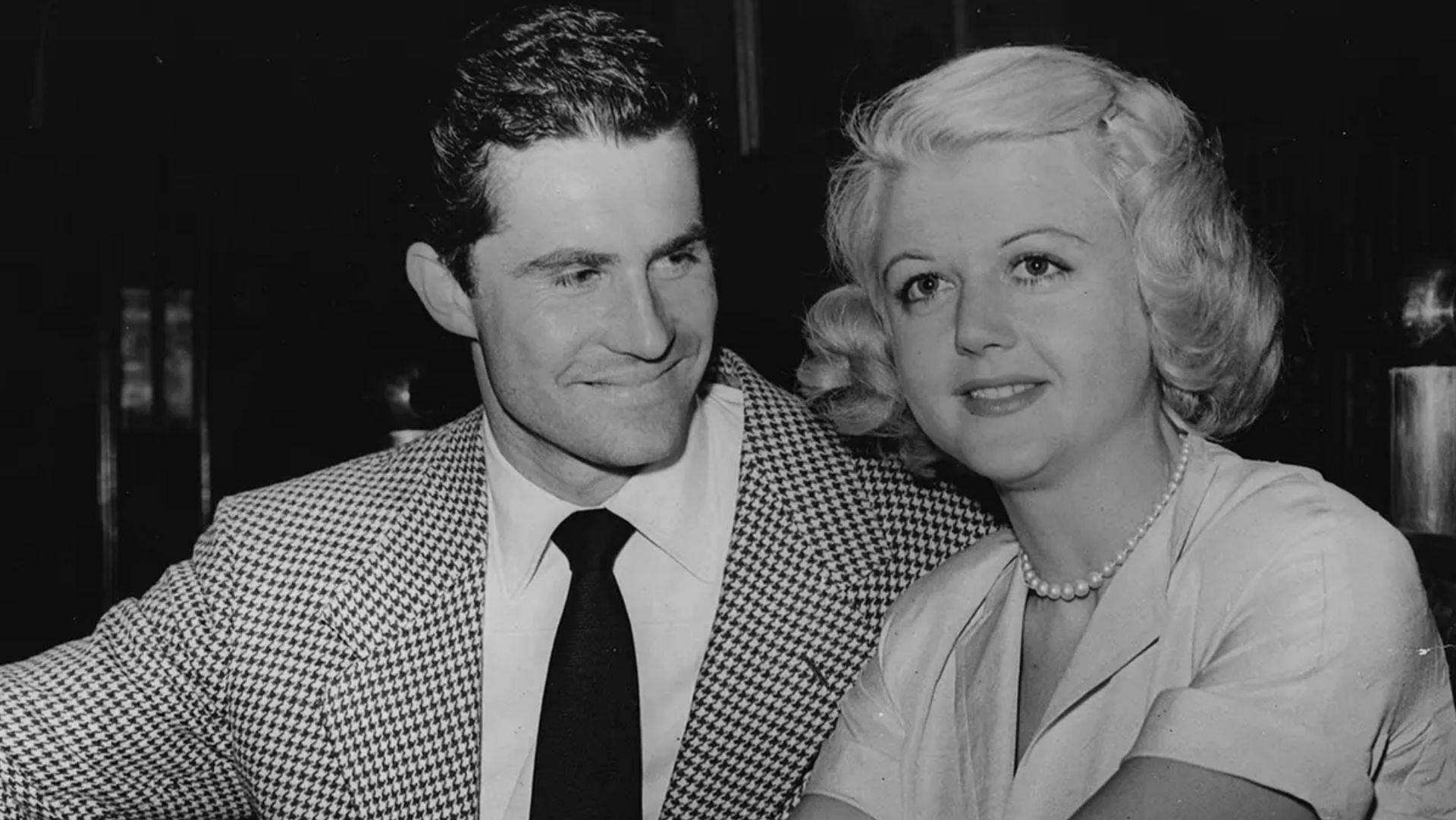

Upon her death in October 2022, Angela Lansbury, the renowned British-American actress, left behind a substantial estate. Her will stipulated that the majority of her wealth would be divided among her three children: Anthony Pullen Shaw, Deirdre Angela Shaw, and David Shaw. Details regarding the specific amounts inherited by each child have not been publicly disclosed.

Angela Lansbury's successful career in film, television, and theater spanned over eight decades. She was best known for her portrayal of Jessica Fletcher in the long-running television series "Murder, She Wrote." Lansbury's estate reflects her financial success and the impact she had on the entertainment industry.

The distribution of Angela Lansbury's estate highlights the importance of estate planning and ensuring that one's assets are distributed according to their wishes. It also serves as a reminder of the legacy that celebrities can leave behind, both in terms of their artistic contributions and their personal wealth.

