Martin Rabbett's net worth refers to the total value of his assets minus his liabilities. It is a measure of his financial wealth and is often used to assess his financial success.

Martin Rabbett's net worth is important because it can provide insights into his financial situation and overall wealth. It can also be used to compare his wealth to others in his industry or to track changes in his wealth over time. Additionally, his net worth can be used to assess his ability to repay debts or make investments.

Martin Rabbett's net worth is a complex figure that is influenced by a variety of factors, including his income, expenses, assets, and liabilities. Understanding the factors that affect his net worth can help individuals make informed decisions about their own financial planning.

- Sandia Tajin Costco A Refreshing Twist To Your Favorite Melon

- Unveiling Lawrence Sullivan A Comprehensive Guide To His Life Achievements And Legacy

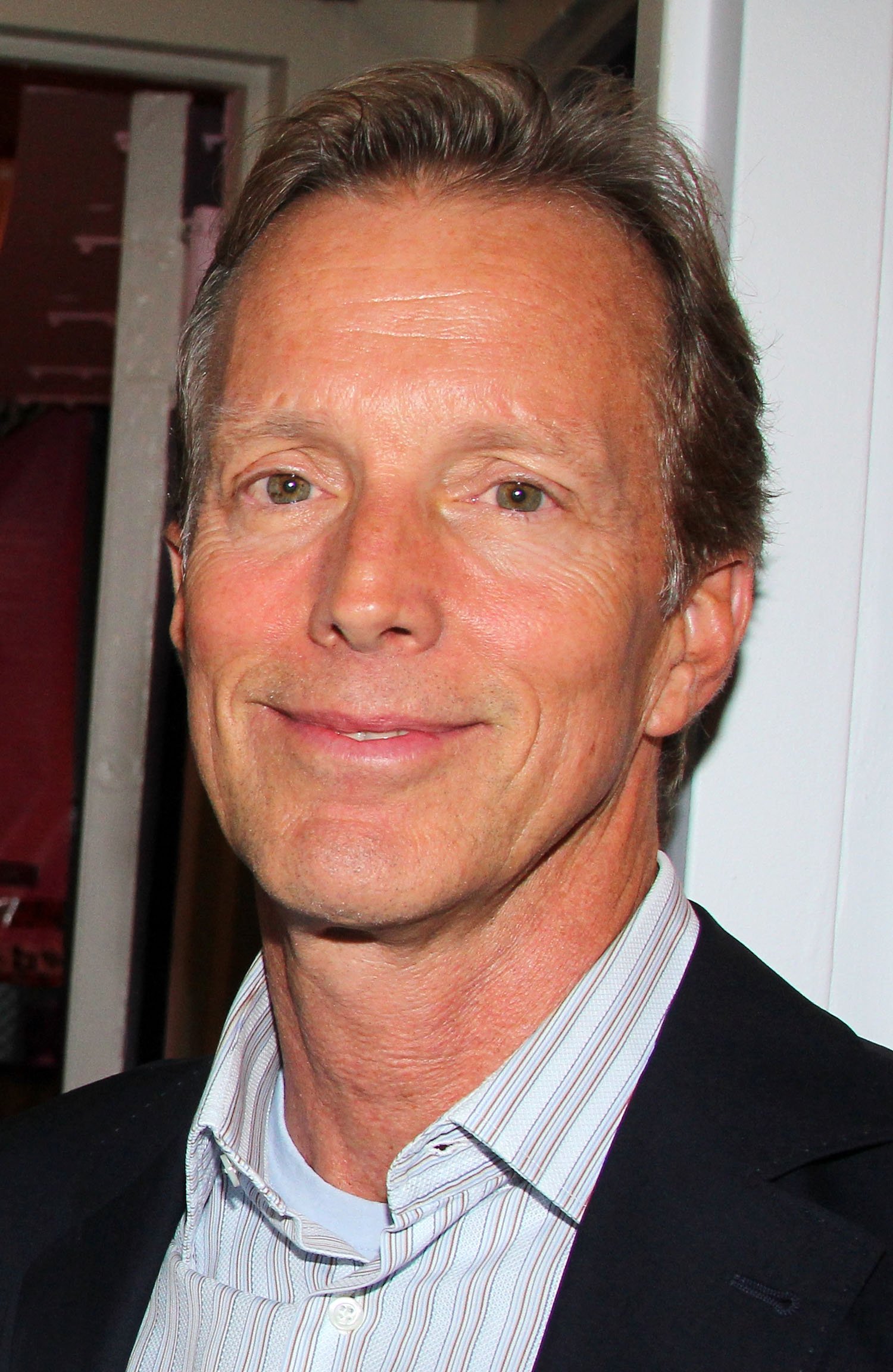

martin rabbett net worth

Martin Rabbett's net worth is a complex figure that is influenced by a variety of factors. Some of the key aspects that affect his net worth include:

- Income

- Expenses

- Assets

- Liabilities

- Investments

- Taxes

- Debt

- Savings

- Lifestyle

- Financial goals

All of these factors play a role in determining Martin Rabbett's overall financial wealth. By understanding the factors that affect his net worth, individuals can make informed decisions about their own financial planning.

Income

Income is an important component of Martin Rabbett's net worth. It is the amount of money he earns from his job, investments, and other sources. His income is used to pay for his expenses, such as housing, food, and transportation. It is also used to save for the future and invest in assets that can grow his wealth.

- Planes Girl Exploring The World Of Aviation Enthusiasts And Their Impact

- Understanding Male Belly Expansion Causes Effects And Solutions

The higher Martin Rabbett's income, the higher his net worth is likely to be. This is because he will have more money available to save and invest. Additionally, a higher income can allow him to afford a higher standard of living, which can also contribute to his overall wealth.

There are a number of ways that Martin Rabbett can increase his income. He can negotiate a raise at his job, start a side hustle, or invest in income-generating assets. By increasing his income, he can increase his net worth and improve his overall financial well-being.

