to Mercedes-Benz's economies of scale. This would allow Tesla to reduce its costs and improve its profitability.

- Increased brand recognition: Mercedes-Benz is one of the most recognizable brands in the world. The acquisition of Mercedes-Benz would give Tesla access to Mercedes-Benz's brand recognition and help Tesla to become a more recognizable brand.

Overall, the market share of Mercedes-Benz and Tesla is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. The acquisition would give Tesla a number of advantages, including increased market share, access to new markets, economies of scale, and increased brand recognition.

Brand value

Brand value is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. Brand value is the monetary value of a brand based on its reputation, customer loyalty, and marketing reach. Mercedes-Benz and Tesla are two of the world's most valuable brands, with brand values of $56.1 billion and $53.4 billion, respectively. This means that the acquisition of Mercedes-Benz would give Tesla a significant boost in brand value.

There are a number of reasons why brand value is important for Tesla. First, brand value can help Tesla to attract new customers. Customers are more likely to purchase products from brands that they trust and are familiar with. Second, brand value can help Tesla to charge a premium for its products. Customers are willing to pay more for products from brands that they perceive to be valuable. Third, brand value can help Tesla to attract and retain employees. Employees are more likely to work for brands that they are proud to be associated with.

Overall, the brand value of Mercedes-Benz and Tesla is a key factor in understanding the potential significance of Elon Musk's acquisition of Mercedes-Benz. The acquisition would give Tesla a significant boost in brand value, which would have a number of benefits for the company.

Competition

The acquisition of Mercedes-Benz by Tesla would create a formidable competitor to other automakers. This is because Mercedes-Benz is one of the world's largest and most respected automakers, with a strong brand reputation and a loyal customer base. Tesla, on the other hand, is a leader in the electric vehicle market, with a reputation for innovation and technological advancement. Together, the two companies would have a powerful combination of brand recognition, manufacturing expertise, and technological innovation, which would make them a major force in the global automotive industry.

The acquisition would also create a more competitive landscape for other automakers. Currently, the automotive industry is dominated by a few large companies, such as Toyota, Volkswagen, and General Motors. The addition of a Tesla-Mercedes-Benz combination would create a new competitor that could challenge these established players. This would lead to increased innovation and lower prices for consumers.

Overall, the acquisition of Mercedes-Benz by Tesla would have a significant impact on the automotive industry. It would create a formidable competitor to other automakers and lead to increased innovation and lower prices for consumers.

Consumers

The potential acquisition of Mercedes-Benz by Elon Musk has sparked speculation about the potential benefits for consumers. One of the main benefits that has been cited is the increased choice and innovation that could result from the merger of these two automotive giants.

- Greater Variety of Products:

One of the main ways that consumers could benefit from the acquisition is through a greater variety of products to choose from. Mercedes-Benz is known for its luxury vehicles, while Tesla is known for its electric vehicles. By combining the two companies, consumers would have access to a wider range of vehicles, including electric luxury vehicles, which are currently not widely available.

- Lower Prices:

Another potential benefit for consumers is lower prices. Tesla has a reputation for producing electric vehicles that are more affordable than comparable gasoline-powered vehicles. By combining with Mercedes-Benz, Tesla could potentially leverage its manufacturing expertise to reduce the cost of producing electric luxury vehicles, making them more affordable for consumers.

- Enhanced Technology:

Tesla is known for its innovative technology, including its electric powertrain, autopilot system, and large touchscreen display. By combining with Mercedes-Benz, Tesla could potentially integrate its technology into Mercedes-Benz vehicles, providing consumers with access to the latest and greatest automotive technology.

Overall, the potential acquisition of Mercedes-Benz by Elon Musk could provide a number of benefits for consumers, including a greater variety of products, lower prices, and enhanced technology.

Employees

The potential acquisition of Mercedes-Benz by Elon Musk could have a significant impact on the employees of both companies. This is because a merger of this magnitude would likely lead to changes in the organizational structure, company culture, and job responsibilities of employees. For example, there could be redundancies in certain job functions, leading to layoffs or reassignments. Additionally, the integration of two different company cultures could lead to challenges for employees who are accustomed to different ways of working.

However, there could also be positive outcomes for employees as well. For example, the acquisition could lead to new opportunities for career growth and development. Additionally, the combined company could have greater resources to invest in employee training and benefits.

Overall, the impact of the acquisition on employees is difficult to predict and will depend on a number of factors, such as the specific terms of the deal, the integration plans of the two companies, and the overall economic climate. However, it is clear that the acquisition has the potential to have a significant impact on the lives of employees of both Mercedes-Benz and Tesla.

FAQs about Elon Musk's Potential Acquisition of Mercedes-Benz

Elon Musk's potential acquisition of Mercedes-Benz has sparked widespread interest and discussion. Here are answers to some frequently asked questions about this topic:

Question 1: Is it confirmed that Elon Musk is acquiring Mercedes-Benz?