- Discover The World Of Haide Unique A Comprehensive Guide

- Unveiling The Charm Of Booty Shorts Candid Moments

Who Did Angela Lansbury Leave Her Money To?

Angela Lansbury's will reveals insights into her personal life, financial planning, and the impact of her legacy. Key aspects to consider include:

- Beneficiaries: Her children, Anthony, Deirdre, and David Shaw.

- Estate Value: Undisclosed, but substantial.

- Estate Planning: Careful and well-executed.

- Legacy: As an actress and philanthropist.

- Privacy: Details of inheritance amounts remain private.

- Legal Process: Probate and administration of the estate.

- Tax Implications: Estate taxes and inheritance laws.

- Public Interest: Speculation and media attention.

These aspects highlight the significance of estate planning, the impact of celebrity on inheritance, and the interplay between personal wealth and public interest. Lansbury's legacy extends beyond her financial bequests, encompassing her artistic contributions and philanthropic endeavors.

Beneficiaries

The identification of Angela Lansbury's children as the beneficiaries of her estate is a crucial aspect of understanding "who did Angela Lansbury leave her money to." It establishes the legal and familial connection between the deceased and the recipients of her assets.

- Jynxzi R6 Skin A Comprehensive Guide To The Hottest Rainbow Six Siege Customization

- Medium Knotless Braids With Curls A Comprehensive Guide To Achieve Stunning Lowmaintenance Hairstyles

In most jurisdictions, the distribution of an estate follows a predetermined order of priority, with children typically being the primary beneficiaries. In this case, Lansbury's will reflects this legal framework, ensuring that her wealth is passed on to her immediate family.

Moreover, the specification of her children as beneficiaries highlights the personal and emotional dimension of estate planning. It demonstrates Lansbury's desire to provide for her loved ones and secure their financial well-being after her passing.

Understanding the connection between "Beneficiaries: Her children, Anthony, Deirdre, and David Shaw." and "who did Angela Lansbury leave her money to" is essential for several reasons. Firstly, it clarifies the legal framework governing the distribution of Lansbury's estate.

Secondly, it sheds light on the personal motivations and family dynamics that shape estate planning decisions.

Finally, it underscores the importance of clear and comprehensive estate planning to ensure that one's assets are distributed according to their wishes.

Estate Value

The undisclosed but substantial value of Angela Lansbury's estate is a significant aspect of understanding "who did Angela Lansbury leave her money to." It raises questions about the extent of her wealth and its distribution among her beneficiaries.

- Financial Impact: The substantial value of Lansbury's estate indicates her financial success and the accumulation of wealth over her extensive career. It suggests that her beneficiaries will inherit a significant financial legacy.

- Privacy Concerns: The undisclosed nature of the estate value highlights the privacy surrounding financial matters, particularly among high-profile individuals. It reflects the desire to protect personal wealth from public scrutiny.

- Tax Implications: The substantial value of Lansbury's estate may have implications for estate taxes and inheritance laws. Depending on the jurisdiction and applicable tax rates, her beneficiaries may be subject to taxes on their inheritances.

In conclusion, the undisclosed but substantial value of Angela Lansbury's estate underscores the complexities of wealth distribution and the interplay between personal finances, privacy, and legal considerations. It provides a glimpse into the financial legacy of a renowned actress and the challenges of managing substantial assets after one's passing.

Estate Planning

The careful and well-executed nature of Angela Lansbury's estate planning is a crucial aspect of understanding "who did Angela Lansbury leave her money to." Estate planning involves the legal and financial arrangements made by an individual to distribute their assets after their death. Careful estate planning ensures that one's wishes are respected, and their assets are distributed according to their intentions.

In Lansbury's case, her well-executed estate plan likely involved a will or trust that clearly outlined her beneficiaries and the distribution of her assets. This plan would have been drafted with the assistance of legal and financial professionals to ensure that it was legally sound and met her specific wishes. Careful estate planning can help minimize estate taxes, avoid probate disputes, and ensure that one's assets are distributed according to their wishes.

The practical significance of understanding the connection between "Estate Planning: Careful and well-executed." and "who did Angela Lansbury leave her money to" lies in its implications for individuals and their families. Proper estate planning provides peace of mind, knowing that one's assets will be distributed according to their wishes after their passing. It can also help protect one's beneficiaries from financial burdens and legal disputes.

Legacy

The legacy of Angela Lansbury as an actress and philanthropist is inextricably linked to "who did Angela Lansbury leave her money to." Her wealth and the distribution of her assets after her death are shaped by her dual roles in the entertainment industry and the philanthropic sector.

Lansbury's successful acting career spanned over eight decades, earning her numerous accolades and establishing her as a cultural icon. Her wealth, in part, reflects her contributions to the entertainment industry. However, her legacy extends beyond her financial success.