Expenses

Expenses are an important part of Martin Rabbett's net worth. They are the costs that he incurs to maintain his lifestyle and meet his financial obligations. Expenses can be divided into two main categories: fixed expenses and variable expenses.

- Fixed expenses are those that remain relatively constant from month to month. These expenses typically include housing, transportation, and food. Fixed expenses are important to consider when budgeting because they represent a significant portion of Martin Rabbett's monthly cash flow.

- Variable expenses are those that can vary from month to month. These expenses typically include entertainment, travel, and dining out. Variable expenses can be more difficult to budget for, but they can also be more easily reduced if necessary.

By understanding his expenses, Martin Rabbett can make informed decisions about how to manage his finances. He can identify areas where he can cut back on spending and redirect those funds to savings or investments. By carefully managing his expenses, Martin Rabbett can increase his net worth and improve his overall financial well-being.

Assets

Assets are an important part of Martin Rabbett's net worth. They are the things that he owns that have value. Assets can be divided into two main categories: tangible assets and intangible assets.

- Tangible assets are physical assets that can be seen and touched. These assets typically include real estate, vehicles, and jewelry. Tangible assets are important to consider when calculating Martin Rabbett's net worth because they represent a significant portion of his wealth.

- Intangible assets are non-physical assets that do not have a physical form. These assets typically include intellectual property, such as patents and copyrights, and goodwill. Intangible assets can be more difficult to value than tangible assets, but they can also be very valuable.

By understanding his assets, Martin Rabbett can make informed decisions about how to manage his finances. He can identify areas where he can increase his wealth and make strategic investments. By carefully managing his assets, Martin Rabbett can increase his net worth and improve his overall financial well-being.

Liabilities

Liabilities are the debts and obligations that Martin Rabbett owes to other individuals or entities. They are an important part of his net worth because they represent the amount of money that he owes. Liabilities can be divided into two main categories: short-term liabilities and long-term liabilities.