As of now, there is no official confirmation from either Elon Musk or Mercedes-Benz regarding an acquisition. The rumor originated from a tweet by Musk expressing admiration for Mercedes-Benz and hinting at a possible collaboration. However, no concrete details or negotiations have been made public.

Question 2: What would be the potential impact on the automotive industry?

A merger between Tesla and Mercedes-Benz would create a formidable force in the automotive industry, combining the legacy and luxury of Mercedes-Benz with Tesla's innovation in electric vehicles and technology. It could accelerate the transition towards electric mobility and drive advancements in autonomous driving and other automotive technologies.

Question 3: How would it affect the employees of both companies?

The impact on employees would depend on various factors, including the terms of the deal and the integration plans. There could be potential for job redundancies in overlapping roles, but also opportunities for career growth and collaboration in new areas of development.

Question 4: What are the potential benefits for consumers?

Consumers could benefit from a wider range of vehicle options, including electric luxury vehicles. The combined entity could potentially leverage its expertise to enhance technology and offer innovative features, leading to a better driving experience.

Question 5: Are there any potential risks or drawbacks?

The integration of two large companies with different cultures and operations could pose challenges. Additionally, the deal could face regulatory scrutiny and potential antitrust concerns, depending on the market share and competitive landscape after the merger.

Question 6: What is the likelihood of this acquisition happening?

The likelihood of the acquisition remains uncertain. It would depend on factors such as the due diligence process, regulatory approvals, and the overall strategic objectives of both companies. Market conditions and the broader economic climate may also influence the feasibility of such a deal.

In summary, while the potential acquisition of Mercedes-Benz by Elon Musk has generated significant interest, it is important to note that it is still speculative at this stage. The impact and implications of such a deal would be far-reaching, affecting the automotive industry, consumers, employees, and the wider economy. As the situation evolves, more information and clarity will emerge.

Transition to the next article section...

Tips for Understanding the Potential Acquisition of Mercedes-Benz by Elon Musk

The potential acquisition of Mercedes-Benz by Elon Musk has significant implications for the automotive industry and beyond. Here are some tips to better understand this topic:

Tip 1: Consider the Strategic Fit

Analyze the strategic rationale behind a potential merger between Tesla and Mercedes-Benz. Consider how their respective strengths, such as Tesla's electric vehicle expertise and Mercedes-Benz's luxury brand, complement each other.

Tip 2: Evaluate the Market Landscape

Assess the competitive landscape of the automotive industry, including market share, technological advancements, and consumer trends. Understand how the acquisition would impact the dynamics and competitive positioning of the combined entity.

Tip 3: Examine the Financial Implications

Evaluate the financial aspects of the potential deal, including the acquisition price, potential synergies, and impact on profitability. Consider the long-term financial implications for both Tesla and Mercedes-Benz.

Tip 4: Analyze the Regulatory Environment

Understand the regulatory environment surrounding the automotive industry, particularly in relation to antitrust laws and emissions regulations. Assess the potential impact of the acquisition on regulatory compliance and approvals.

Tip 5: Consider the Impact on Employees

Recognize the potential impact on the employees of both companies. Evaluate how the merger could affect job security, career opportunities, and company culture.

Tip 6: Monitor Industry News and Analysis

Stay informed by following industry news, expert analysis, and financial reports related to the potential acquisition. This will provide a comprehensive understanding of the evolving situation.

Tip 7: Assess the Potential Benefits

Identify the potential benefits of the acquisition, such as enhanced innovation, expanded product offerings, and improved customer experience. Consider how these benefits could impact the automotive industry and consumers.

Tip 8: Evaluate the Risks and Drawbacks

Acknowledge the potential risks and drawbacks associated with the acquisition, such as integration challenges, cultural differences, and regulatory hurdles. Assess the likelihood and potential impact of these risks.

By considering these tips, you can gain a deeper understanding of the potential acquisition of Mercedes-Benz by Elon Musk and its implications for the automotive industry and beyond.

Transition to the article's conclusion...

Conclusion

The potential acquisition of Mercedes-Benz by Elon Musk has sparked significant interest and speculation within the automotive industry and beyond. While the deal remains unconfirmed, it presents a compelling scenario that could reshape the landscape of luxury and electric vehicle manufacturing.

The combination of Mercedes-Benz's legacy, brand recognition, and manufacturing expertise with Tesla's technological advancements in electric vehicles and autonomous driving has the potential to create a formidable force in the automotive market. However, the integration of two large companies with distinct cultures and operations poses challenges that need to be carefully addressed.

The impact of such an acquisition would extend beyond the automotive industry, potentially influencing consumer choices, employee dynamics, and regulatory frameworks. It is crucial to monitor the developments closely and analyze the potential implications thoroughly to make informed assessments of the deal's significance and long-term effects.

- Understanding Male Belly Expansion Causes Effects And Solutions

- Lexis Czumakabreu A Rising Star In The Spotlight