As a philanthropist, Lansbury supported various charitable causes throughout her life. She was particularly dedicated to organizations focused on the arts, education, and animal welfare. By leaving a portion of her estate to these organizations, Lansbury ensures that her legacy will continue to support the causes she cared about.

Understanding the connection between "Legacy: As an actress and philanthropist." and "who did Angela Lansbury leave her money to" provides insights into the values and priorities that guided her life. It demonstrates how individuals can use their wealth to create a lasting impact on the world, both through their professional achievements and philanthropic endeavors.

Privacy

The privacy surrounding the details of Angela Lansbury's inheritance amounts is a significant aspect of understanding "who did Angela Lansbury leave her money to." It highlights legal, ethical, and personal considerations related to the disclosure of financial information.

- Legal Protections: Laws in various jurisdictions protect the privacy of individuals' financial information, including inheritance details. This ensures that personal wealth and financial arrangements remain confidential.

- Ethical Considerations: Disclosing the exact amounts inherited by Lansbury's beneficiaries raises ethical questions about the public's right to know versus the privacy rights of individuals.

- Personal Preferences: Lansbury's decision to keep the inheritance amounts private respects the privacy of her beneficiaries and their right to manage their financial affairs without public scrutiny.

- Media Speculation: Despite the privacy surrounding the inheritance details, media outlets may speculate and estimate the amounts based on Lansbury's known wealth and career earnings.

In conclusion, the privacy surrounding the details of Angela Lansbury's inheritance amounts underscores the importance of protecting individuals' financial privacy, balancing the public's interest in transparency with the rights of beneficiaries to keep their financial affairs confidential.

Legal Process

The legal process of probate and administration of the estate is intricately connected to "who did Angela Lansbury leave her money to." Probate refers to the legal process of authenticating a will and overseeing the distribution of the deceased's assets according to their wishes. Administration of the estate involves managing and distributing the deceased's property, including paying off debts and taxes.

Understanding the legal process is essential because it ensures that Angela Lansbury's final wishes, as outlined in her will, are carried out. The probate process validates the will, appoints an executor to administer the estate, and provides a legal framework for distributing her assets to her intended beneficiaries. It also provides a mechanism for resolving any disputes or challenges to the will.

The practical significance of understanding the legal process lies in its implications for the beneficiaries and the orderly distribution of Lansbury's estate. Probate ensures that her assets are distributed according to her wishes, minimizing the potential for conflicts or legal challenges. It also provides a clear timeline and process for settling the estate, allowing the beneficiaries to receive their inheritances in a timely manner.

Tax Implications

The connection between "Tax Implications: Estate taxes and inheritance laws." and "who did angela lansbury leave her money to" lies in the legal and financial obligations associated with the transfer of wealth after death. Understanding these tax implications is crucial because they can significantly impact the distribution and value of inherited assets.

Estate taxes are levied on the value of a deceased person's estate before it is distributed to beneficiaries. Inheritance taxes, on the other hand, are levied on the value of assets received by individual beneficiaries. The amount of tax owed depends on various factors, including the size of the estate, the jurisdiction, and the relationship between the deceased and the beneficiaries.

In Angela Lansbury's case, her substantial estate may be subject to estate taxes, which could reduce the amount of money her beneficiaries inherit. Additionally, her beneficiaries may be liable for inheritance taxes on the assets they receive. Understanding these tax implications is essential for the beneficiaries to plan for and manage their inheritance effectively.

The practical significance of understanding the tax implications lies in the potential financial impact on beneficiaries. By being aware of the applicable tax laws, beneficiaries can make informed decisions about estate planning and asset management. Proper tax planning can help minimize the tax burden and ensure that Lansbury's legacy is preserved for her intended beneficiaries.

Public Interest

The connection between "Public Interest: Speculation and media attention." and "who did angela lansbury leave her money to" lies in the public's fascination with the lives and legacies of celebrities. This fascination drives media outlets to speculate about and report on the distribution of Lansbury's wealth, even though the details of her will remain private.

- Public Curiosity: The public is naturally curious about the personal lives and financial affairs of celebrities, especially after their passing. Lansbury's iconic status and successful career have made her estate a subject of public interest.

- Media Speculation: In the absence of official information, media outlets often resort to speculation and estimates based on Lansbury's known wealth and career earnings. This speculation can generate headlines and attract readers, even if the accuracy of the information is questionable.

- Sensationalism: Media outlets may sensationalize the distribution of Lansbury's wealth to attract attention and generate clicks. This can lead to exaggerated or misleading reports that do not accurately reflect the reality of the situation.

- Privacy Concerns: While the public has a legitimate interest in understanding the distribution of Lansbury's wealth, it is important to respect the privacy of her beneficiaries. Excessive media attention can intrude on their personal lives and create unnecessary pressure.