- Short-term liabilities are debts that are due within one year. These liabilities typically include credit card debt, personal loans, and accounts payable. Short-term liabilities are important to consider when calculating Martin Rabbett's net worth because they can have a significant impact on his cash flow.

- Long-term liabilities are debts that are due more than one year from now. These liabilities typically include mortgages, car loans, and student loans. Long-term liabilities are important to consider when calculating Martin Rabbett's net worth because they can have a significant impact on his long-term financial planning.

By understanding his liabilities, Martin Rabbett can make informed decisions about how to manage his finances. He can identify areas where he can reduce his debt and improve his cash flow. By carefully managing his liabilities, Martin Rabbett can increase his net worth and improve his overall financial well-being.

Investments

Investments are an important part of Martin Rabbett's net worth. They are the assets that he owns that are expected to generate income or appreciate in value over time. Investments can be divided into two main categories: financial investments and real estate investments.

- Financial investments are investments that are traded on financial markets, such as stocks, bonds, and mutual funds. Financial investments can be a good way to grow wealth over time, but they can also be risky. The value of financial investments can fluctuate significantly, and there is always the potential to lose money.

- Real estate investments are investments in property, such as land, buildings, and houses. Real estate investments can be a good way to generate income through rent or appreciation. However, real estate investments can also be illiquid, and it can be difficult to sell a property quickly if needed.

By understanding the different types of investments and their risks and rewards, Martin Rabbett can make informed decisions about how to allocate his assets. By carefully managing his investments, he can increase his net worth and improve his overall financial well-being.

Taxes

Taxes play a significant role in determining Martin Rabbett's net worth. Taxes are mandatory payments levied on individuals and businesses by governments to fund public services and programs. They can be classified into various types, each with its specific rules and implications for net worth.

- Income Tax

Income tax is levied on an individual's taxable income, which includes earnings from employment, investments, and other sources. The amount of income tax owed depends on the individual's income level and tax bracket. Higher income typically results in higher income tax liability. Understanding income tax laws and optimizing deductions and credits can help minimize tax liability and preserve net worth.

- Capital Gains Tax

Capital gains tax is levied on profits made from the sale of assets, such as stocks, bonds, and real estate. The amount of capital gains tax owed depends on the asset's holding period and the individual's tax bracket. Careful planning and understanding of capital gains tax implications can help maximize net worth by minimizing tax liability on investment gains.

- Property Tax

Property tax is levied on real estate owned by individuals and businesses. The amount of property tax owed depends on the assessed value of the property and the local tax rates. Property taxes can be a significant expense for property owners and can impact net worth. Understanding property tax laws and exemptions can help minimize the tax burden and preserve net worth.

- Sales Tax

Sales tax is levied on the sale of goods and services. The amount of sales tax owed depends on the type of goods or services purchased and the local tax rate. Sales tax can be a significant expense for consumers and can impact net worth. Understanding sales tax laws and exemptions can help minimize the tax burden and preserve net worth.

In conclusion, taxes have a multifaceted impact on Martin Rabbett's net worth. Understanding the different types of taxes, their implications, and strategies for minimizing tax liability is crucial for preserving and growing wealth. Careful tax planning and optimization can help maximize net worth and achieve long-term financial goals.

Debt

Debt plays a significant role in Martin Rabbett's net worth. It represents the amount of money he owes to creditors, and it can have a major impact on his financial health.

- Consumer Debt

Consumer debt is the most common type of debt, and it includes things like credit card debt, personal loans, and medical debt. Consumer debt can be a major burden, and it can make it difficult to save money and build wealth.

- Mortgage Debt

Mortgage debt is another common type of debt, and it is secured by real estate. Mortgage debt can be a good investment, but it can also be a major financial risk. If Martin Rabbett defaults on his mortgage, he could lose his home.

- Business Debt

Business debt is debt that is incurred by a business. Martin Rabbett may have business debt if he owns his own company. Business debt can be a good way to finance growth, but it can also be a major financial risk.

- Student Loan Debt

Student loan debt is a type of debt that is used to pay for college or graduate school. Student loan debt can be a major financial burden, and it can take many years to repay.

Debt can have a major impact on Martin Rabbett's net worth. It can reduce his net worth by increasing his liabilities. It can also make it more difficult for him to save money and invest. If Martin Rabbett is struggling with debt, he should seek professional help.

Savings

Savings are an important part of Martin Rabbett's net worth. They represent the amount of money he has set aside for future use. Savings can be used for a variety of purposes, such as emergencies, retirement, or education. Savings can also be used to invest in assets that can grow in value over time.

The amount of savings that Martin Rabbett has will depend on a number of factors, including his income, expenses, and financial goals. It is important for him to develop a savings plan that will help him reach his financial goals. A savings plan should include a budget that tracks income and expenses, as well as a plan for how much money to save each month.

There are a number of benefits to saving money. Savings can provide a financial cushion in case of emergencies. Savings can also help Martin Rabbett reach his financial goals, such as buying a house or retiring early. Saving money can also help him build wealth over time.

There are a number of different ways to save money. Martin Rabbett can open a savings account at a bank or credit union. He can also save money by investing in stocks, bonds, or mutual funds. No matter how he chooses to save, it is important for him to make saving a priority. Savings are an essential part of financial security and wealth building.

Lifestyle

Lifestyle plays a significant role in determining Martin Rabbett's net worth. It encompasses his spending habits, consumption patterns, and overall approach to managing his finances. Understanding how lifestyle choices impact net worth is crucial for financial planning and wealth accumulation.

- Spending Habits

Martin Rabbett's spending habits have a direct impact on his net worth. Making informed decisions about purchases, avoiding impulse spending, and prioritizing essential expenses can help him control outflows and increase savings.

- Consumption Patterns

The type and quantity of goods and services consumed by Martin Rabbett influence his net worth. Choosing cost-effective options, reducing unnecessary purchases, and considering sustainable consumption practices can positively impact his financial well-being.

- Financial Management

Martin Rabbett's approach to managing his finances plays a vital role in determining his net worth. Creating a budget, tracking expenses, and seeking professional financial advice can help him make informed decisions, minimize debt, and maximize wealth.

- Investment Strategy

Martin Rabbett's investment strategy is an integral part of his lifestyle and net worth. Allocating funds wisely, diversifying investments, and understanding risk tolerance can help him grow his wealth and achieve long-term financial goals.

In summary, Martin Rabbett's lifestyle choices have a significant impact on his net worth. By making conscious decisions about spending, consumption, and financial management, he can optimize his financial well-being and work towards achieving his financial aspirations.

Financial goals

Martin Rabbett's financial goals play a critical role in determining his net worth. By understanding his financial goals, individuals can gain insights into his financial priorities, risk tolerance, and investment strategies.

- Retirement planning

Martin Rabbett's retirement goals are a key factor in his net worth. He needs to save and invest enough money to ensure that he can maintain his desired lifestyle after he retires. His retirement goals will depend on a number of factors, including his desired retirement age, his expected expenses in retirement, and his risk tolerance.

- Education planning

Martin Rabbett may have financial goals related to education, such as saving for his children's college tuition. These goals will depend on a number of factors, including the number of children he has, the type of education he wants them to have, and his risk tolerance.

- Homeownership

Martin Rabbett may have a goal of owning a home. This goal will depend on a number of factors, including his income, his debt-to-income ratio, and his risk tolerance.

- Investment goals

Martin Rabbett may have financial goals related to investing. These goals will depend on a number of factors, including his risk tolerance, his time horizon, and his investment objectives.

By understanding Martin Rabbett's financial goals, individuals can gain insights into his financial priorities and risk tolerance. This information can be used to make informed decisions about his investments and financial planning.