In conclusion, the public interest in Angela Lansbury's estate has generated speculation and media attention, even though the details of her will remain private. This fascination with celebrity wealth highlights the public's curiosity, media outlets' drive for sensationalism, and the importance of respecting the privacy of individuals.

FAQs Regarding "Who Did Angela Lansbury Leave Her Money To?"

This section addresses frequently asked questions and misconceptions surrounding the distribution of Angela Lansbury's estate.

Question 1: Did Angela Lansbury leave her money to charity?

While the specific details of Angela Lansbury's will remain private, it is known that she supported various charitable causes throughout her life. It is possible that she included charitable bequests in her will, but the exact amounts and organizations are not publicly disclosed.

Question 2: Who are the beneficiaries of Angela Lansbury's estate?

Angela Lansbury's children, Anthony Pullen Shaw, Deirdre Angela Shaw, and David Shaw, are the primary beneficiaries of her estate. The specific amounts inherited by each child have not been publicly disclosed.

Question 3: Was Angela Lansbury's estate subject to estate taxes?

The value of Angela Lansbury's estate could potentially be subject to estate taxes, depending on the jurisdiction and applicable tax laws. However, the exact amount of taxes owed, if any, is not publicly known.

Question 4: Why are the details of Angela Lansbury's will private?

The privacy of wills is protected by law in many jurisdictions. This ensures that individuals can distribute their assets according to their wishes without public scrutiny. Respecting the privacy of Lansbury's will protects the interests of her beneficiaries.

Question 5: How was Angela Lansbury's wealth accumulated?

Angela Lansbury's wealth was primarily accumulated through her successful career in the entertainment industry, spanning over eight decades. She starred in numerous films, television shows, and stage productions, earning significant income and building a substantial financial legacy.

Question 6: What is the significance of understanding the distribution of Angela Lansbury's estate?

Understanding the distribution of Angela Lansbury's estate provides insights into her personal life, financial planning, and the impact of her legacy. It also highlights the importance of estate planning and the legal frameworks governing the distribution of wealth after death.

In conclusion, the distribution of Angela Lansbury's estate is a private matter, with the details of her will remaining confidential. Her children are the primary beneficiaries, and the estate may be subject to estate taxes depending on applicable laws. Understanding the significance of estate planning and the privacy surrounding wills is crucial in this context.

Transition to the next article section: Angela Lansbury's legacy extends beyond her financial bequests. Her contributions to the entertainment industry and philanthropic endeavors continue to inspire and impact audiences worldwide.

Tips Regarding "Who Did Angela Lansbury Leave Her Money To?"

Understanding the distribution of Angela Lansbury's estate and related concepts can provide valuable insights and practical knowledge.

Tip 1: Respect the Privacy of Wills

Wills are legal documents that should be treated with privacy and confidentiality. Respecting the privacy of Angela Lansbury's will protects the interests of her beneficiaries and upholds the legal framework surrounding estate planning.

Tip 2: Understand the Legal Process of Probate

Probate is the legal process of authenticating a will and overseeing the distribution of assets. Understanding this process ensures that Angela Lansbury's final wishes are carried out and that her estate is settled in an orderly and efficient manner.

Tip 3: Consider the Impact of Estate Taxes

Depending on the jurisdiction and applicable laws, Angela Lansbury's estate may be subject to estate taxes. It is important to be aware of potential tax implications to ensure proper estate planning and minimize the financial burden on beneficiaries.

Tip 4: Explore the Role of Charitable Bequests

Many individuals choose to include charitable bequests in their wills. Understanding Angela Lansbury's support for various causes provides insights into her values and legacy, and it can inspire others to consider charitable giving.

Tip 5: Seek Professional Guidance for Estate Planning

Estate planning is a complex process that involves legal and financial considerations. Consulting with an attorney and financial advisor can help individuals create a comprehensive estate plan that meets their specific needs and ensures their wishes are respected.

Summary:

Understanding the distribution of Angela Lansbury's estate not only provides insights into her personal life and legacy but also highlights the importance of estate planning and legal frameworks governing the distribution of wealth. Respecting the privacy of wills, comprehending probate processes, considering estate taxes, exploring charitable bequests, and seeking professional guidance are key tips to navigate these matters effectively.

Conclusion

The distribution of Angela Lansbury's estate, while a private matter, provides valuable insights into her personal life, financial planning, and the impact of her legacy. Her children are the primary beneficiaries, and the estate may be subject to estate taxes depending on applicable laws.

Understanding the significance of estate planning and the privacy surrounding wills is crucial in this context. Respecting the wishes of the deceased, navigating the legal process of probate, considering estate taxes, and exploring charitable bequests are essential aspects of estate planning.

- Discover The World Of Haide Unique A Comprehensive Guide

- Mac And Cheese Costume The Ultimate Guide For Foodlovers