FAQs on Martin Rabbett's Net Worth

This section addresses frequently asked questions surrounding Martin Rabbett's net worth, providing clear and informative answers to enhance understanding.

Question 1: How is Martin Rabbett's net worth calculated?

Martin Rabbett's net worth is calculated by subtracting his liabilities from his assets. Assets include cash, investments, and property, while liabilities include debts and loans.

Question 2: What factors influence Martin Rabbett's net worth?

Martin Rabbett's net worth is influenced by various factors, including his income, expenses, investments, and overall financial management. Changes in these factors can impact his net worth over time.

Question 3: How does Martin Rabbett's net worth compare to others in his industry?

Martin Rabbett's net worth can be compared to others in his industry to assess his financial standing relative to peers. This comparison can provide insights into his financial success and industry competitiveness.

Question 4: Is Martin Rabbett's net worth publicly available?

Martin Rabbett's net worth is not publicly available as it is considered personal financial information. However, estimates and approximations may be made based on available data and public records.

Question 5: How can I increase my net worth?

Increasing your net worth involves strategies such as increasing your income, reducing expenses, investing wisely, and managing debt effectively. It requires a disciplined and long-term approach to financial planning.

Question 6: What are some common misconceptions about net worth?

A common misconception is that net worth is solely determined by income. However, it is also influenced by financial decisions, savings, and investments. Another misconception is that a high net worth always equates to financial security, which may not be the case if liabilities and expenses are not managed responsibly.

In summary, Martin Rabbett's net worth is a measure of his financial wealth and is influenced by various factors. Understanding the concept of net worth and its components is essential for effective financial planning and wealth management.

Transition to the next article section...

Tips to Enhance Net Worth

Managing and growing net worth requires strategic planning and informed decisions. Here are several tips to consider:

Tip 1: Track Income and Expenses

Create a budget to monitor cash flow, identify areas for savings, and make informed financial decisions.

Tip 2: Reduce Unnecessary Expenses

Evaluate spending habits and eliminate non-essential expenses to free up funds for savings and investments.

Tip 3: Increase Income Streams

Explore opportunities to generate additional income through side hustles, investments, or career advancement.

Tip 4: Invest Wisely

Develop an investment strategy that aligns with risk tolerance and financial goals. Diversify investments to mitigate risks and enhance returns.

Tip 5: Manage Debt Effectively

Prioritize paying off high-interest debt and consider debt consolidation options to reduce interest payments and improve cash flow.

Tip 6: Seek Professional Advice

Consult with a financial advisor to develop a personalized financial plan and make informed decisions based on expertise and market insights.

Tip 7: Stay Informed

Continuously educate yourself about financial markets, investment strategies, and tax laws to make well-informed financial choices.

Summary: By implementing these tips, individuals can gain greater control over their finances, make strategic decisions, and work towards enhancing their net worth over time.

Transition to Conclusion: Effective net worth management requires a disciplined approach, informed decision-making, and a commitment to long-term financial well-being.

Conclusion

The exploration of Martin Rabbett's net worth has revealed the multifaceted nature of financial wealth and its impact on an individual's overall financial well-being. Understanding the factors that influence net worth, such as income, expenses, assets, liabilities, and investments, is crucial for effective financial planning and management.

Martin Rabbett's net worth serves as a measure of his financial success and provides insights into his financial standing relative to others in his industry. It is a dynamic figure that is subject to change over time, influenced by various economic and personal factors. By making informed decisions, implementing prudent financial strategies, and seeking professional guidance when necessary, individuals can work towards enhancing their net worth and achieving their long-term financial goals.

Understanding the concept of net worth and its components is essential for individuals to take control of their financial lives, make informed decisions, and strive towards financial security and prosperity.

- Puppygirl Xo Exploring The Rise Of A Digital Sensation

- How To Archive Tiktok Videos A Comprehensive Guide